Europe Paints And Coatings Market Overview

- The Europe Paints and Coatings Market is valued at USD 32 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand in the construction and automotive sectors, alongside a rising focus on eco-friendly and sustainable products. The market has seen a shift towards innovative technologies and formulations that enhance performance and reduce environmental impact. Recent trends highlight the impact of renovation programs under the European Green Deal, accelerating demand for specialty coatings in building refurbishment, as well as increased utilization in wind energy, electric vehicles, and electronics manufacturing .

- Key players in this market include Germany, France, and the United Kingdom, which dominate due to their robust industrial base and significant investments in infrastructure development. Germany, in particular, is known for its advanced manufacturing capabilities and strong automotive industry, while France and the UK benefit from a diverse range of applications across various sectors .

- The European Union continues to enforce the REACH regulation, which aims to ensure the safe use of chemicals in paints and coatings. This regulation requires manufacturers to register and assess the risks associated with their products, promoting transparency and safety in the market .

Europe Paints And Coatings Market Segmentation

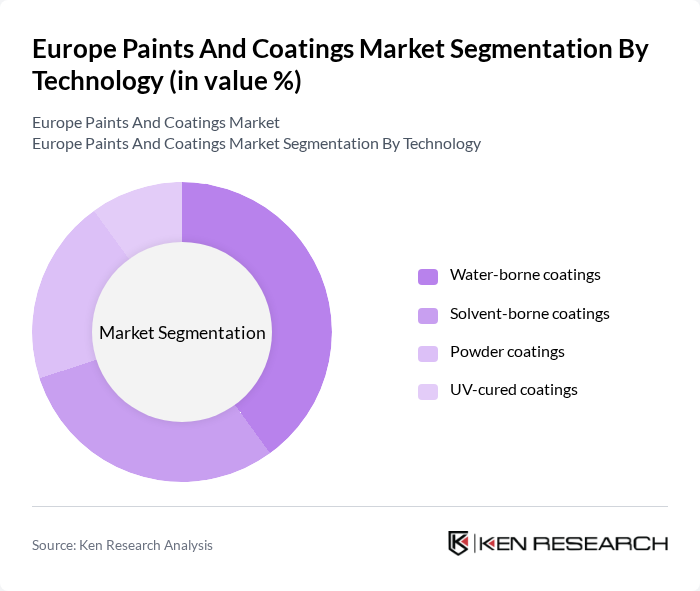

By Technology:The technology segment of the paints and coatings market includes various methods of application and formulation. The primary subsegments are water-borne coatings, solvent-borne coatings, powder coatings, and UV-cured coatings. Water-borne coatings are gaining traction due to their low volatile organic compound (VOC) emissions, regulatory compliance, and ease of application, while powder coatings are favored for their durability, environmental benefits, and efficiency in industrial applications .

