Region:Europe

Author(s):Geetanshi

Product Code:KRAA1974

Pages:92

Published On:August 2025

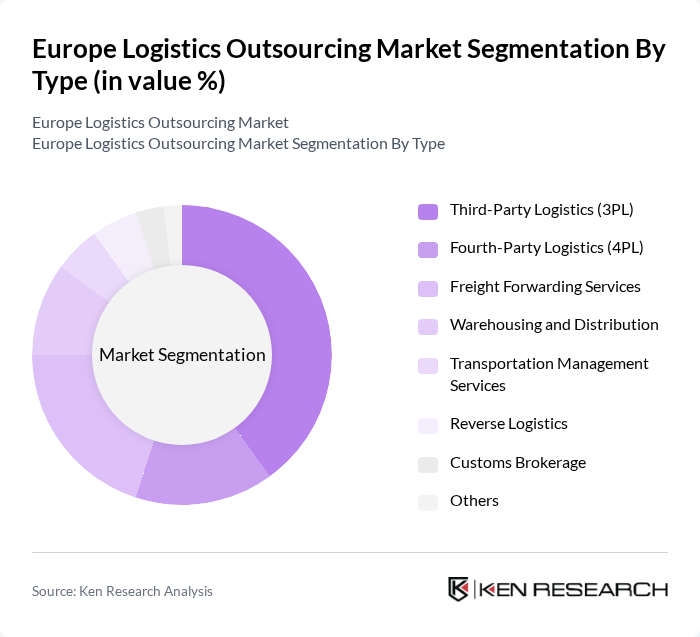

By Type:The logistics outsourcing market can be segmented into various types, including Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), Freight Forwarding Services, Warehousing and Distribution, Transportation Management Services, Reverse Logistics, Customs Brokerage, and Others. Among these,Third-Party Logistics (3PL)is the most dominant segment, driven by the increasing demand for integrated logistics solutions that offer flexibility, scalability, and access to advanced technologies for businesses.

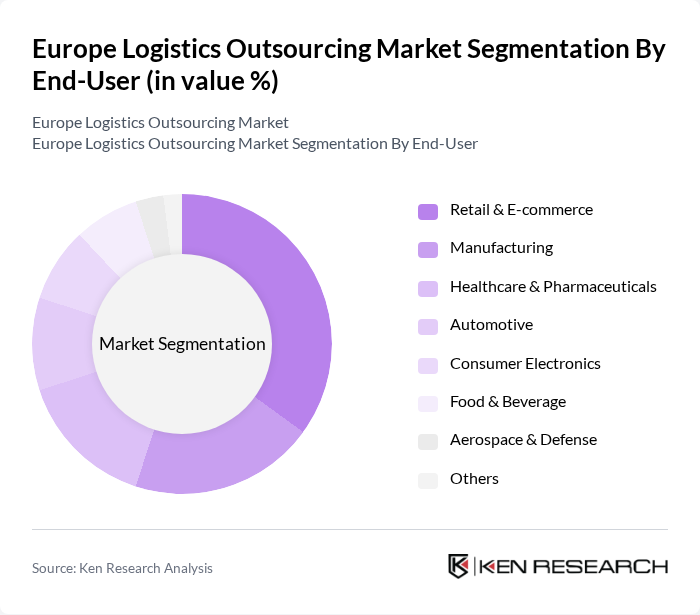

By End-User:The end-user segmentation of the logistics outsourcing market includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Consumer Electronics, Food & Beverage, Aerospace & Defense, and Others. TheRetail & E-commercesegment is leading this market due to the rapid growth of online shopping and omnichannel retail, which has significantly increased the demand for agile, technology-enabled logistics and distribution services to meet evolving consumer expectations.

The Europe Logistics Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, CEVA Logistics, UPS Supply Chain Solutions, DSV, Geodis, FedEx Logistics, SNCF Logistics, Yusen Logistics, Rhenus Logistics, Bolloré Logistics, Hellmann Worldwide Logistics, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe logistics outsourcing market appears promising, driven by ongoing digital transformation and the increasing adoption of automation technologies. As companies prioritize efficiency and customer satisfaction, the demand for integrated logistics solutions will likely rise. Furthermore, the focus on sustainability will push logistics providers to innovate, adopting greener practices and technologies. This evolving landscape presents opportunities for growth and adaptation, ensuring that logistics outsourcing remains a vital component of the European supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Services Warehousing and Distribution Transportation Management Services Reverse Logistics Customs Brokerage Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Consumer Electronics Food & Beverage Aerospace & Defense Others |

| By Service Type | Transportation Services Value-Added Services (e.g., packaging, labeling) Inventory Management Order Fulfillment Supply Chain Consulting Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Intermodal Transport Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

| By Geographic Coverage | Domestic Logistics International Logistics Regional Logistics Pan-European Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Outsourcing | 60 | Logistics Managers, Supply Chain Executives |

| Manufacturing Supply Chain Management | 50 | Operations Managers, Procurement Directors |

| Healthcare Logistics Services | 40 | Supply Chain Coordinators, Compliance Officers |

| Food and Beverage Distribution | 45 | Logistics Directors, Quality Assurance Managers |

| E-commerce Fulfillment Strategies | 55 | E-commerce Managers, Warehouse Operations Managers |

The Europe Logistics Outsourcing Market is valued at approximately USD 435 billion, driven by the increasing demand for efficient supply chain management, e-commerce growth, and the need for cost-effective logistics solutions.