Region:Europe

Author(s):Geetanshi

Product Code:KRAA0011

Pages:94

Published On:July 2025

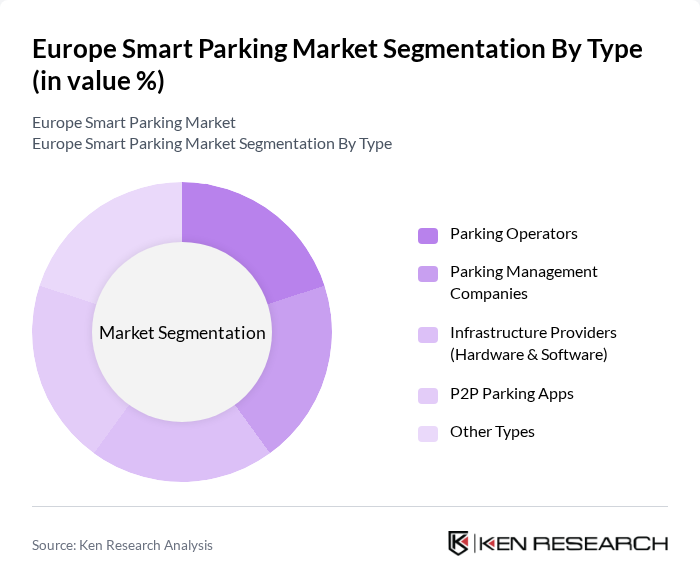

By Type:The smart parking market is segmented into Parking Operators, Parking Management Companies, Infrastructure Providers (Hardware & Software), P2P Parking Apps, and Other Types. Among these, Parking Management Companies and Infrastructure Providers are leading the market due to their ability to deliver comprehensive, integrated solutions that combine technology with user-friendly interfaces. These companies provide real-time data on parking availability, payment processing, and user notifications, significantly enhancing the parking experience for consumers. The increasing demand for efficient parking solutions in urban areas has led to a surge in the adoption of these services, making them a preferred choice for municipalities and private operators .

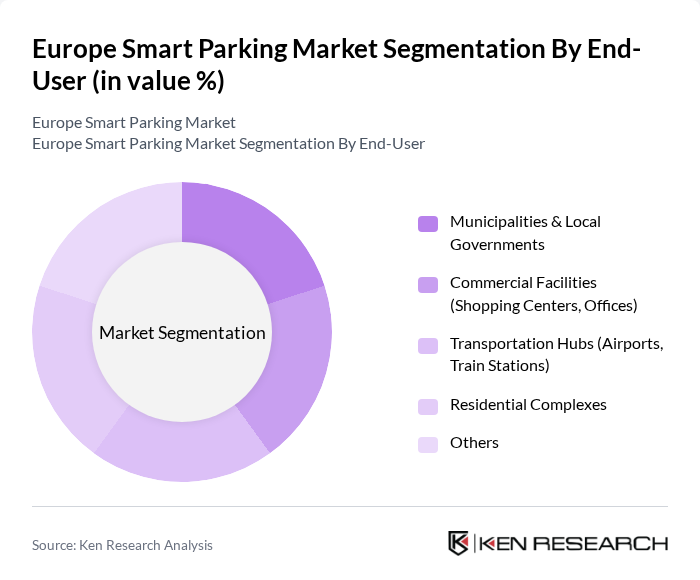

By End-User:The end-user segmentation includes Municipalities & Local Governments, Commercial Facilities (Shopping Centers, Offices), Transportation Hubs (Airports, Train Stations), Residential Complexes, and Others. Municipalities & Local Governments are leading this segment as they are increasingly adopting smart parking solutions to manage urban traffic and improve public services. The growing need for efficient urban mobility and the pressure to reduce congestion in city centers have prompted local governments to invest in smart parking technologies. This trend is further supported by public funding initiatives and sustainability goals aimed at enhancing urban infrastructure .

The Europe Smart Parking Market is characterized by a dynamic mix of regional and international players. Leading participants such as APCOA Parking, EasyPark Group, Flowbird Group, Parkopedia, ParkMobile, JustPark, ParkNow (BMW Group/Daimler, now part of EasyPark), Smart Parking Ltd., Streetline, ParkMe, Parclick, Indigo Group, Q-Park, ParkBee, and SKIDATA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart parking market in Europe appears promising, driven by technological advancements and increasing urbanization. As cities prioritize sustainability, the integration of AI and machine learning into parking solutions will enhance efficiency and user experience. Additionally, the rise of electric vehicles will necessitate the expansion of smart parking infrastructure, creating opportunities for innovative solutions that cater to evolving urban mobility needs while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Parking Operators Parking Management Companies Infrastructure Providers (Hardware & Software) P2P Parking Apps Other Types |

| By End-User | Municipalities & Local Governments Commercial Facilities (Shopping Centers, Offices) Transportation Hubs (Airports, Train Stations) Residential Complexes Others |

| By Country/Region | Germany United Kingdom France Spain The Netherlands Rest of Europe (Nordics, Italy, etc.) |

| By Technology | Sensor-Based Systems (Ultrasonic, Magnetic, RFID) Cloud-Based Solutions Mobile Applications AI-Powered Parking Guidance Systems Others |

| By Application | Urban Parking Management Event Parking Management Airport Parking Solutions EV Charging Integration Others |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Smart Parking Solutions | 100 | City Planners, Urban Development Officials |

| Technology Providers in Smart Parking | 80 | Product Managers, Business Development Executives |

| End-User Experience with Smart Parking | 60 | Drivers, Parking Facility Managers |

| Regulatory Impact on Smart Parking | 50 | Policy Makers, Transportation Authorities |

| Market Trends and Innovations | 40 | Industry Analysts, Research Scholars |

The Europe Smart Parking Market is valued at approximately USD 3.3 billion, driven by urbanization, rising vehicle ownership, and the integration of advanced technologies like IoT and AI in parking management solutions.