Region:Europe

Author(s):Geetanshi

Product Code:KRAB0028

Pages:94

Published On:August 2025

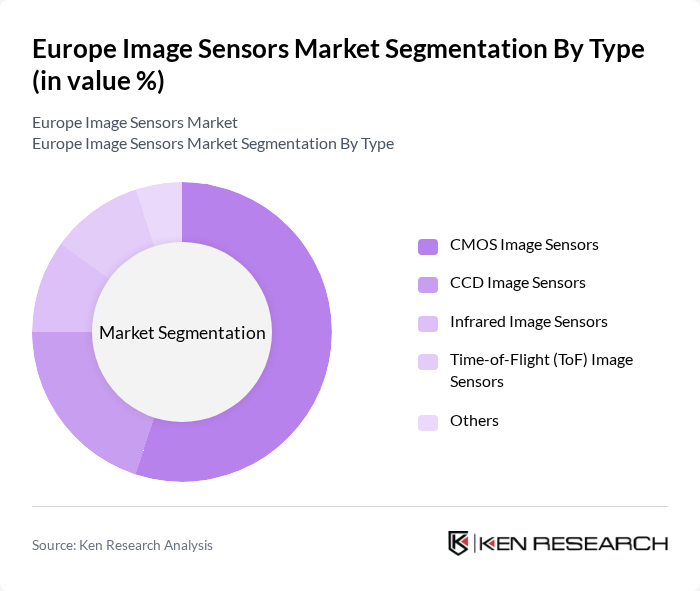

By Type:The market is segmented into various types of image sensors, including CMOS Image Sensors, CCD Image Sensors, Infrared Image Sensors, Time-of-Flight (ToF) Image Sensors, and Others. CMOS Image Sensors are leading the market due to their low power consumption, high speed, cost-effectiveness, and suitability for integration in compact devices. Their dominance is reinforced by widespread adoption in smartphones, automotive cameras, and industrial machine vision, while CCD sensors retain relevance in specialized imaging applications.

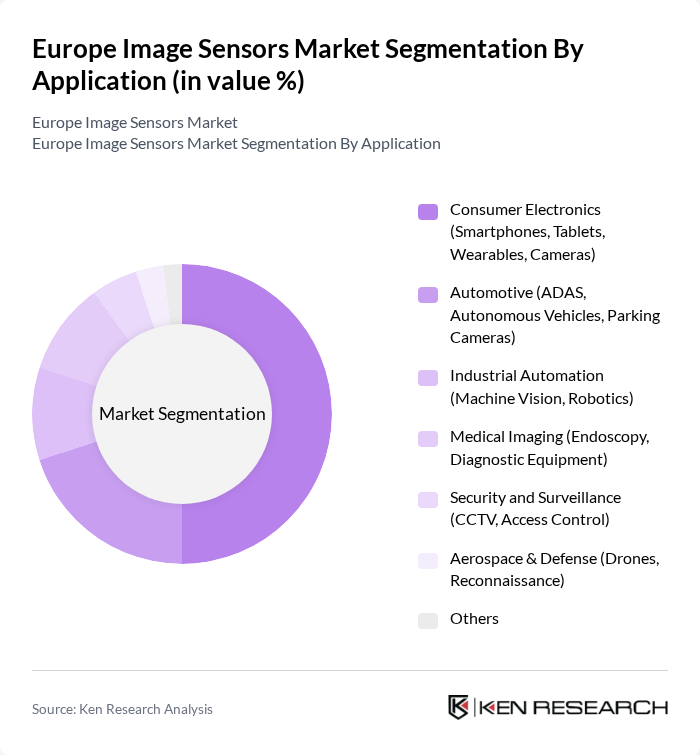

By Application:The applications of image sensors include Consumer Electronics, Automotive, Industrial Automation, Medical Imaging, Security and Surveillance, Aerospace & Defense, and Others. The Consumer Electronics segment is the most significant, driven by the increasing demand for high-quality cameras in smartphones, tablets, and wearables, as well as the growing trend of social media sharing. Automotive applications are rapidly expanding due to regulatory mandates for front-camera systems and the proliferation of ADAS features. Industrial automation, medical imaging, and security and surveillance are also notable growth areas, leveraging advances in AI, machine vision, and sensor miniaturization.

