Region:Europe

Author(s):Rebecca

Product Code:KRAB0241

Pages:93

Published On:August 2025

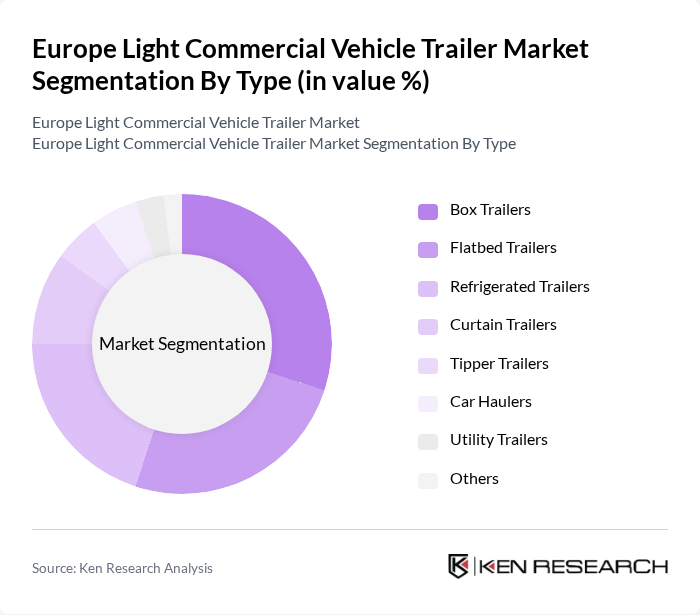

By Type:The market is segmented into various types of trailers, including Box Trailers, Flatbed Trailers, Refrigerated Trailers, Curtain Trailers, Tipper Trailers, Car Haulers, Utility Trailers, and Others. Among these,Box TrailersandFlatbed Trailersare particularly popular due to their versatility and ability to accommodate a wide range of cargo. The demand forRefrigerated Trailerscontinues to rise, driven by the growth in the food and beverage sector and the increasing need for temperature-controlled transport solutions .

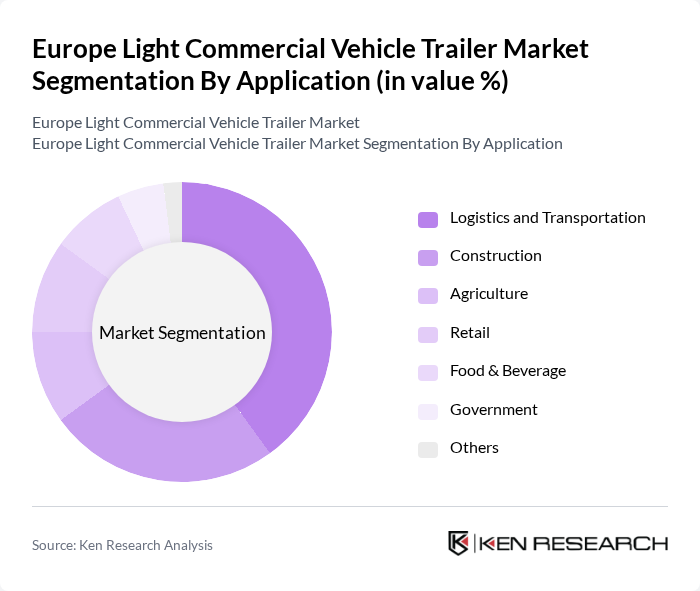

By Application:The application segments include Logistics and Transportation, Construction, Agriculture, Retail, Food & Beverage, Government, and Others. TheLogistics and Transportationsegment holds a significant share due to the increasing demand for efficient freight transport solutions, especially for last-mile delivery in urban areas. TheConstructionsector also contributes notably, as it requires various types of trailers for transporting materials and equipment to job sites. The modernization of the agricultural sector and the growth of organized retail further support demand across other segments .

The Europe Light Commercial Vehicle Trailer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ifor Williams Trailers, UNSINN Fahrzeugtechnik GmbH, Debon Trailers, Schmitz Cargobull AG, Krone Trailer, Kögel Trailer GmbH & Co. KG, Böckmann Fahrzeugwerke GmbH, Trigano Remorques, VEZEKO, Fruehauf, AL-KO Vehicle Technology, D-TEC Trailers, Fendt, TREDZ, and B.H.H. Trailers contribute to innovation, geographic expansion, and service delivery in this space .

The future of the light commercial vehicle trailer market in Europe appears promising, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt electric and hybrid trailer technologies, the market is expected to witness a transformation in design and functionality. Additionally, the growing emphasis on reducing carbon emissions will likely lead to innovative solutions that align with environmental regulations, fostering a more sustainable transportation ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Box Trailers Flatbed Trailers Refrigerated Trailers Curtain Trailers Tipper Trailers Car Haulers Utility Trailers Others |

| By Application | Logistics and Transportation Construction Agriculture Retail Food & Beverage Government Others |

| By Payload Capacity | Up to 1,500 kg ,501 kg to 3,000 kg ,001 kg to 5,000 kg Above 5,000 kg |

| By Trailer Configuration | Single Axle Tandem Axle Tri-Axle Multi-Axle |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | United Kingdom Germany France Italy Spain Russia Denmark Estonia Sweden Rest of Europe |

| By Price Range | Low-End Trailers Mid-Range Trailers High-End Trailers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Commercial Vehicle Fleet Operators | 120 | Fleet Managers, Operations Directors |

| Trailer Manufacturers | 60 | Product Development Managers, Sales Executives |

| Logistics and Transportation Companies | 100 | Logistics Managers, Supply Chain Analysts |

| End-User Industries (Construction, Agriculture) | 50 | Procurement Officers, Project Managers |

| Regulatory Bodies and Industry Associations | 40 | Policy Makers, Industry Analysts |

The Europe Light Commercial Vehicle Trailer Market is valued at approximately USD 115 million, driven by the increasing demand for efficient transportation solutions and advancements in trailer technology, including telematics and enhanced safety features.