Region:Europe

Author(s):Dev

Product Code:KRAA1678

Pages:93

Published On:August 2025

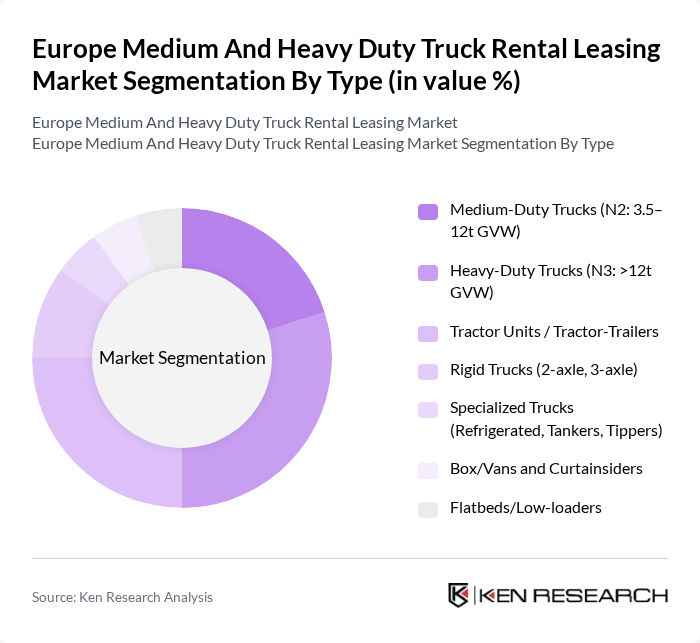

By Type:The market is segmented into various types of trucks, including Medium-Duty Trucks, Heavy-Duty Trucks, Tractor Units, Rigid Trucks, Specialized Trucks, Box/Vans and Curtainsiders, and Flatbeds/Low-loaders. Each type serves different operational needs and customer preferences, influencing their market share and growth potential .

The Heavy-Duty Trucks segment is currently dominating the market due to their essential role in long-haul transportation and logistics. These trucks are preferred for their higher payload capacity and efficiency in transporting large volumes of goods over long distances. The increasing demand for freight services, particularly in e-commerce and manufacturing sectors, has further solidified the position of heavy-duty trucks in the rental and leasing market. Additionally, advancements in technology, telematics, and fuel-efficiency measures, along with compliance needs under tightening EU emissions policies, are making these trucks more appealing to businesses seeking optimized total cost of use .

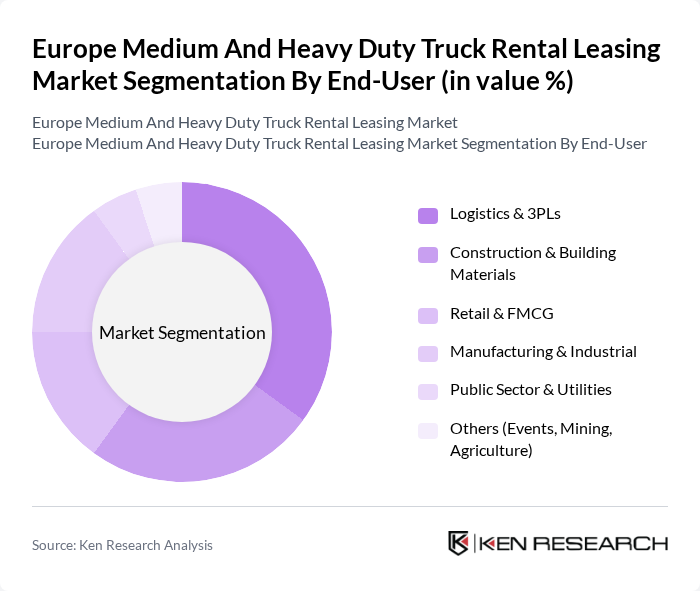

By End-User:The market is segmented by end-users, including Logistics & 3PLs, Construction & Building Materials, Retail & FMCG, Manufacturing & Industrial, Public Sector & Utilities, and Others. Each end-user segment has unique requirements and influences the demand for truck rental and leasing services .

The Logistics & 3PLs segment leads the market, driven by the rapid growth of e-commerce and the increasing need for efficient supply chain solutions. As businesses seek to enhance their logistics capabilities, the demand for rental and leasing services for trucks has surged. This segment benefits from the flexibility and cost-effectiveness of rental solutions, allowing logistics companies to scale their operations according to market demands without the burden of owning a fleet. Broader adoption of contract logistics, telematics-enabled maintenance, and bundled full-service leasing is reinforcing this leadership among 3PLs .

