Region:Europe

Author(s):Shubham

Product Code:KRAC0867

Pages:98

Published On:August 2025

Market.png)

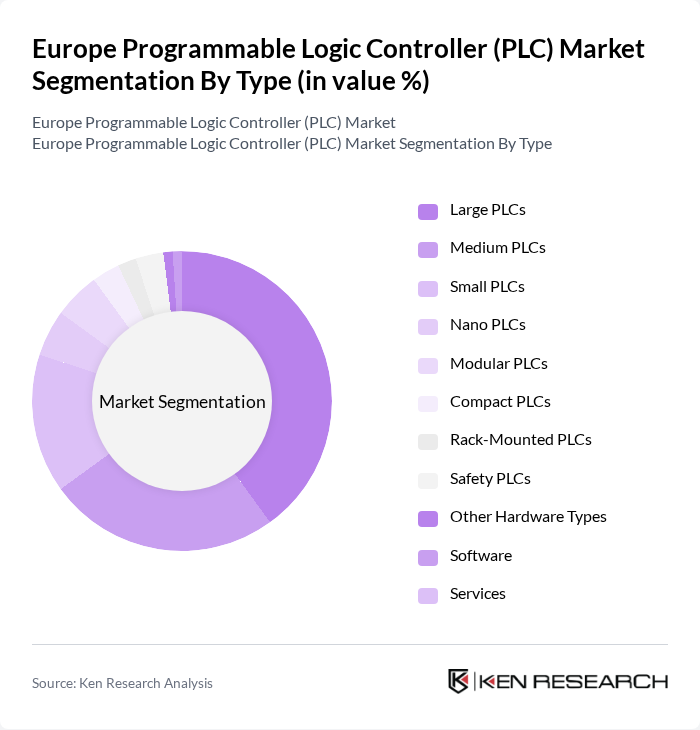

By Type:The PLC market can be segmented into various types, including Large PLCs, Medium PLCs, Small PLCs, Nano PLCs, Modular PLCs, Compact PLCs, Rack-Mounted PLCs, Safety PLCs, Other Hardware Types, Software, and Services. Among these,Large PLCsdominate the market due to their extensive capabilities and suitability for complex industrial applications. The demand for Large PLCs is driven by the need for high processing power, scalability, and advanced connectivity features in large manufacturing setups, making them essential for industries such as automotive, energy, and chemicals. Modular and compact PLCs are also gaining traction due to their flexibility and ease of integration in mid-sized operations .

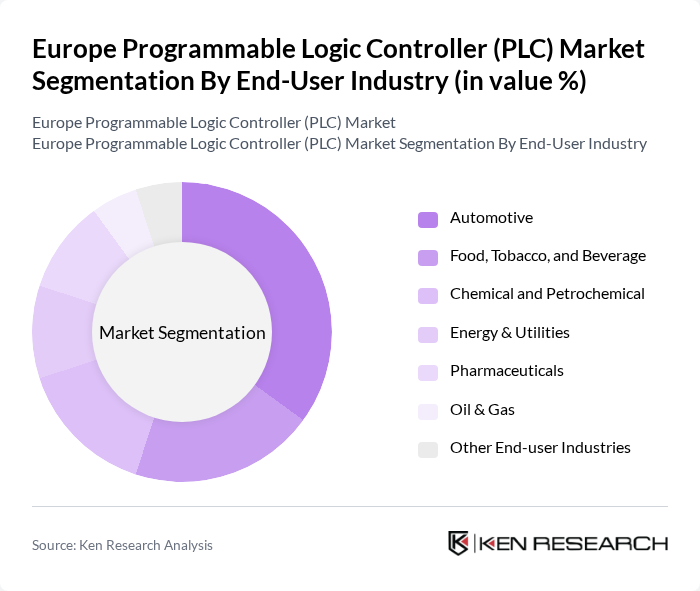

By End-User Industry:The PLC market is segmented by end-user industries, including Automotive, Food, Tobacco, and Beverage, Chemical and Petrochemical, Energy & Utilities, Pharmaceuticals, Oil & Gas, and Other End-user Industries. TheAutomotive sectoris the leading end-user of PLCs, driven by the industry's push for automation and efficiency in production lines. The increasing complexity of automotive manufacturing processes necessitates the use of advanced PLC systems to ensure precision, reliability, and integration with robotics and smart sensors. Food & beverage, pharmaceuticals, and energy sectors are also significant adopters, leveraging PLCs for process control, quality assurance, and regulatory compliance .

The Europe Programmable Logic Controller (PLC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, Mitsubishi Electric Corporation, ABB Ltd., Omron Corporation, Honeywell International Inc., Yokogawa Electric Corporation, Beckhoff Automation GmbH & Co. KG, B&R Industrial Automation GmbH (A member of ABB Group), Panasonic Holdings Corporation, National Instruments Corporation, Delta Electronics, Inc., WAGO Kontakttechnik GmbH & Co. KG, Festo SE & Co. KG, Eaton Corporation plc, Emerson Electric Co., Lenze SE, Robert Bosch GmbH, Ependion AB (formerly Beijer Electronics Group AB) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Europe PLC market appears promising, driven by technological advancements and increasing investments in automation. As industries embrace Industry 4.0, the demand for intelligent and interconnected PLC systems is expected to rise. Furthermore, the integration of AI and machine learning into PLCs will enhance operational efficiency and decision-making processes. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Large PLCs Medium PLCs Small PLCs Nano PLCs Modular PLCs Compact PLCs Rack-Mounted PLCs Safety PLCs Other Hardware Types Software Services |

| By End-User Industry | Automotive Food, Tobacco, and Beverage Chemical and Petrochemical Energy & Utilities Pharmaceuticals Oil & Gas Other End-user Industries |

| By Application | Process Automation Factory Automation Building Automation Transportation Systems Others |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | Energy & Utilities Chemicals Aerospace & Defense Others |

| By Country/Region | Germany United Kingdom France Italy Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector PLC Usage | 100 | Production Managers, Automation Engineers |

| Food & Beverage Automation | 60 | Quality Control Managers, Operations Supervisors |

| Pharmaceutical Industry PLC Applications | 40 | Regulatory Affairs Specialists, Process Engineers |

| Automotive Manufacturing Automation | 80 | Plant Managers, Supply Chain Coordinators |

| Energy Sector PLC Implementations | 50 | Project Managers, Electrical Engineers |

The Europe Programmable Logic Controller (PLC) Market is valued at approximately USD 3.6 billion, driven by the increasing adoption of automation technologies and the demand for efficient manufacturing processes across various industries.