Region:Europe

Author(s):Rebecca

Product Code:KRAC0231

Pages:81

Published On:August 2025

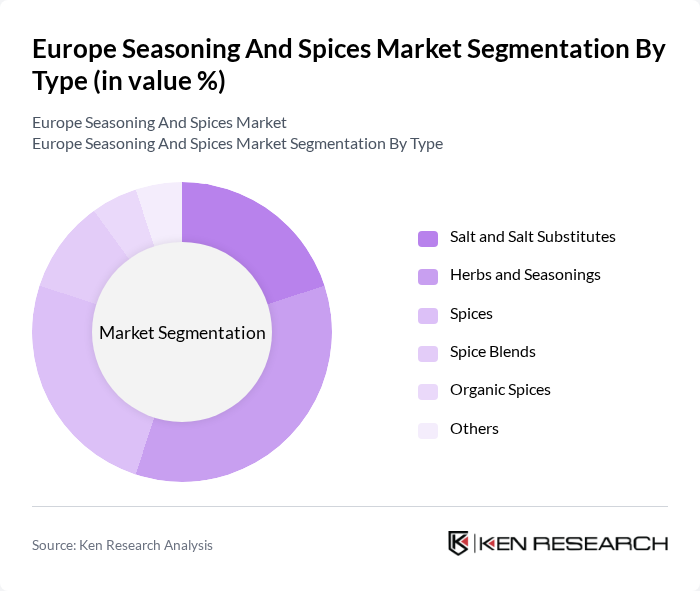

By Type:The market is segmented into Salt and Salt Substitutes, Herbs and Seasonings, Spices, Spice Blends, Organic Spices, and Others. The Herbs and Seasonings segment is currently leading the market, supported by rising consumer inclination toward healthy and flavorful cooking. Increased home cooking and the popularity of plant-based diets have further fueled demand for herbs and seasonings, as consumers seek to enhance culinary experiences. The trend toward organic products is gaining traction, with health-conscious consumers preferring natural ingredients over artificial additives.

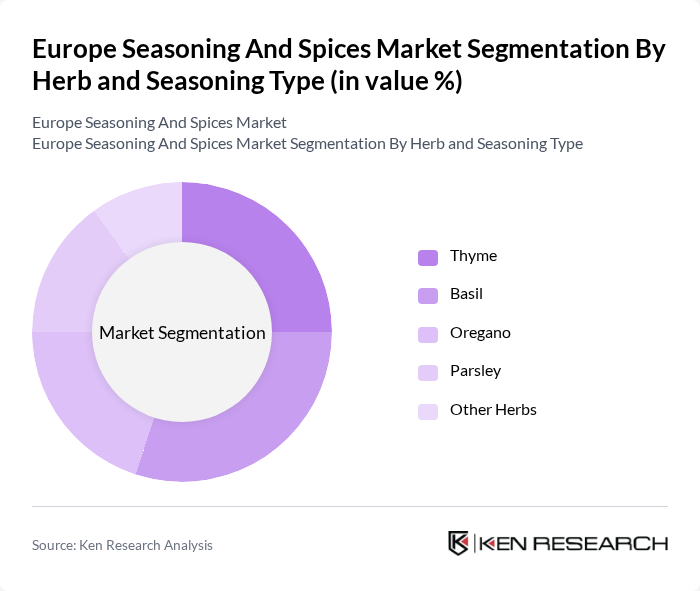

By Herb and Seasoning Type:This segmentation includes Thyme, Basil, Oregano, Parsley, and Other Herbs. Thyme and Basil remain particularly popular due to their versatility and health benefits. The Mediterranean diet trend, emphasizing fresh herbs, has significantly boosted demand for these ingredients. Increasing awareness of the health benefits associated with herbs has led to a rise in their usage in both home cooking and food manufacturing.

The Europe Seasoning and Spices Market is characterized by a dynamic mix of regional and international players. Leading participants such as McCormick & Company, Inc., Olam International Limited, Associated British Foods plc, Fuchs Gruppe, Döhler GmbH, Kerry Group plc, Euroma B.V., Verstegen Spices & Sauces B.V., Bart Ingredients Co. Ltd., Wiberg GmbH, Kotányi GmbH, La Chinata S.L., Ducros (McCormick France), Kania GmbH, Pacific Spice Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe seasoning and spices market appears promising, driven by evolving consumer preferences and technological advancements. The trend towards sustainable sourcing is expected to gain momentum, with companies increasingly adopting eco-friendly practices. Additionally, the rise of plant-based diets will likely create new opportunities for innovative seasoning blends that cater to health-conscious consumers. As e-commerce continues to expand, brands will leverage digital marketing strategies to enhance consumer engagement and drive sales in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | Salt and Salt Substitutes Herbs and Seasonings Spices Spice Blends Organic Spices Others |

| By Herb and Seasoning Type | Thyme Basil Oregano Parsley Other Herbs |

| By Spice Type | Pepper Cardamom Cinnamon Clove Nutmeg Turmeric Other Spices |

| By Application | Bakery and Confectionery Soup, Noodles, and Pasta Meat and Seafood Sauces, Salads, and Dressing Savory Snacks Other Applications |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales Others |

| By Region | Spain United Kingdom Germany France Italy Russia Rest of Europe |

| By End-User | Households Restaurants Food Manufacturers Catering Services Others |

| By Packaging Type | Glass Jars Plastic Containers Pouches Bulk Packaging Others |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Spice Sales | 150 | Retail Managers, Category Buyers |

| Food Manufacturing Sector | 100 | Production Managers, Quality Control Officers |

| Restaurant Industry Insights | 80 | Chefs, Restaurant Owners |

| Consumer Preferences | 120 | Household Consumers, Culinary Enthusiasts |

| Export Market Analysis | 70 | Export Managers, Trade Analysts |

The Europe Seasoning and Spices Market is valued at approximately USD 7.2 billion, reflecting a robust growth driven by consumer preferences for natural and organic products, as well as the rising trend of home cooking and gourmet food preparation.