The Europe Medium And Heavy Duty Truck Rental Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fraikin Group, TIP Group (formerly TIP Trailer Services), PACCAR Leasing GmbH (PacLease Europe), MAN Financial Services (Truck & Bus), Renault Trucks Financial Services, DAF Trucks Financial Services, Mercedes?Benz Mobility AG (Daimler Truck Financial Services Europe), Volvo Financial Services Europe, Ryder Europe, Penske Truck Leasing (Europe), Sixt Truck Rental, Europcar Vans & Trucks, NRS – Northgate Vehicle Hire (Redde Northgate), Frachtauto.pl (Grupa DBK), Fraikin España & Benelux Operations contribute to innovation, geographic expansion, and service delivery in this space .

The future of the medium and heavy-duty truck rental leasing market in Europe appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt electric and hybrid vehicles, the rental market is likely to see a shift towards greener fleets. Additionally, the integration of telematics and IoT technologies will enhance fleet management efficiency, allowing rental companies to optimize operations and reduce costs. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Medium-Duty Trucks (N2: 3.5–12t GVW) Heavy-Duty Trucks (N3: >12t GVW) Tractor Units / Tractor-Trailers Rigid Trucks (2-axle, 3-axle) Specialized Trucks (Refrigerated, Tankers, Tippers) Box/Vans and Curtainsiders Flatbeds/Low-loaders |

| By End-User | Logistics & 3PLs Construction & Building Materials Retail & FMCG Manufacturing & Industrial Public Sector & Utilities Others (Events, Mining, Agriculture) |

| By Rental Duration | Short-Term/Spot Rentals (Daily–Monthly) Long-Term Contract Hire/Leasing (12–60 months) Seasonal/Project-Based Rentals |

| By Fleet Size of Customer | Small Fleets (?25 vehicles) Medium Fleets (26–200 vehicles) Large Fleets (>200 vehicles) |

| By Operating Model | Full-Service Leasing (maintenance, tires, telematics) Maintenance-Only/Finance Lease Flexible/On-Demand Rental |

| By Powertrain | Diesel Natural Gas (CNG/LNG) Battery-Electric Hybrid/Other |

| By Booking Channel | Offline (Branch, Phone) Online/Digital Platforms |

| By Geography | Western Europe Northern Europe Southern Europe Central & Eastern Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medium-Duty Truck Rental | 100 | Fleet Managers, Rental Company Executives |

| Heavy-Duty Truck Leasing | 80 | Logistics Directors, Procurement Managers |

| Regional Transportation Services | 70 | Operations Managers, Supply Chain Analysts |

| Construction and Infrastructure Leasing | 60 | Project Managers, Equipment Rental Specialists |

| Retail and Distribution Truck Rentals | 90 | Distribution Managers, Retail Logistics Coordinators |

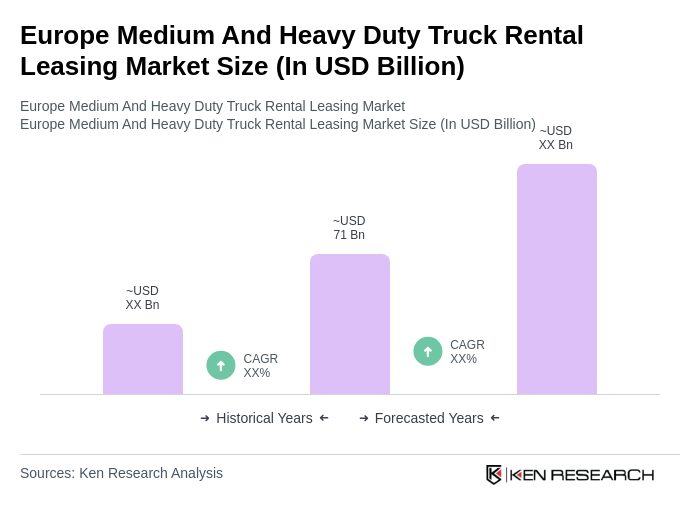

The Europe Medium and Heavy Duty Truck Rental Leasing Market is valued at approximately USD 71 billion, reflecting a significant growth driven by increasing logistics demand and the rise of e-commerce activities across the region.