Region:Europe

Author(s):Dev

Product Code:KRAA1666

Pages:81

Published On:August 2025

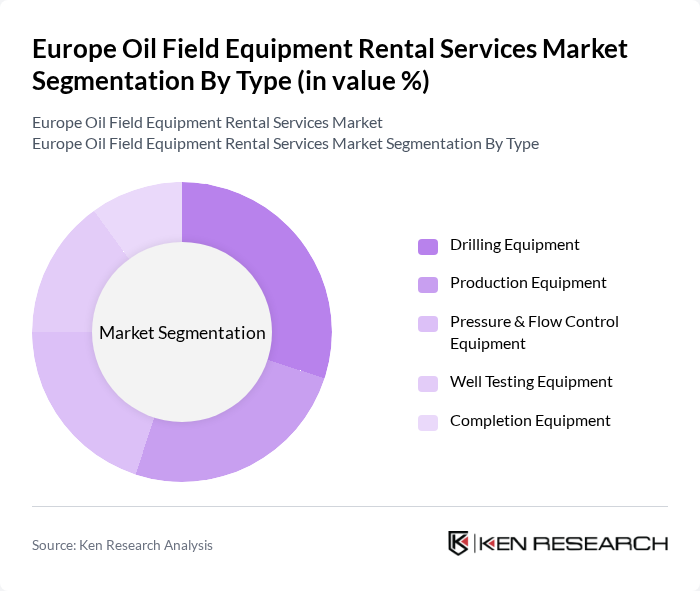

By Type:The market is segmented into various types of equipment that are essential for oil field operations. The subsegments include:

The dominant subsegment in this category is Drilling Equipment, which accounts for a significant portion of the market share. This is supported by sustained offshore drilling programs in the North Sea and operator preference for renting high-cost drilling assets and tools to preserve cash and access the latest technology. The demand for advanced drilling technologies and equipment that enhance efficiency and safety further propels this segment's growth, with digitalization and automation increasingly embedded in rented fleets.

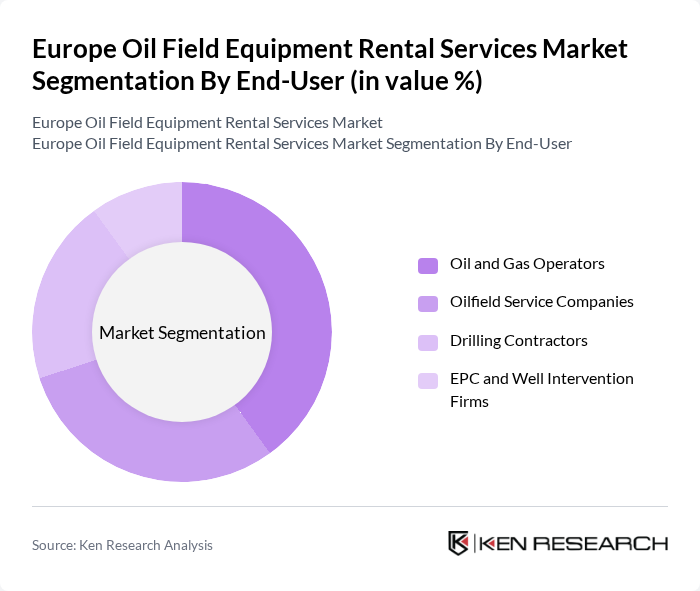

By End-User:The market is segmented based on the end-users who utilize the rental services. The subsegments include:

Oil and Gas Operators are the leading end-users in this market segment, representing a substantial share. This dominance is attributed to their continuous need for reliable and efficient equipment to support exploration and production activities. The operators often prefer rental services to minimize capital expenditure and maintain operational flexibility. Furthermore, the increasing complexity of oil extraction processes necessitates the use of specialized equipment, which rental services can provide without the burden of ownership costs.

The Europe Oil Field Equipment Rental Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SLB (Schlumberger Limited), Halliburton Company, Baker Hughes Company, Weatherford International plc, NOV Inc. (formerly National Oilwell Varco), Aker Solutions ASA, TechnipFMC plc, Saipem S.p.A., KCA Deutag, Petrofac Limited, Ashtead Technology Holdings plc, EnerMech Ltd, Sparrows Group, TESCO Corporation Europe B.V. (Top Drives & Tubular Services), Expro Group Holdings N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe oil field equipment rental market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As companies increasingly adopt automation and data analytics, operational efficiencies are expected to improve significantly. Furthermore, the expansion of offshore drilling activities and the integration of renewable energy sources will likely create new avenues for growth, positioning rental services as essential components in the evolving energy landscape of Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Equipment Production Equipment Pressure & Flow Control Equipment Well Testing Equipment Completion Equipment |

| By End-User | Oil and Gas Operators Oilfield Service Companies Drilling Contractors EPC and Well Intervention Firms |

| By Region | North Sea (Norway, UK, Denmark, Netherlands) Continental Western Europe (Germany, France, Benelux) Northern Europe & Baltics (Sweden, Finland, Baltics) Southern & Eastern Europe (Italy, Spain, Poland, Others) |

| By Application | Onshore Offshore |

| By Rental Duration | Short-term Rentals Long-term Rentals Project-based Rentals |

| By Pricing Model | Fixed Pricing Variable (Usage-Based) Pricing Framework/Call-off Agreements |

| By Service Type | Equipment Rental (Capital Equipment, Tools) Maintenance & Inspection Services Logistics & Onsite Support Digital Monitoring & Asset Tracking Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Field Equipment Rental Services | 120 | Rental Managers, Operations Directors |

| Exploration and Production Companies | 90 | Project Managers, Procurement Officers |

| Maintenance and Support Services | 75 | Maintenance Supervisors, Technical Managers |

| Geographical Market Segmentation | 65 | Regional Managers, Business Development Executives |

| Emerging Technologies in Equipment Rental | 50 | Innovation Managers, Technology Officers |

The Europe Oil Field Equipment Rental Services Market is valued at approximately USD 24 billion, driven by increasing demand for oil and gas exploration and production activities, as well as a trend towards outsourcing equipment rental services to reduce costs.