Region:Europe

Author(s):Shubham

Product Code:KRAA1856

Pages:82

Published On:August 2025

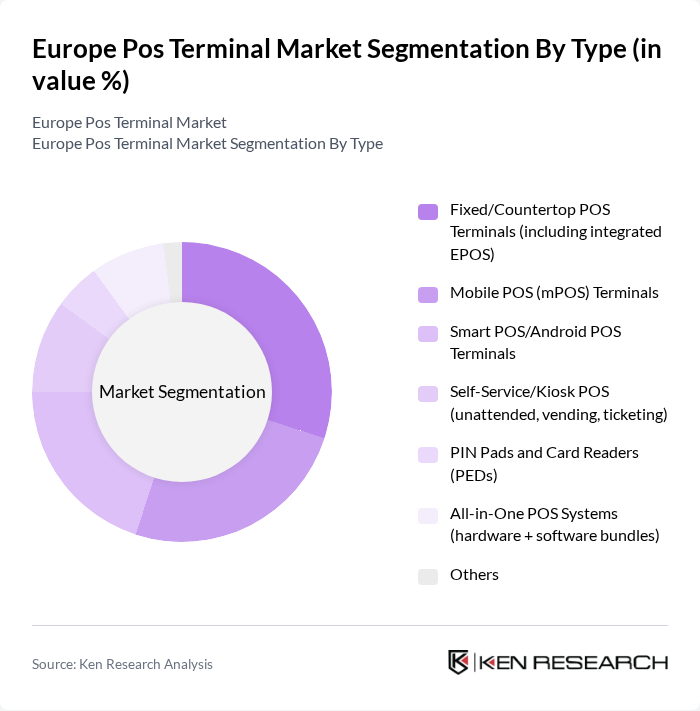

By Type:The market is segmented into various types of POS terminals, including Fixed/Countertop POS Terminals, Mobile POS (mPOS) Terminals, Smart POS/Android POS Terminals, Self-Service/Kiosk POS, PIN Pads and Card Readers, All-in-One POS Systems, and Others. Each of these sub-segments caters to different business needs and consumer preferences.

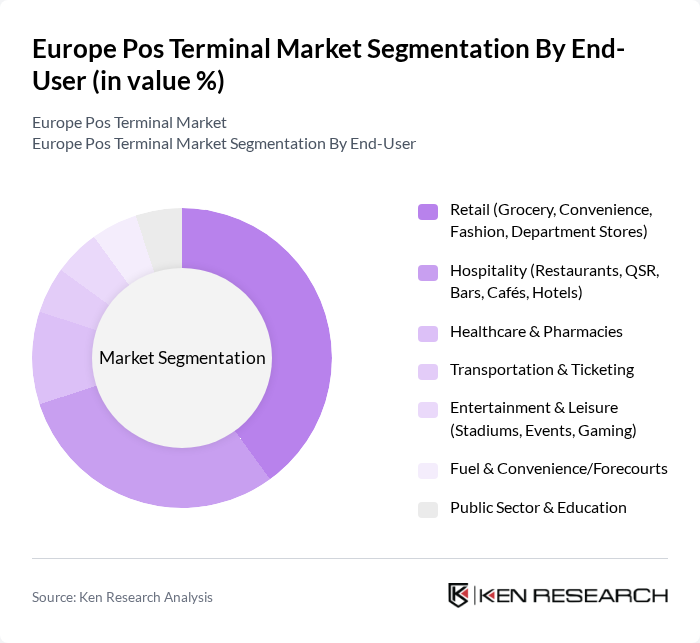

By End-User:The end-user segmentation includes Retail, Hospitality, Healthcare & Pharmacies, Transportation & Ticketing, Entertainment & Leisure, Fuel & Convenience/Forecourts, Public Sector & Education, and Others. Each sector has unique requirements for payment processing, influencing the type of POS systems adopted.

The Europe POS terminal market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingenico (a Worldline brand), Verifone, PAX Technology, Worldline, Adyen, Nexi Group, Viva.com, SumUp, Zettle by PayPal, myPOS, Stripe (Terminal), Revolut (Revolut Reader), Diebold Nixdorf, NCR Voyix, Lightspeed contribute to innovation, geographic expansion, and service delivery in this space.

