Region:Europe

Author(s):Dev

Product Code:KRAD0581

Pages:95

Published On:August 2025

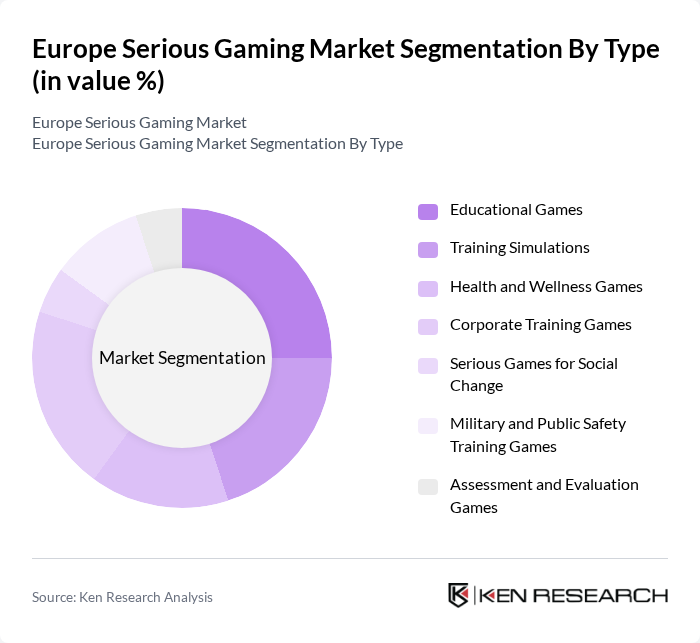

By Type:The serious gaming market can be segmented into various types, including educational games, training simulations, health and wellness games, corporate training games, serious games for social change, military and public safety training games, and assessment and evaluation games. Each of these sub-segments caters to specific needs and applications, driving the overall market growth.

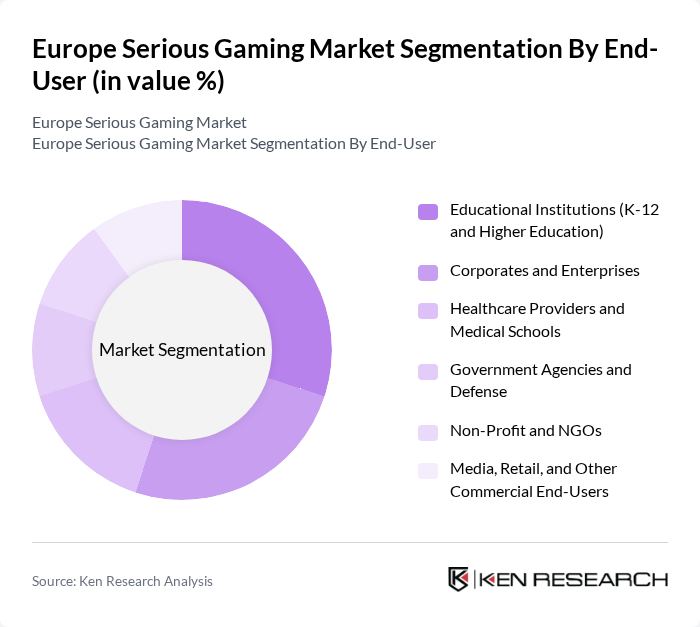

By End-User:The end-user segmentation includes educational institutions (K-12 and higher education), corporates and enterprises, healthcare providers and medical schools, government agencies and defense, non-profit organizations, and media, retail, and other commercial end-users. Each segment utilizes serious gaming for different purposes, contributing to the market's expansion.

The Europe Serious Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ubisoft Entertainment S.A., Serious Games Interactive A/S, Triseum, LLC, IJsfontein Interactive Media B.V., appliedVR, Inc., Learning Technologies Group plc (LTG), Prowise B.V., Gamelearn S.L., PlayGen Ltd, Pear Therapeutics, Inc. (digital therapeutics), Kognito Interactive, Inc., EON Reality, Inc., VR Education Holdings plc (ENGAGE XR Holdings plc), The Game Agency, LLC, BreakAway Games, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the serious gaming market in Europe appears promising, driven by technological advancements and increasing acceptance across various sectors. As organizations recognize the value of gamified solutions for training and education, investment in serious games is expected to rise. Additionally, the integration of artificial intelligence and virtual reality will enhance user experiences, making serious games more engaging and effective. This evolution will likely lead to broader adoption and innovative applications in diverse fields, including healthcare and corporate training.

| Segment | Sub-Segments |

|---|---|

| By Type | Educational Games Training Simulations Health and Wellness Games Corporate Training Games Serious Games for Social Change Military and Public Safety Training Games Assessment and Evaluation Games |

| By End-User | Educational Institutions (K-12 and Higher Education) Corporates and Enterprises Healthcare Providers and Medical Schools Government Agencies and Defense Non-Profit and NGOs Media, Retail, and Other Commercial End-Users |

| By Application | Learning and Education Simulation Training Advertising and Marketing Patient Rehabilitation and Digital Therapeutics Public Awareness and Behavior Change Campaigns |

| By Distribution Channel | Direct Enterprise Sales Online Platforms and App Stores Channel Partners and System Integrators Academic and Institutional Partnerships |

| By Pricing Model | Subscription (SaaS/LMS-integrated) Perpetual License (One-Time Purchase) Freemium and In-App Monetization Enterprise Licensing and Seat-Based Pricing |

| By User Demographics | Age Groups Professional Backgrounds Educational Levels Accessibility and Inclusion Segments |

| By Region | Western Europe Northern Europe Southern Europe Eastern Europe Central and Southeastern Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Educational Institutions | 120 | Teachers, Curriculum Developers |

| Corporate Training Programs | 100 | Training Managers, HR Directors |

| Healthcare Simulation Training | 80 | Medical Educators, Simulation Technicians |

| Government and NGO Initiatives | 70 | Policy Makers, Project Managers |

| End-User Feedback | 100 | Students, Trainees, Gamers |

The Europe Serious Gaming Market is valued at approximately USD 10 billion, reflecting significant growth driven by the increasing adoption of gamification across various sectors such as education, healthcare, and corporate training.