Region:Europe

Author(s):Geetanshi

Product Code:KRAA1291

Pages:81

Published On:August 2025

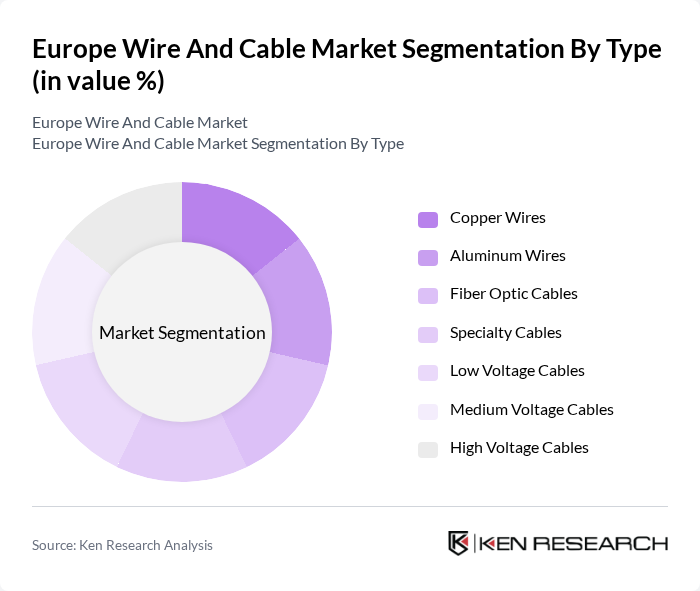

By Type:

The wire and cable market is segmented into various types, including Copper Wires, Aluminum Wires, Fiber Optic Cables, Specialty Cables, Low Voltage Cables, Medium Voltage Cables, and High Voltage Cables. Among these, Copper Wires hold a significant share due to their excellent conductivity and reliability, making them the preferred choice for electrical applications. The demand for Fiber Optic Cables is also increasing, driven by the need for high-speed internet and data transmission. The trend towards renewable energy sources has further boosted the demand for Specialty Cables designed for specific applications.

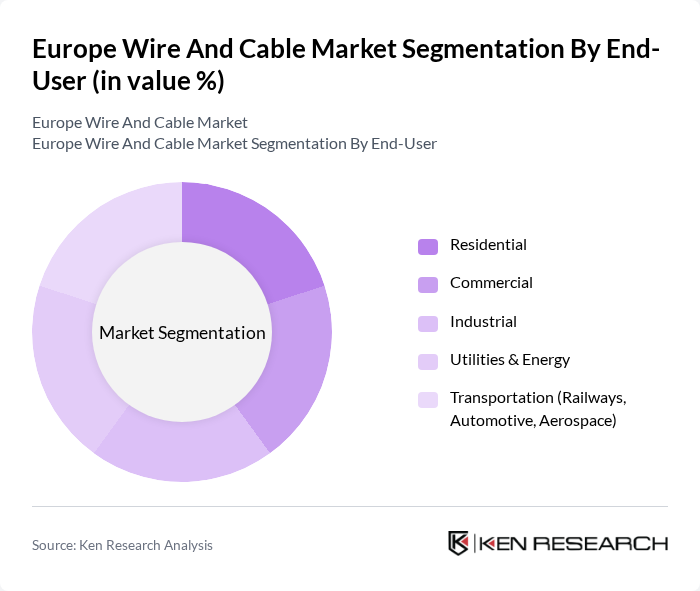

By End-User:

The end-user segmentation includes Residential, Commercial, Industrial, Utilities & Energy, and Transportation (Railways, Automotive, Aerospace). The Industrial sector leads the market, driven by the increasing demand for automation and electrification in manufacturing processes. The Utilities & Energy sector is also significant, as it requires extensive wiring for power generation and distribution. The growing trend of electric vehicles is boosting the Transportation segment, particularly in railways and automotive applications.

The Europe Wire and Cable Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexans S.A., Prysmian Group, NKT A/S, Leoni AG, TELE-FONIKA Kable S.A., British Cables Company (Wilms Group), Lapp Group, Belden Inc., Eland Cables Ltd., Sumitomo Electric Industries, Ltd., TE Connectivity Ltd., Siemens AG, ABB Ltd., Schneider Electric SE, Furukawa Electric Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Europe wire and cable market is poised for significant transformation driven by technological advancements and sustainability initiatives. As the demand for renewable energy and smart grid technologies increases, manufacturers will need to innovate and adapt to changing consumer preferences. The integration of IoT in wire and cable applications will further enhance operational efficiency. Additionally, the expansion into emerging markets presents a promising avenue for growth, allowing companies to diversify their portfolios and capitalize on new opportunities in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Wires Aluminum Wires Fiber Optic Cables Specialty Cables Low Voltage Cables Medium Voltage Cables High Voltage Cables |

| By End-User | Residential Commercial Industrial Utilities & Energy Transportation (Railways, Automotive, Aerospace) |

| By Application | Power Generation Transmission & Distribution Telecommunications Construction Data Centers & IT Infrastructure |

| By Distribution Mode | Direct Sales Distributors Online Sales |

| By Price Range | Economy Mid-Range Premium |

| By Component | Conductors Insulation Sheathing Connectors & Accessories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Wire Usage | 120 | Project Managers, Electrical Engineers |

| Telecommunications Cable Demand | 60 | Network Engineers, Telecom Operators |

| Automotive Wiring Applications | 50 | Procurement Managers, Design Engineers |

| Renewable Energy Cable Requirements | 40 | Energy Project Managers, Sustainability Officers |

| Industrial Cable Solutions | 70 | Operations Managers, Maintenance Supervisors |

The Europe Wire and Cable Market is valued at approximately USD 68 billion, driven by increasing electricity demand, advancements in telecommunications, and the expansion of renewable energy projects.