The future of the POS terminal market in Europe appears promising, driven by ongoing technological innovations and changing consumer behaviors. As businesses increasingly adopt cloud-based solutions and multi-channel payment systems, the market is expected to evolve rapidly. Additionally, the focus on enhancing customer experiences will lead to the development of more intuitive and user-friendly POS systems. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in the dynamic payment landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed/Countertop POS Terminals (including integrated EPOS) Mobile POS (mPOS) Terminals Smart POS/Android POS Terminals Self-Service/Kiosk POS (unattended, vending, ticketing) PIN Pads and Card Readers (PEDs) All-in-One POS Systems (hardware + software bundles) Others |

| By End-User | Retail (Grocery, Convenience, Fashion, Department Stores) Hospitality (Restaurants, QSR, Bars, Cafés, Hotels) Healthcare & Pharmacies Transportation & Ticketing Entertainment & Leisure (Stadiums, Events, Gaming) Fuel & Convenience/Forecourts Public Sector & Education Others |

| By Sales Channel | Direct (OEM/ISV direct sales) Value-Added Resellers (VARs) & Distributors Payment Service Providers/Acquirer Channels Online/E-commerce System Integrators Retail Partnerships Others |

| By Region | Western Europe (UK, Germany, France, Benelux, Ireland) Northern Europe (Nordics, Baltics) Southern Europe (Italy, Spain, Portugal, Greece) Eastern Europe (Poland, Czechia, Hungary, Romania, Baltics) Central Europe (Austria, Switzerland) Others |

| By Payment Method | Card Payments (Credit/Debit, EMV) Contactless/NFC (incl. Apple Pay, Google Pay) Mobile Wallets & SoftPOS BNPL at POS Closed-Loop & Gift Cards Account-to-Account/Instant Payments (e.g., SEPA Instant) Others |

| By Deployment Mode | On-Premises Cloud/SaaS Hybrid Edge/Offline-First Others |

| By Price Range | Entry-Level/mPOS Devices Mid-Range Smart POS High-End Integrated POS/EPOS Enterprise-Grade/Kiosk Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail POS Terminal Usage | 120 | Store Managers, IT Directors |

| Hospitality Sector Payment Solutions | 100 | Operations Managers, Front Desk Supervisors |

| Mobile Payment Adoption | 80 | Small Business Owners, Entrepreneurs |

| POS Terminal Technology Trends | 70 | Product Managers, R&D Specialists |

| Consumer Preferences in Payment Methods | 90 | End-users, Customer Experience Managers |

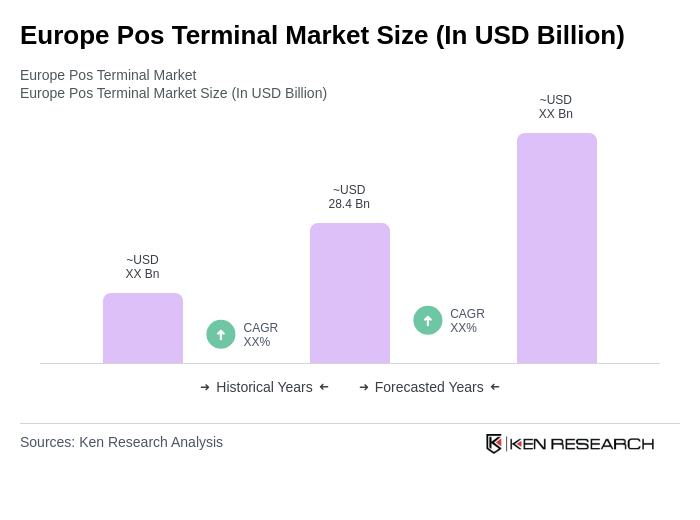

The Europe POS terminal market is valued at approximately USD 28.4 billion, reflecting its significant contribution to the global POS terminal market, which Europe accounts for about one-quarter of, driven by cashless payment adoption and technological advancements.