Region:Europe

Author(s):Shubham

Product Code:KRAD0731

Pages:83

Published On:August 2025

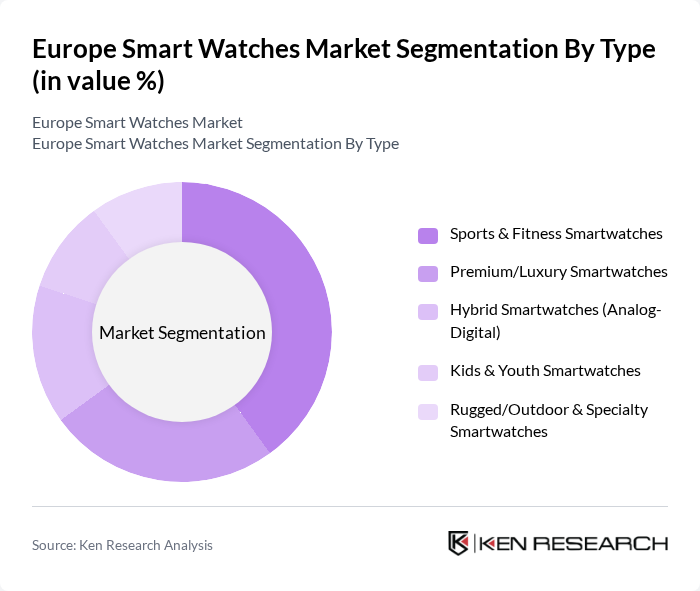

By Type:The smartwatch market can be segmented into various types, including Sports & Fitness Smartwatches, Premium/Luxury Smartwatches, Hybrid Smartwatches (Analog-Digital), Kids & Youth Smartwatches, and Rugged/Outdoor & Specialty Smartwatches. Among these, Sports & Fitness Smartwatches are currently leading the market due to the increasing focus on health and fitness among consumers. The trend of fitness tracking and health monitoring has made these devices highly sought after, especially among fitness enthusiasts and health-conscious individuals. Continuous feature upgrades such as ECG, SpO?, sleep staging, temperature sensing, and support for LTE/eSIM and NFC payments reinforce the lead of health/fitness-centric models in Europe.

By End-User:The end-user segmentation includes Individual Consumers, Enterprise & Corporate Wellness Programs, Healthcare & Insurance Programs, and Fitness Enthusiasts & Athletes. Individual Consumers dominate this segment, driven by the growing trend of personal health management and the convenience offered by smartwatches. The increasing integration of health monitoring features has made these devices appealing to a broad audience, including those who are not professional athletes but are health-conscious. Insurer-linked wellness incentives and remote monitoring pilots further broaden usage beyond athletes to mainstream consumers in Western and Northern Europe.

The Europe Smart Watches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit (Google LLC), Fossil Group, Inc., Huawei Technologies Co., Ltd., Suunto Oy, Withings S.A.S., Amazfit (Zepp Health Corporation), Mobvoi Inc. (TicWatch), Xiaomi Corporation, Polar Electro Oy, TAG Heuer (LVMH), Montblanc (Richemont), HMD Global (Nokia brand wearables ecosystem) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European smartwatches market appears promising, driven by ongoing technological advancements and a growing emphasis on health and wellness. As consumers increasingly seek devices that offer comprehensive health monitoring and smart home integration, manufacturers are likely to focus on enhancing features and user experience. Additionally, the rise of e-commerce platforms is expected to facilitate broader market access, allowing brands to reach diverse consumer segments and adapt to changing preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Sports & Fitness Smartwatches Premium/Luxury Smartwatches Hybrid Smartwatches (Analog-Digital) Kids & Youth Smartwatches Rugged/Outdoor & Specialty Smartwatches |

| By End-User | Individual Consumers Enterprise & Corporate Wellness Programs Healthcare & Insurance Programs Fitness Enthusiasts & Athletes |

| By Distribution Channel | Online Retail (Brand D2C, Marketplaces) Offline Retail (CE Stores, Department & Jewelry Stores) Telco Carriers & Operator Bundles Specialist & Sports Retailers |

| By Price Range | Budget (Under €150) Mid-Range (€150–€400) Premium (€400 and Above) |

| By Operating System/Compatibility | watchOS (Apple) Wear OS by Google Proprietary OS (e.g., HarmonyOS, Zepp OS, Fitbit OS) Platform-Agnostic/Hybrid |

| By Feature Set | Health Monitoring (ECG, SpO2, BP, Afib alerts) Connectivity (LTE/eSIM, 5G-ready, NFC) Battery & Power (Fast charge, multi-week life) Durability & Outdoor (GPS, GLONASS, WR ratings) |

| By Country | Germany United Kingdom France Italy Spain Nordics (Sweden, Norway, Finland, Denmark) Benelux (Netherlands, Belgium, Luxembourg) Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Smart Watch Usage | 150 | Smart Watch Users, Fitness Enthusiasts |

| Retail Insights on Smart Watches | 100 | Retail Managers, Sales Associates |

| Technology Adoption Trends | 80 | Technology Analysts, Market Researchers |

| Health and Fitness Tracking Preferences | 70 | Health Professionals, Fitness Trainers |

| Smart Watch Feature Evaluation | 90 | Product Managers, UX Designers |

The Europe Smart Watches Market is valued at approximately USD 6.7 billion, reflecting a steady growth trend driven by increasing health consciousness and technological advancements in wearable devices.