Region:Europe

Author(s):Shubham

Product Code:KRAB4357

Pages:84

Published On:October 2025

Market.png)

By Type:The market is segmented into various types, including Core Banking Solutions, Payment Processing Services, Compliance and Risk Management Tools, Customer Engagement Platforms, and Others. Among these, Core Banking Solutions are leading the market due to their essential role in enabling banks and financial institutions to manage their operations efficiently. The increasing demand for integrated banking solutions that offer real-time processing and enhanced customer experiences is driving the growth of this segment.

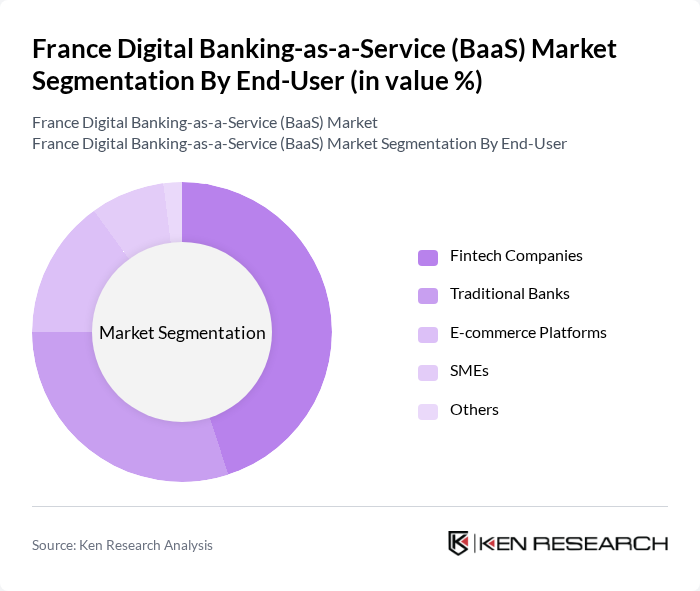

By End-User:The end-user segmentation includes Fintech Companies, Traditional Banks, E-commerce Platforms, SMEs, and Others. Fintech Companies are currently the dominant segment, driven by their agility and innovative approaches to financial services. The increasing collaboration between traditional banks and fintech firms is also contributing to the growth of this segment, as they leverage BaaS solutions to enhance their service offerings and improve customer engagement.

The France Digital Banking-as-a-Service (BaaS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, Orange Bank, N26, Revolut, Lydia, Qonto, Shine, Alan, Bankin', Younited Credit, Anytime, Frichti, Lydia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BaaS market in France appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer experiences, leading to increased adoption rates. Furthermore, as traditional banks seek to innovate, partnerships with fintech companies will likely become more prevalent, fostering a collaborative environment that encourages the development of new financial products tailored to consumer needs, thus expanding the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Core Banking Solutions Payment Processing Services Compliance and Risk Management Tools Customer Engagement Platforms Others |

| By End-User | Fintech Companies Traditional Banks E-commerce Platforms SMEs Others |

| By Business Model | Subscription-Based Pay-Per-Use Freemium Others |

| By Service Offering | API Management Digital Wallets Fraud Detection Services Others |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Pricing Model | Tiered Pricing Flat Rate Pricing Usage-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fintech Startups Utilizing BaaS | 100 | Founders, CTOs, Product Managers |

| Traditional Banks Adopting BaaS Solutions | 80 | Digital Transformation Officers, Innovation Leads |

| Regulatory Bodies and Compliance Experts | 50 | Regulators, Compliance Officers |

| End-Users of Digital Banking Services | 120 | Consumers, Small Business Owners |

| Investors in Fintech and BaaS Ventures | 70 | Venture Capitalists, Angel Investors |

The France Digital Banking-as-a-Service (BaaS) market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and the rise of fintech companies.