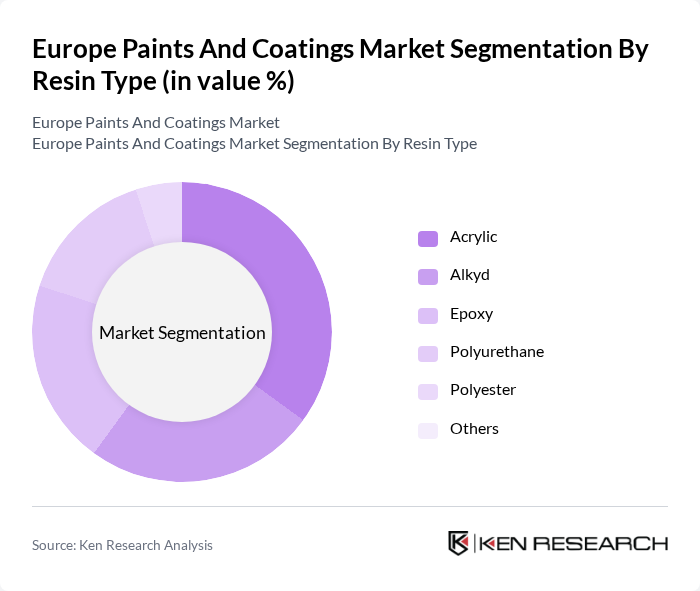

By Resin Type:The resin type segment encompasses various materials used in the formulation of paints and coatings. Key subsegments include acrylic, alkyd, epoxy, polyurethane, polyester, and others. Acrylic resins are particularly popular due to their versatility, excellent adhesion, and weather resistance, while epoxy resins are favored for their chemical resistance, mechanical strength, and durability in industrial and protective applications .

Europe Paints And Coatings Market Competitive Landscape

The Europe Paints And Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, RPM International Inc., Axalta Coating Systems LLC, Kansai Paint Co., Ltd., Jotun A/S, Hempel A/S, Tikkurila Oyj, Sika AG, Covestro AG, Henkel AG & Co. KGaA, 3M Company, Albi Protective Coatings, Nullifire contribute to innovation, geographic expansion, and service delivery in this space.

Europe Paints And Coatings Market Industry Analysis

Growth Drivers

- Increasing Demand for Eco-Friendly Products:The European paints and coatings market is witnessing a significant shift towards eco-friendly products, driven by consumer preferences for sustainable options. In future, the market for bio-based coatings is projected to reach €1.5 billion, reflecting a 20% increase from the previous year. This growth is supported by the European Union's Green Deal, which aims to reduce carbon emissions by at least 55% by 2030, encouraging manufacturers to innovate in sustainable formulations.

- Growth in the Construction Industry:The construction sector in Europe is expected to grow by 3.5% in future, fueled by increased investments in infrastructure and residential projects. This growth translates to a higher demand for paints and coatings, with an estimated consumption of 1.2 million tons in the construction segment alone. The European Commission's funding initiatives for sustainable urban development further bolster this demand, creating a robust market environment for coatings.

- Technological Advancements in Paint Formulations:Innovations in paint technology are driving market growth, with advancements such as self-cleaning and anti-microbial coatings gaining traction. In future, the market for smart coatings is anticipated to reach €800 million, reflecting a 15% increase from the previous year. These technologies not only enhance performance but also align with consumer demands for durability and functionality, thereby expanding the market's potential.

Market Challenges

- Fluctuating Raw Material Prices:The paints and coatings industry faces significant challenges due to volatile raw material prices, particularly for key ingredients like titanium dioxide and resins. In future, the price of titanium dioxide is projected to rise by 10%, impacting production costs. This volatility can lead to increased prices for end consumers, potentially dampening demand and affecting overall market stability.

- Stringent Environmental Regulations:Compliance with stringent environmental regulations poses a challenge for manufacturers in the European paints and coatings market. The REACH regulation requires extensive testing and registration of chemical substances, which can incur costs exceeding €1 million per substance. As regulations tighten, companies may face increased operational costs and potential penalties, impacting their competitiveness and profitability in the market.

Europe Paints And Coatings Market Future Outlook

The future of the Europe paints and coatings market appears promising, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in research and development to create advanced formulations. Additionally, the integration of digital technologies in manufacturing processes is expected to enhance efficiency and reduce costs, positioning companies to better meet evolving market demands and regulatory requirements.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in Eastern Europe present significant growth opportunities for the paints and coatings sector. With a projected GDP growth rate of 4% in future, these regions are experiencing increased construction activities, leading to a rising demand for coatings. Companies can capitalize on this trend by establishing local production facilities to cater to regional needs effectively.

- Innovations in Smart Coatings:The development of smart coatings, which offer functionalities such as self-healing and temperature regulation, represents a lucrative opportunity. The market for these advanced coatings is expected to grow significantly, with an estimated value of €1 billion in future. This innovation aligns with the increasing demand for high-performance products in sectors like automotive and aerospace, driving further market expansion.