Region:Europe

Author(s):Shubham

Product Code:KRAB0739

Pages:83

Published On:August 2025

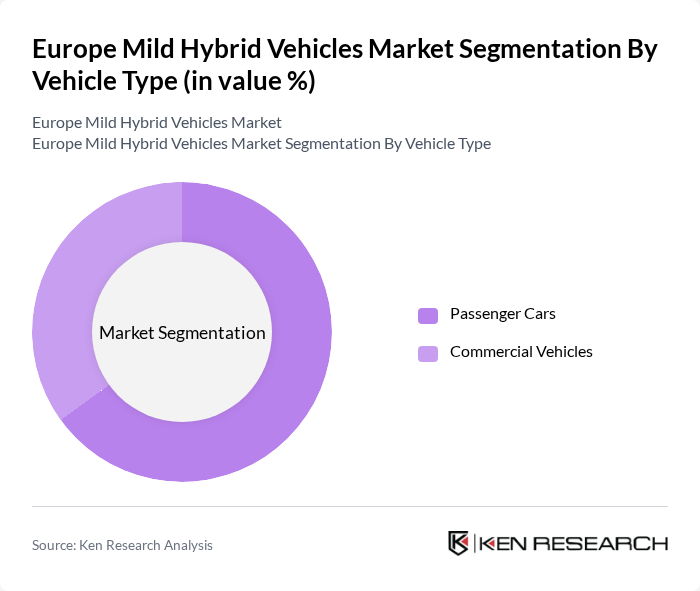

By Vehicle Type:

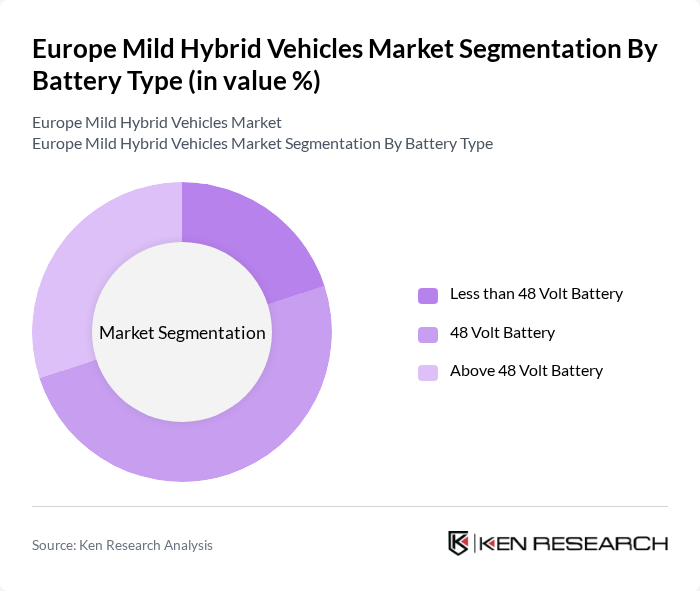

By Battery Type:

By Country:

The Europe Mild Hybrid Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, BMW AG, Volkswagen AG, Mercedes-Benz Group AG, Audi AG, Hyundai Motor Company, Kia Corporation, Nissan Motor Co., Ltd., Stellantis N.V. (includes Fiat, Peugeot, Opel, Citroën), Renault S.A., Volvo Car Corporation, Dr. Ing. h.c. F. Porsche AG, Jaguar Land Rover Automotive PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mild hybrid vehicle market in Europe appears promising, driven by ongoing technological innovations and increasing environmental consciousness among consumers. As automakers continue to enhance hybrid systems, the efficiency and affordability of these vehicles are expected to improve. Additionally, the expansion of charging infrastructure and government incentives will likely facilitate greater adoption. The market is poised for growth as urbanization trends continue, leading to a demand for sustainable mobility solutions that align with consumer preferences for eco-friendly transportation options.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Commercial Vehicles |

| By Battery Type | Less than 48 Volt Battery Volt Battery Above 48 Volt Battery |

| By Country | Germany United Kingdom Italy France Spain Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Mild Hybrid Vehicles | 120 | Car Owners, Potential Buyers |

| Dealership Insights on Mild Hybrid Sales | 60 | Sales Managers, Dealership Owners |

| Expert Opinions on Hybrid Technology Trends | 40 | Automotive Engineers, Industry Analysts |

| Government Policy Impact on Hybrid Adoption | 40 | Regulatory Officials, Policy Makers |

| Market Trends in Automotive Emissions Regulations | 40 | Environmental Consultants, Compliance Officers |

The Europe Mild Hybrid Vehicles Market is valued at approximately USD 16 billion, driven by increasing consumer demand for fuel-efficient vehicles, stringent emission regulations, and advancements in hybrid technology.