Region:Europe

Author(s):Rebecca

Product Code:KRAA2097

Pages:86

Published On:August 2025

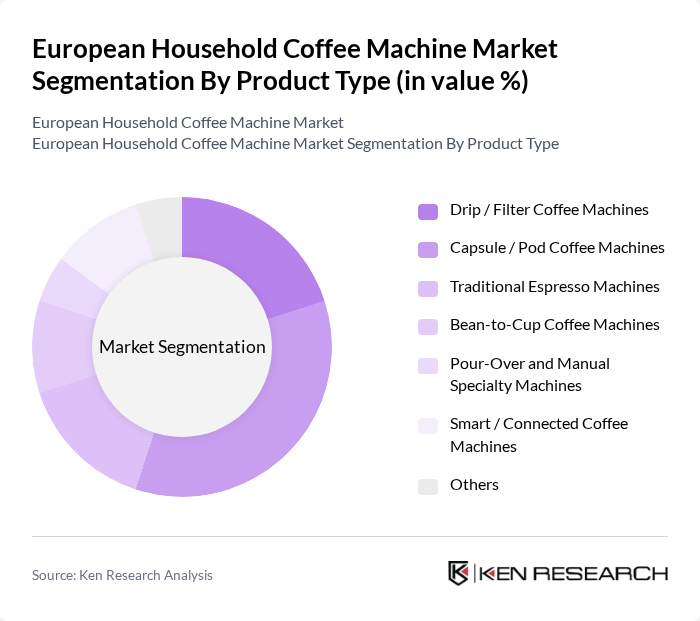

By Product Type:The product type segmentation encompasses a diverse range of coffee machines tailored to varying consumer preferences and brewing methods. Subsegments include Drip / Filter Coffee Machines, Capsule / Pod Coffee Machines, Traditional Espresso Machines, Bean-to-Cup Coffee Machines, Pour-Over and Manual Specialty Machines, Smart / Connected Coffee Machines, and Others. Capsule / Pod Coffee Machines maintain significant popularity due to their convenience, ease of use, and wide variety, particularly appealing to busy consumers seeking quick and consistent coffee solutions. Bean-to-cup systems are expanding at the fastest rate, reflecting the premiumization trend in home coffee consumption.

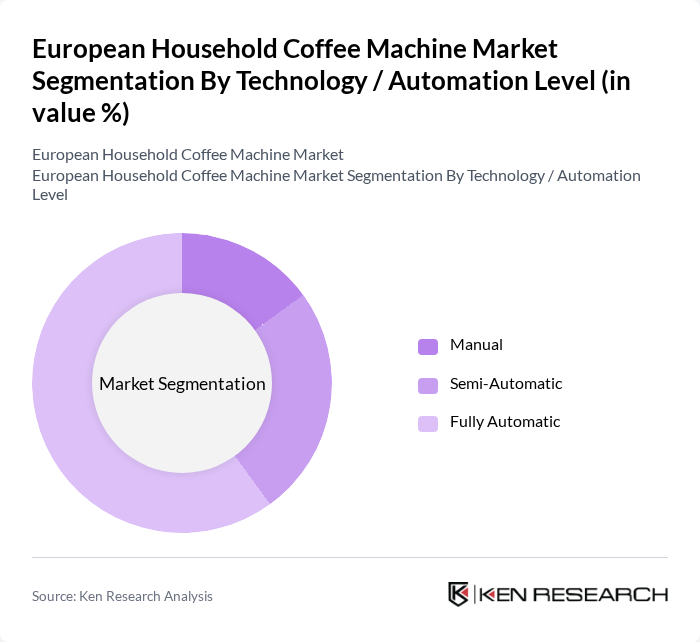

By Technology / Automation Level:This segmentation highlights the automation spectrum in coffee machines, including Manual, Semi-Automatic, and Fully Automatic models. Fully Automatic machines lead the market, reflecting consumer preferences for convenience, consistency, and advanced features such as programmable brewing and integration with smart home ecosystems. The trend toward automation underscores the growing demand for efficient, user-friendly coffee preparation at home.

The European Household Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as De'Longhi S.p.A., Breville Group Limited, Koninklijke Philips N.V., BSH Hausgeräte GmbH (Bosch Home Appliances), Krups GmbH, Nestlé Nespresso S.A., Cuisinart (Conair Corporation), Hamilton Beach Brands Holding Company, Gaggia S.p.A., Smeg S.p.A., Miele & Cie. KG, Jura Elektroapparate AG, Rancilio Group S.p.A., La Marzocco S.r.l., Tchibo GmbH, Illycaffè S.p.A., Dualit Limited, AB Electrolux, and Schaerer AG contribute to innovation, geographic expansion, and service delivery in this space.

The European household coffee machine market is poised for continued growth, driven by evolving consumer preferences and technological innovations. As more consumers seek personalized coffee experiences, manufacturers are likely to invest in customizable features and smart technologies. Additionally, the increasing focus on sustainability will push brands to develop eco-friendly products. The rise of e-commerce will further facilitate market expansion, allowing consumers easier access to a wider range of coffee machines and related products.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drip / Filter Coffee Machines Capsule / Pod Coffee Machines Traditional Espresso Machines Bean-to-Cup Coffee Machines Pour-Over and Manual Specialty Machines Smart / Connected Coffee Machines Others |

| By Technology / Automation Level | Manual Semi-Automatic Fully Automatic |

| By Distribution Channel | Multi-Brand Electrical and Appliance Stores Specialty Coffee and Kitchenware Stores Online Pure-Play Retailers Direct-to-Consumer Webshops Mass Merchandisers and Hypermarkets |

| By Geography | United Kingdom Germany France Spain Italy BENELUX (Belgium, Netherlands, Luxembourg) NORDICS (Denmark, Finland, Iceland, Norway, Sweden) Rest of Europe |

| By Price Range | Budget Mid-Range Premium |

| By Features | Programmable Settings Built-in Grinder Milk Frother Smart Connectivity |

| By Material | Plastic Stainless Steel Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Coffee Machine Users | 120 | Homeowners, Coffee Enthusiasts |

| Retailers of Coffee Machines | 60 | Store Managers, Sales Representatives |

| Baristas and Coffee Shop Owners | 50 | Baristas, Café Managers |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

| Manufacturers of Coffee Machines | 45 | Product Development Managers, Marketing Directors |

The European Household Coffee Machine Market is valued at approximately USD 5.2 billion, reflecting a robust growth trajectory driven by increasing consumer demand for premium coffee experiences and advanced brewing technologies.