Region:Europe

Author(s):Dev

Product Code:KRAD0452

Pages:96

Published On:August 2025

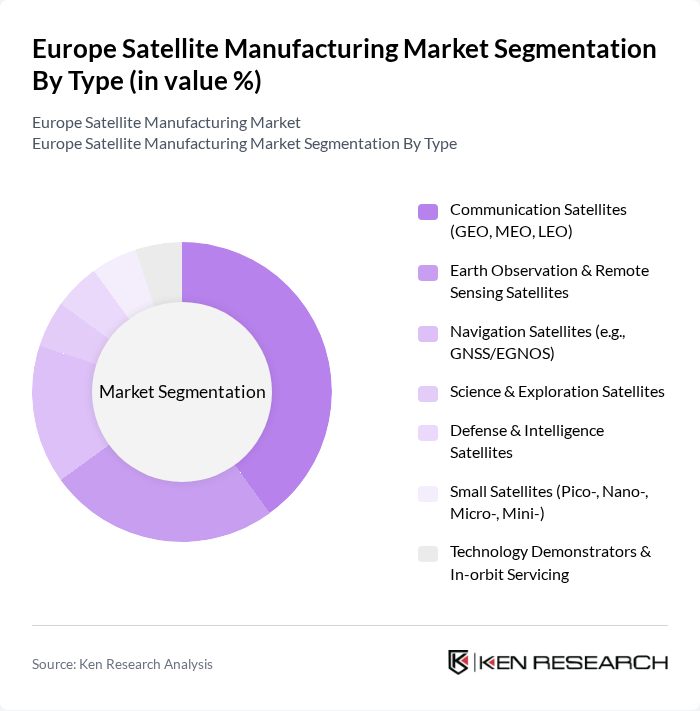

By Type:The satellite manufacturing market can be segmented into various types, including communication satellites, earth observation satellites, navigation satellites, science and exploration satellites, defense and intelligence satellites, small satellites, and technology demonstrators. Each of these sub-segments plays a crucial role in addressing specific market needs and applications .

The communication satellites segment, particularly those in GEO, MEO, and LEO orbits, dominates the market due to the increasing demand for broadband connectivity and global communication services. The rise of non?geostationary broadband constellations and expanded commercial communications orders has supported higher manufacturing throughput; parallel advances in electric propulsion, digital payloads, and standardized platforms enable smaller, more efficient satellites delivering high?throughput services .

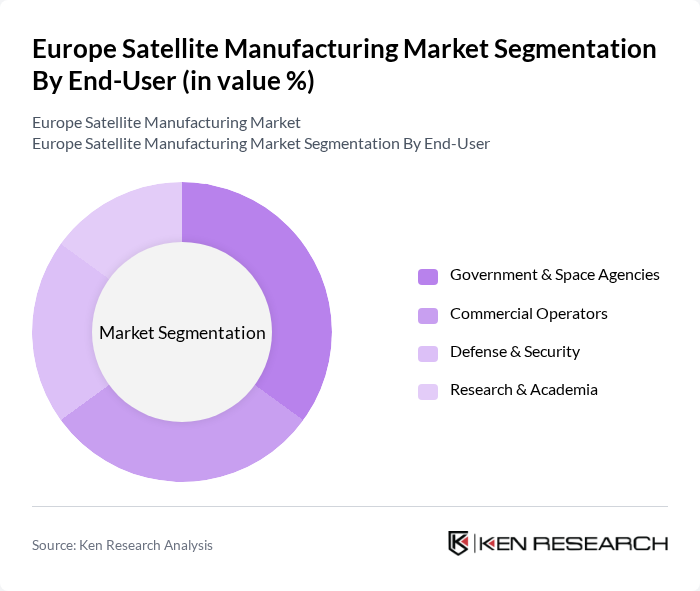

By End-User:The satellite manufacturing market can also be segmented by end-user, which includes government and space agencies, commercial operators, defense and security, and research and academia. Each of these end-users has distinct requirements and applications for satellite technology .

The government and space agencies segment leads the market due to substantial investments in satellite programs aimed at national security, scientific research, and environmental monitoring. ESA?led programs and national procurements create multi?year order backlogs for primes and small?sat specialists, while public?private partnerships are accelerating innovation and industrial capacity expansion .

The Europe Satellite Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Thales Alenia Space, OHB SE, Surrey Satellite Technology Ltd (SSTL), Leonardo S.p.A., QinetiQ Group plc, OneWeb (Eutelsat OneWeb), Eutelsat Group, SES S.A., GMV Innovating Solutions, RUAG Space (Beyond Gravity), AAC Clyde Space, GomSpace, Exotrail, ISISPACE Group (ISIS – Innovative Solutions In Space) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European satellite manufacturing market appears promising, driven by ongoing technological advancements and increasing collaboration between public and private sectors. The rise of small satellite production and the expansion of satellite internet services are expected to reshape the industry landscape. As sustainability becomes a priority, manufacturers are likely to innovate in eco-friendly satellite designs, ensuring compliance with environmental regulations while meeting the growing demand for satellite services across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Communication Satellites (GEO, MEO, LEO) Earth Observation & Remote Sensing Satellites Navigation Satellites (e.g., GNSS/EGNOS) Science & Exploration Satellites Defense & Intelligence Satellites Small Satellites (Pico-, Nano-, Micro-, Mini-) Technology Demonstrators & In-orbit Servicing |

| By End-User | Government & Space Agencies Commercial Operators Defense & Security Research & Academia |

| By Application | Telecommunications & Broadband Connectivity Earth Observation & Climate Monitoring Science, Technology, and Exploration Missions Navigation, PNT & Timing Broadcasting & Media Space Situational Awareness (SSA) & Space Safety |

| By Component | Payload (Imagers, Transponders, SDRs) Platform/Bus (Structure, Power, Thermal, AOCS) Propulsion (Chemical, Electric) Launch Services (European and International) Ground Segment (TT&C, Data Processing) |

| By Sales Channel | Direct to Government (Prime Contracts) Direct to Commercial Operators Consortia/JV & Prime-Subcontracting |

| By Distribution Mode | Intra-Europe Programs (e.g., ESA, EU) International Programs & Exports |

| By Policy Support | ESA, EU & National Program Funding Tax Incentives & R&D Credits Grants for SMEs & New Space Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Communication Satellites | 100 | Product Managers, Technical Directors |

| Earth Observation Satellites | 80 | Research Scientists, Program Managers |

| Navigation Satellites | 70 | Systems Engineers, Operations Managers |

| Small Satellite Manufacturing | 60 | Startup Founders, R&D Managers |

| Satellite Launch Services | 90 | Business Development Managers, Logistics Coordinators |

The Europe Satellite Manufacturing Market is valued at approximately USD 12 billion, reflecting a robust growth trajectory supported by increased commercial and institutional satellite programs across telecommunications, earth observation, and navigation sectors.