Region:Central and South America

Author(s):Shubham

Product Code:KRAA2250

Pages:90

Published On:August 2025

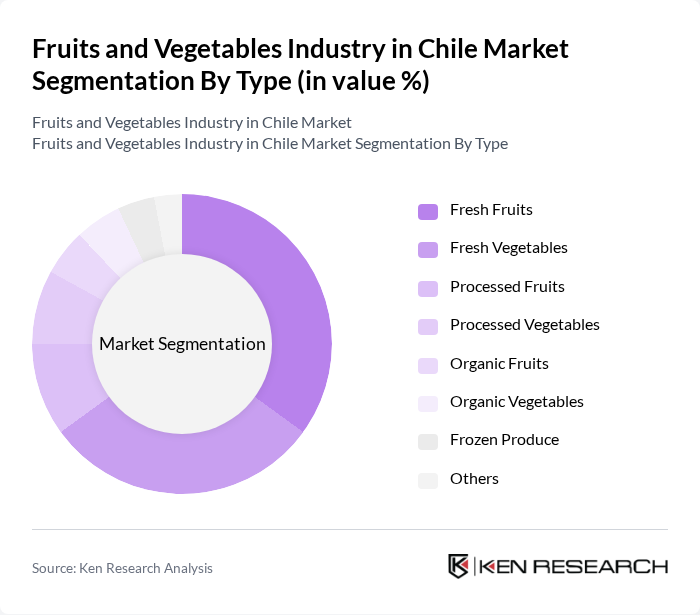

By Type:The market is segmented into fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic fruits, organic vegetables, frozen produce, and others. Each sub-segment addresses distinct consumer preferences and market needs. Fresh produce dominates due to high domestic and export demand, while processed and frozen segments are expanding as convenience and year-round availability become increasingly important for consumers .

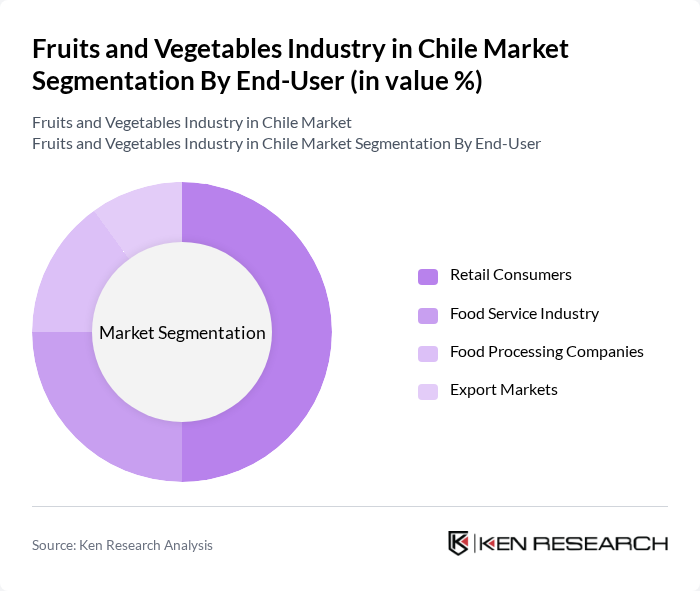

By End-User:The end-user segmentation includes retail consumers, the food service industry, food processing companies, and export markets. Retail and food service channels are the primary drivers of domestic demand, while export markets remain a cornerstone of industry growth, supported by Chile’s strong international reputation for quality and safety .

The Fruits and Vegetables Industry in Chile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hortifrut S.A., Frutícola Olmué S.A., Exportadora Subsole S.A., Agrofruta S.A., Copefrut S.A., Unifrutti Chile S.A., Agricola San Clemente S.A., Frusan S.A., David Del Curto S.A., Agroberries S.A., Prize S.A., Agricola Garces S.A., Río Blanco S.A., Frutícola Viconto S.A., Exportadora Andes Fruits S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fruits and vegetables industry in Chile appears promising, driven by increasing domestic consumption and export potential. As health trends continue to evolve, the demand for organic and sustainably sourced products is expected to rise. Additionally, the integration of digital technologies in distribution channels will enhance market access for producers. In future, the industry is likely to see a shift towards more resilient agricultural practices, ensuring sustainability and profitability amidst ongoing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits (e.g., apples, grapes, avocados, citrus, berries, kiwifruits, stone fruits) Fresh Vegetables (e.g., tomatoes, onions, garlic, lettuce, carrots, potatoes, peppers, cucumbers) Processed Fruits (e.g., canned fruits, fruit juices, dried fruits) Processed Vegetables (e.g., canned vegetables, frozen vegetables) Organic Fruits Organic Vegetables Frozen Produce Others |

| By End-User | Retail Consumers Food Service Industry Food Processing Companies Export Markets |

| By Distribution Channel | Supermarkets/Hypermarkets Traditional Grocery Stores Online Retail Foodservice Wholesale Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging |

| By Price Range | Premium Mid-range Budget |

| By Seasonality | Seasonal Fruits Seasonal Vegetables Year-round Produce |

| By Quality Grade | Grade A Grade B Grade C |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fruit Exporters | 100 | Export Managers, Business Development Executives |

| Vegetable Producers | 80 | Farm Owners, Agricultural Managers |

| Retail Grocery Chains | 90 | Category Managers, Procurement Specialists |

| Food Processing Companies | 60 | Operations Managers, Quality Control Supervisors |

| Logistics and Distribution Firms | 50 | Logistics Coordinators, Supply Chain Analysts |

The Fruits and Vegetables Industry in Chile is valued at approximately USD 1.75 billion, reflecting a robust growth driven by increasing domestic consumption and strong export demand, alongside a rising trend of health-conscious eating among consumers.