Region:Europe

Author(s):Dev

Product Code:KRAB0582

Pages:83

Published On:August 2025

By Type:The IT staffing market can be segmented into various types, including Permanent Staffing, Contract Staffing, Temporary Staffing, Executive Search, Recruitment Process Outsourcing (RPO), Managed Services Provider (MSP), Project-Based Staffing, and Freelance/On-Demand IT Staffing. Each of these sub-segments caters to different client needs and preferences, with varying levels of commitment and flexibility. Demand for contract and temporary staffing has increased due to the rise of project-based work and the need for agile workforce solutions, while permanent staffing remains essential for critical roles and long-term projects .

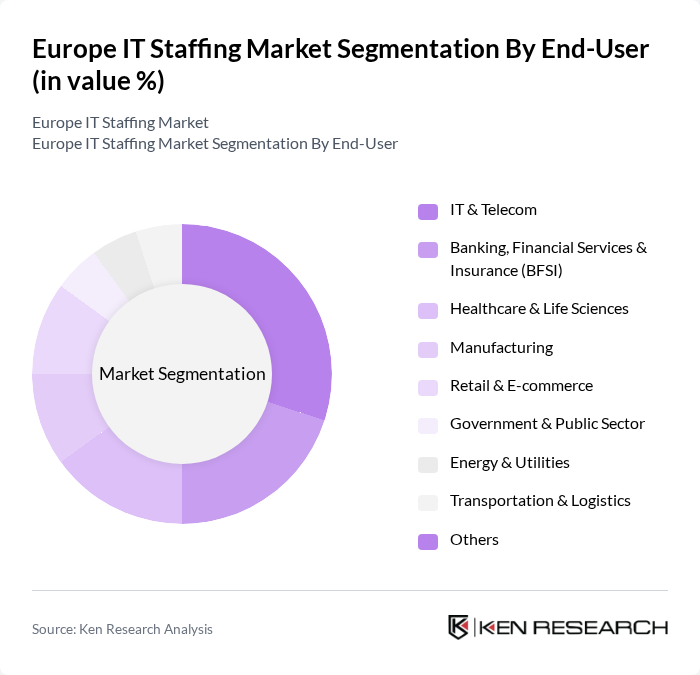

By End-User:The end-user segmentation of the IT staffing market includes various sectors such as IT & Telecom, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Government & Public Sector, Energy & Utilities, Transportation & Logistics, and Others. Each sector has unique staffing requirements, influencing the demand for IT professionals. The IT & Telecom sector leads due to ongoing digitalization, while BFSI and Healthcare are rapidly increasing their IT hiring to support digital transformation and regulatory compliance .

The Europe IT Staffing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adecco Group, Randstad N.V., ManpowerGroup, Hays plc, Robert Half International Inc., Kelly Services, Inc., PageGroup plc (Michael Page), Experis (part of ManpowerGroup), Computer Futures (SThree plc), Harvey Nash Group plc, TEKsystems (Allegis Group), Volt Information Sciences, Inc., Modis (now Akkodis, part of Adecco Group), GFT Technologies SE, NTT DATA EMEA Ltd., Chronos Consulting, VHR Consulting, Aquent, Vero HR, Tiger Recruitment Ltd, Haselhoff Groep, MAS Recruiting, Pertemps contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe IT staffing market appears promising, driven by ongoing digital transformation and the increasing reliance on technology across industries. As businesses continue to adapt to remote work and invest in advanced technologies, the demand for specialized IT talent is expected to rise. Additionally, the emphasis on diversity and inclusion will shape recruitment strategies, fostering a more equitable workforce. Staffing firms that leverage technology and innovative recruitment practices will likely thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Staffing Contract Staffing Temporary Staffing Executive Search Recruitment Process Outsourcing (RPO) Managed Services Provider (MSP) Project-Based Staffing Freelance/On-Demand IT Staffing |

| By End-User | IT & Telecom Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Manufacturing Retail & E-commerce Government & Public Sector Energy & Utilities Transportation & Logistics Others |

| By Skill Set / Job Function | Software Development Data Science & Analytics Cybersecurity Cloud Computing Project Management Business Analysis IT Support & Infrastructure Others |

| By Service Model | On-Demand Staffing Full-Service Staffing Hybrid Staffing Solutions Specialized Staffing Services Others |

| By Geographic Region | United Kingdom Germany France Italy Spain Netherlands Belgium Sweden Norway Poland Denmark Rest of Europe |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Recruitment Channel | Online Job Portals Social Media Recruitment Agencies Employee Referrals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Staffing Agencies in Western Europe | 100 | Recruitment Managers, Business Development Executives |

| Corporate IT Departments in Central Europe | 70 | HR Directors, IT Managers |

| Freelance IT Professionals Across Europe | 60 | Independent Contractors, Consultants |

| Emerging Tech Startups in Southern Europe | 40 | Founders, CTOs |

| Large Enterprises in Northern Europe | 50 | Talent Acquisition Specialists, Project Managers |

The Europe IT Staffing Market is valued at approximately USD 30 billion, reflecting a significant growth driven by the increasing demand for skilled IT professionals and the rapid digital transformation across various industries.