The Europe Image Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Samsung Electronics Co., Ltd., OmniVision Technologies, Inc., STMicroelectronics N.V., ON Semiconductor Corporation, Canon Inc., Panasonic Holdings Corporation, Teledyne Technologies Incorporated, FLIR Systems, Inc., Vishay Intertechnology, Inc., GalaxyCore Shanghai Limited Corporation, PixArt Imaging Inc., e2v Technologies plc, Toshiba Corporation, NXP Semiconductors N.V., Analog Devices, Inc., BAE Systems plc, SK Hynix Inc., Nikon Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe image sensors market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence in image processing is expected to enhance sensor capabilities, while the shift towards smart city initiatives will further boost demand. Additionally, the automotive industry's transition towards electric and autonomous vehicles will create new opportunities for image sensor applications, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | CMOS Image Sensors CCD Image Sensors Infrared Image Sensors Time-of-Flight (ToF) Image Sensors Others |

| By Application | Consumer Electronics (Smartphones, Tablets, Wearables, Cameras) Automotive (ADAS, Autonomous Vehicles, Parking Cameras) Industrial Automation (Machine Vision, Robotics) Medical Imaging (Endoscopy, Diagnostic Equipment) Security and Surveillance (CCTV, Access Control) Aerospace & Defense (Drones, Reconnaissance) Others |

| By End-User | Consumer Electronics Manufacturers Automotive OEMs & Tier 1 Suppliers Healthcare Providers & Medical Device Manufacturers Industrial Companies Security Service Providers Government Agencies |

| By Distribution Channel | Direct Sales Online Retail Distributors/Value-Added Resellers Others |

| By Region | Western Europe (Germany, UK, France, Spain, Italy, Benelux) Eastern Europe (Poland, Russia, Czech Republic, Others) Northern Europe (Nordics, Baltics) Southern Europe (Portugal, Greece, Balkans) |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Digital Image Processing Analog Image Processing Hybrid Image Processing Wafer-Level Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Image Sensors | 100 | Product Managers, Automotive Engineers |

| Consumer Electronics Imaging | 80 | R&D Specialists, Marketing Directors |

| Healthcare Imaging Solutions | 60 | Medical Device Engineers, Procurement Managers |

| Industrial Imaging Applications | 50 | Operations Managers, Quality Control Engineers |

| Security and Surveillance Sensors | 70 | Security System Designers, Technical Directors |

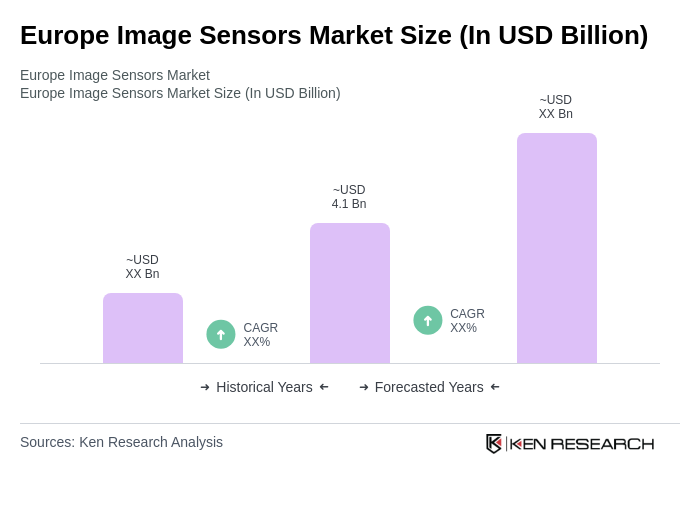

The Europe Image Sensors Market is valued at approximately USD 4.1 billion, driven by the increasing demand for high-resolution imaging across various sectors, including consumer electronics, automotive applications, and industrial automation.