Region:Europe

Author(s):Rebecca

Product Code:KRAA5838

Pages:83

Published On:September 2025

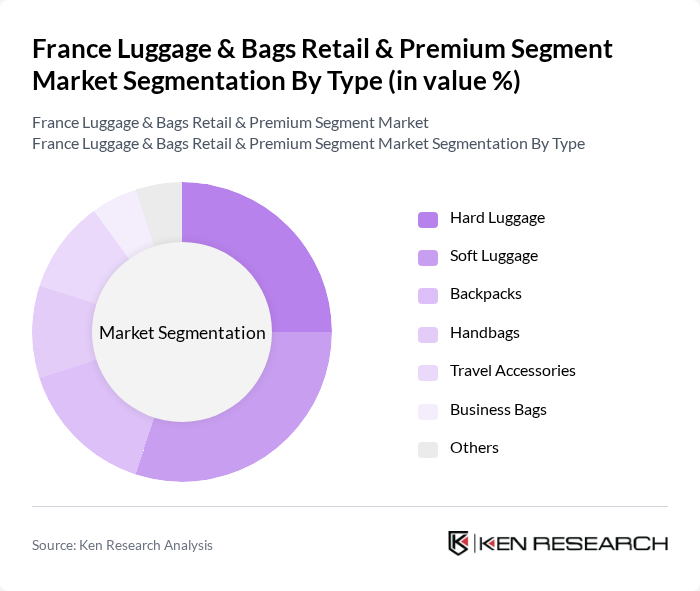

By Type:The market can be segmented into various types of luggage and bags, including Hard Luggage, Soft Luggage, Backpacks, Handbags, Travel Accessories, Business Bags, and Others. Each of these sub-segments caters to different consumer needs and preferences, with specific trends influencing their popularity.

The Soft Luggage sub-segment is currently dominating the market due to its lightweight, flexible nature, and the increasing preference for convenience among travelers. Consumers are gravitating towards soft luggage for its ease of storage and transport, especially for short trips and casual travel. Additionally, the variety of designs and colors available in soft luggage appeals to a broader audience, making it a popular choice among both young and older consumers. The trend towards casual travel and weekend getaways has further bolstered the demand for this type of luggage.

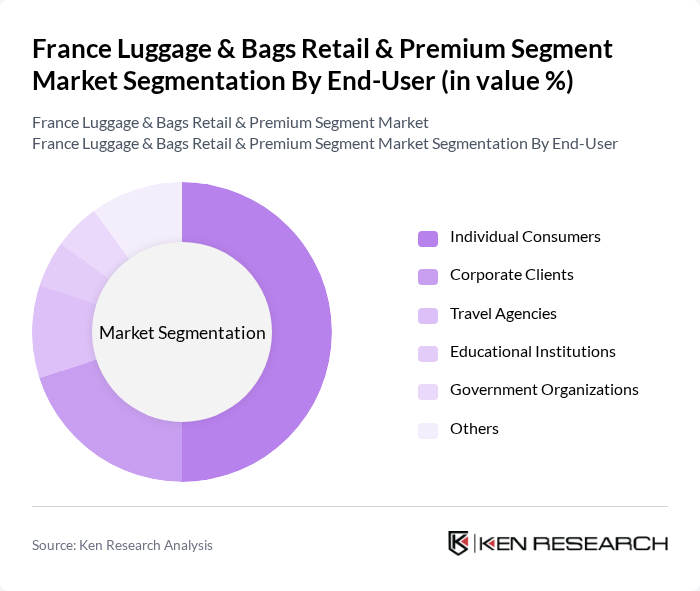

By End-User:The market can also be segmented based on end-users, which include Individual Consumers, Corporate Clients, Travel Agencies, Educational Institutions, Government Organizations, and Others. Each segment has unique purchasing behaviors and requirements that influence their buying decisions.

The Individual Consumers segment is the largest in the market, driven by the increasing number of travelers and the growing trend of personal travel experiences. This segment encompasses a wide range of demographics, including young professionals, families, and retirees, all seeking quality and stylish luggage options. The rise of e-commerce has also made it easier for individual consumers to access a variety of brands and products, further fueling market growth.

The France Luggage & Bags Retail & Premium Segment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., LVMH Moët Hennessy Louis Vuitton, Tumi Holdings, Inc., Rimowa GmbH, American Tourister, Delsey S.A., Eastpak, Herschel Supply Co., Kipling, The North Face, Osprey Packs, Inc., Briggs & Riley, Travelpro International, Inc., Victorinox AG, Crumpler contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luggage and bags retail market in France appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability will likely push brands to innovate with eco-friendly materials, while the rise of smart luggage features will cater to tech-savvy travelers. Additionally, as luxury travel continues to grow, brands that offer premium, customizable products will find significant opportunities to capture market share, enhancing their competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Luggage Soft Luggage Backpacks Handbags Travel Accessories Business Bags Others |

| By End-User | Individual Consumers Corporate Clients Travel Agencies Educational Institutions Government Organizations Others |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Supermarkets/Hypermarkets Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material | Polyester Leather Nylon Canvas Others |

| By Occasion | Business Travel Leisure Travel Daily Use Special Events Others |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Quality-focused Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 150 | Store Managers, Retail Buyers |

| Consumer Preferences in Bags | 200 | Frequent Travelers, Online Shoppers |

| Premium Segment Insights | 100 | Luxury Brand Managers, Marketing Executives |

| Travel Accessories Market | 80 | Product Designers, Category Managers |

| Market Trends and Innovations | 120 | Industry Analysts, Retail Consultants |

The France Luggage & Bags Retail & Premium Segment Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increased travel activities and a rising demand for premium products among fashion-conscious consumers.