Region:Europe

Author(s):Rebecca

Product Code:KRAB0188

Pages:84

Published On:August 2025

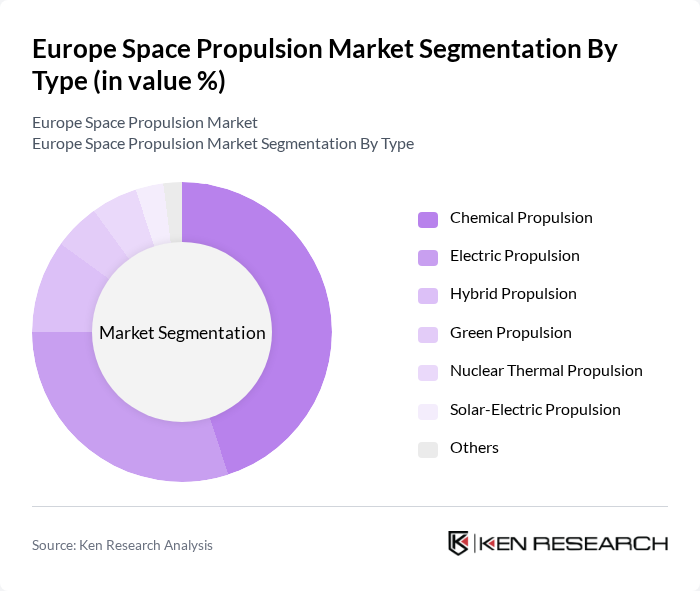

By Type:The market is segmented into various propulsion types, including Chemical Propulsion, Electric Propulsion, Hybrid Propulsion, Green Propulsion, Nuclear Thermal Propulsion, Solar-Electric Propulsion, and Others. Among these, Chemical Propulsion remains the most widely used due to its established technology and reliability in launching satellites and spacecraft. However, Electric Propulsion is rapidly gaining traction for its efficiency, reduced mass requirements, and suitability for long-duration and deep-space missions. Green Propulsion is emerging as a sustainable alternative, supported by increasing regulatory and environmental focus within Europe.

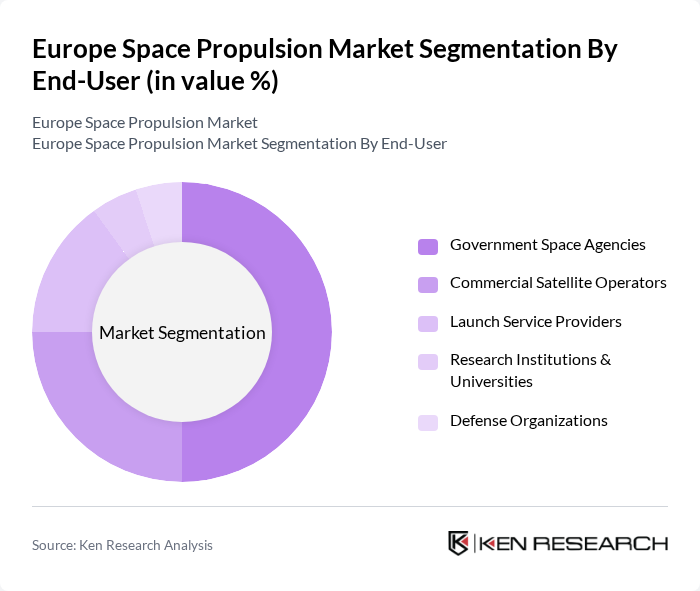

By End-User:The end-user segmentation includes Government Space Agencies, Commercial Satellite Operators, Launch Service Providers, Research Institutions & Universities, and Defense Organizations. Government Space Agencies, such as the European Space Agency (ESA), are the largest consumers of propulsion systems due to their extensive space missions and projects. Commercial Satellite Operators are also significant players, driven by the increasing demand for satellite services, launches, and the deployment of satellite constellations for communication and Earth observation.

The Europe Space Propulsion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Thales Alenia Space, ArianeGroup, Reaction Engines Limited, OHB SE, Avio S.p.A., Safran S.A., Nammo AS, RUAG Space, Inmarsat Group Holdings Ltd., Skyrora Ltd., Isar Aerospace Technologies GmbH, Sitael S.p.A., DLR (German Aerospace Center), and CNES (Centre National d'Études Spatiales) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe Space Propulsion Market appears promising, driven by technological advancements and increasing collaboration among stakeholders. The integration of artificial intelligence in propulsion systems is expected to enhance efficiency and reliability. Furthermore, the focus on sustainability will likely lead to the development of greener propulsion technologies, aligning with global environmental goals. As commercial space activities expand, Europe is poised to become a key player in the global space economy, fostering innovation and growth in the propulsion sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Propulsion Electric Propulsion Hybrid Propulsion Green Propulsion Nuclear Thermal Propulsion Solar-Electric Propulsion Others |

| By End-User | Government Space Agencies (e.g., ESA, DLR, CNES, UKSA, ASI, Roscosmos) Commercial Satellite Operators Launch Service Providers Research Institutions & Universities Defense Organizations |

| By Application | Satellite Launch Deep Space Exploration In-Orbit Servicing & Debris Removal Cargo & Crew Transport Space Tourism |

| By Component | Thrusters & Engines Propellant Tanks Power Processing Units Fuel Types Control & Guidance Systems |

| By Sales Channel | Direct Contracts Distributors & Integrators Online Platforms |

| By Distribution Mode | Land Transport Air Transport Sea Transport |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Propulsion Systems | 100 | Propulsion Engineers, Product Managers |

| Electric Propulsion Technologies | 80 | R&D Directors, Aerospace Analysts |

| Launch Vehicle Development | 90 | Project Managers, Technical Leads |

| Satellite Propulsion Applications | 70 | Systems Engineers, Operations Managers |

| Emerging Propulsion Startups | 40 | Founders, Innovation Officers |

The Europe Space Propulsion Market is valued at approximately USD 2.5 billion, driven by increased investments in space exploration, advancements in propulsion technologies, and a growing demand for satellite launches and constellations.