Region:Europe

Author(s):Dev

Product Code:KRAB0392

Pages:83

Published On:August 2025

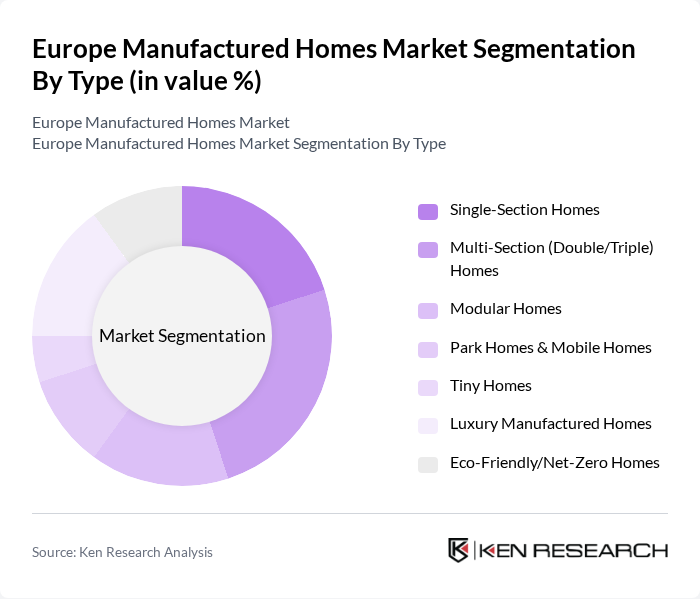

By Type:The market is segmented into various types of manufactured homes, including Single-Section Homes, Multi-Section (Double/Triple) Homes, Modular Homes, Park Homes & Mobile Homes, Tiny Homes, Luxury Manufactured Homes, and Eco-Friendly/Net-Zero Homes. Each type caters to different consumer preferences and needs, with varying levels of customization, size, and price points.

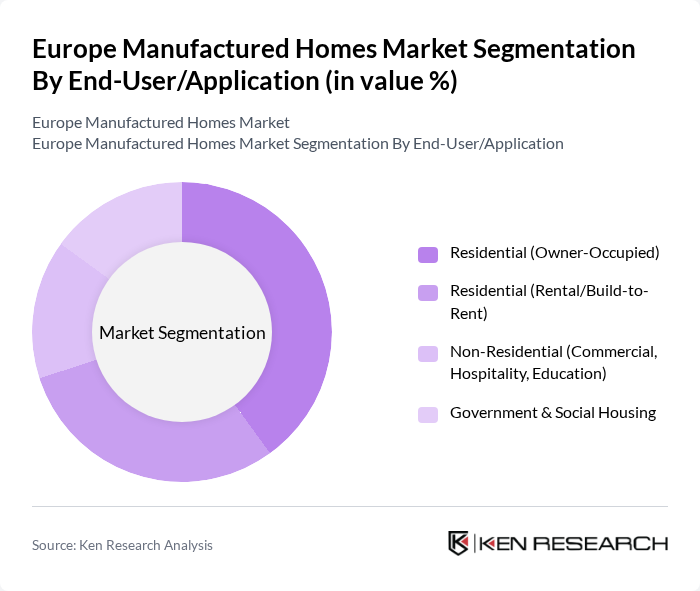

By End-User/Application:The market is further segmented by end-user applications, which include Residential (Owner-Occupied), Residential (Rental/Build-to-Rent), Non-Residential (Commercial, Hospitality, Education), and Government & Social Housing. Each application serves distinct market needs, with residential applications being the most significant segment due to the growing demand for affordable housing. Increased adoption is also visible in rental and public-sector procurement to address housing shortages and accelerate delivery timelines .

The Europe Manufactured Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nordic Homes AS, Ilke Homes Ltd, Laing O'Rourke (Explore Manufacturing), Modulaire Group, Algeco, Skanska AB, PEAB AB, Bonava AB, Katerra Europe S.L. (legacy assets), Willerby Ltd, ABI Holiday Homes, Victory Leisure Homes, Omar Park Homes Ltd, Pathfinder Homes, Tingdene Homes Ltd contribute to innovation, geographic expansion, and service delivery in this space .

The future of the manufactured homes market in Europe appears promising, driven by increasing urbanization and a growing emphasis on affordable housing solutions. As governments implement policies to support sustainable living, the integration of smart technologies into manufactured homes is likely to enhance their appeal. Additionally, the trend towards customization will cater to diverse consumer preferences, making manufactured homes a more attractive option for a broader demographic, particularly millennials and first-time buyers.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Section Homes Multi-Section (Double/Triple) Homes Modular Homes Park Homes & Mobile Homes Tiny Homes Luxury Manufactured Homes Eco-Friendly/Net-Zero Homes |

| By End-User/Application | Residential (Owner-Occupied) Residential (Rental/Build-to-Rent) Non-Residential (Commercial, Hospitality, Education) Government & Social Housing |

| By Placement/Community Type | Private Property (Fee Simple) Manufactured Home Communities/Parks Temporary/Relocatable Sites |

| By Distribution Channel | Direct Sales (Manufacturer to Buyer) Authorized Dealers Online/Digital Sales Developers and Community Operators |

| By Price Range | Entry-Level Mid-Range Premium |

| By Material System | Timber/Light-Frame Wood Steel Frame Hybrid/Composite Panels Concrete/Lightweight Concrete |

| By Financing Mechanism | Mortgage Finance Chattel/Personal Property Loans Leasing & Rent-to-Buy Public Subsidies/Grants |

| By Country | Germany United Kingdom France Italy Spain Netherlands Sweden Norway Denmark Poland Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufactured Home Buyers | 150 | First-time homebuyers, Retirees, Young families |

| Manufactured Home Manufacturers | 100 | Production Managers, Sales Directors, Marketing Executives |

| Real Estate Agents | 80 | Residential Real Estate Agents, Brokers specializing in manufactured homes |

| Financial Institutions | 70 | Loan Officers, Mortgage Brokers, Financial Advisors |

| Regulatory Bodies | 50 | Policy Makers, Housing Authority Representatives, Urban Planners |

The Europe Manufactured Homes Market is valued at approximately USD 8.3 billion, reflecting a consistent trend in the high-single-digit billions, driven by increasing demand for affordable housing and sustainable living solutions.