Region:Europe

Author(s):Dev

Product Code:KRAB4327

Pages:95

Published On:October 2025

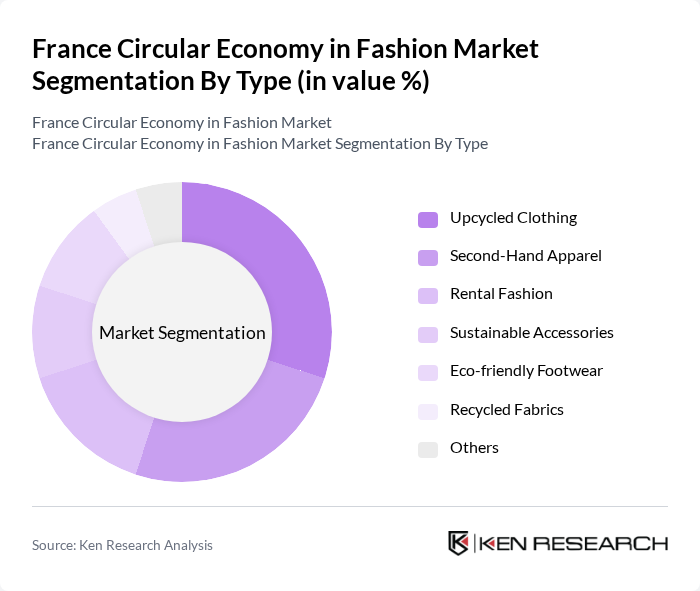

By Type:The market is segmented into various types, including Upcycled Clothing, Second-Hand Apparel, Rental Fashion, Sustainable Accessories, Eco-friendly Footwear, Recycled Fabrics, and Others. Among these, Upcycled Clothing is gaining significant traction as consumers seek unique, sustainable options that reduce waste. The trend towards personalization and individuality in fashion is driving the popularity of upcycled products, making it a leading subsegment.

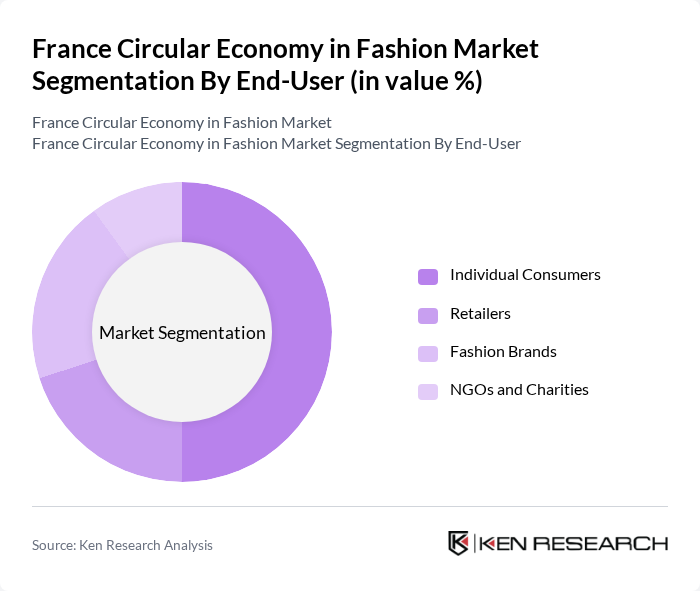

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Fashion Brands, and NGOs and Charities. Individual Consumers are the dominant segment, driven by a growing preference for sustainable and ethical fashion choices. This shift in consumer behavior is influenced by increased awareness of environmental issues and the desire for unique, second-hand items, making them a key driver in the circular economy.

The France Circular Economy in Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stella McCartney, Veja, Reformation, Etnies, Patagonia, H&M Conscious, The RealReal, Depop, ASOS Marketplace, ThredUp, Mud Jeans, Armedangels, Ecoalf, TOMS, Pangaia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the circular economy in France's fashion market appears promising, driven by increasing consumer demand for sustainable practices and government support. As brands innovate and adopt circular models, the market is likely to witness a surge in eco-friendly products. Additionally, the integration of technology in recycling processes and consumer engagement will enhance transparency and trust, fostering a more sustainable fashion ecosystem. The focus on local production will further strengthen community ties and reduce carbon footprints, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Upcycled Clothing Second-Hand Apparel Rental Fashion Sustainable Accessories Eco-friendly Footwear Recycled Fabrics Others |

| By End-User | Individual Consumers Retailers Fashion Brands NGOs and Charities |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Pop-Up Shops Thrift Stores |

| By Price Range | Budget Mid-Range Premium |

| By Material Type | Organic Cotton Recycled Polyester Tencel Hemp |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44) Gender Income Level |

| By Brand Positioning | Luxury Sustainable Brands Affordable Eco-Friendly Brands Niche Circular Fashion Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retailers Implementing Circular Practices | 100 | Sustainability Managers, Retail Operations Directors |

| Consumers Engaged in Sustainable Fashion | 150 | Eco-conscious Shoppers, Fashion Enthusiasts |

| Textile Recycling Companies | 80 | Operations Managers, Business Development Executives |

| Fashion Industry Experts and Consultants | 60 | Industry Analysts, Sustainability Consultants |

| Government and Regulatory Bodies | 50 | Policy Makers, Environmental Officers |

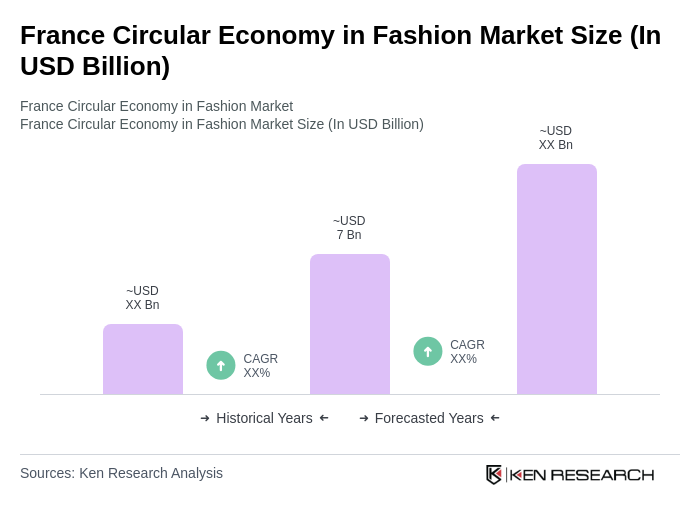

The France Circular Economy in Fashion Market is valued at approximately USD 7 billion, reflecting a significant growth driven by consumer awareness of sustainability, government initiatives, and the demand for eco-friendly fashion products.