Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1045

Pages:86

Published On:October 2025

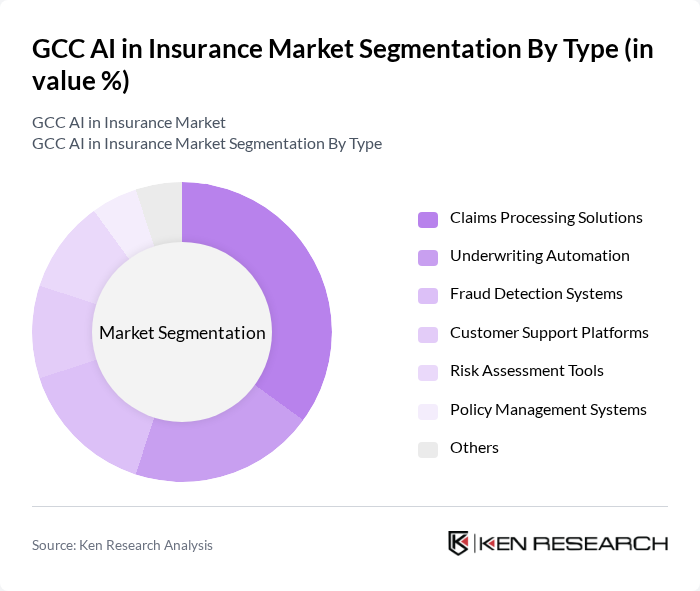

By Type:The segmentation by type includes various solutions that leverage AI technology to enhance insurance processes. The subsegments are Claims Processing Solutions, Underwriting Automation, Fraud Detection Systems, Customer Support Platforms, Risk Assessment Tools, Policy Management Systems, and Others. Among these, Claims Processing Solutions are currently leading the market due to their ability to significantly reduce processing time and improve customer satisfaction. The increasing demand for faster and more efficient claims handling is driving this trend, as insurers seek to leverage AI technologies to enhance their service delivery .

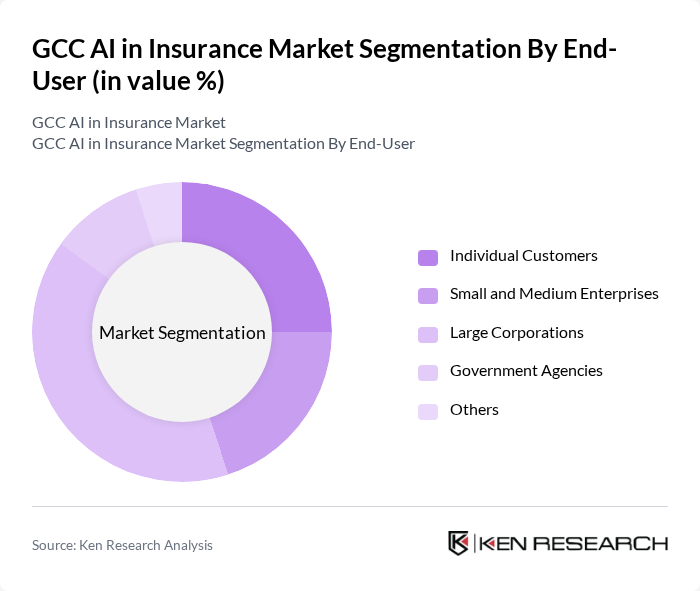

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises, Large Corporations, Government Agencies, and Others. Individual Customers are currently leading the market, driven by the increasing demand for personalized insurance products and services. As consumers become more tech-savvy, they expect seamless interactions and tailored solutions, prompting insurers to invest in AI technologies that cater to these needs .

The GCC AI in Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AXA Gulf, Allianz Saudi Fransi, Qatar Insurance Company (QIC), Dubai Insurance Company, Abu Dhabi National Insurance Company (ADNIC), Oman Insurance Company, Gulf Insurance Group (GIG), National General Insurance Company (NGI), Emirates Insurance Company, Bahrain National Holding, Saudi Arabian Insurance Company (SAICO), Al Hilal Takaful, Takaful Emarat, Noor Takaful, Al Ain Ahlia Insurance Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GCC AI in insurance market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As insurers increasingly adopt predictive analytics and personalized insurance products, the market is expected to see enhanced operational efficiencies and improved customer engagement. Additionally, the integration of AI with IoT technologies will facilitate real-time data collection, enabling insurers to offer tailored solutions that meet individual customer needs, thereby fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Claims Processing Solutions Underwriting Automation Fraud Detection Systems Customer Support Platforms Risk Assessment Tools Policy Management Systems Others |

| By End-User | Individual Customers Small and Medium Enterprises Large Corporations Government Agencies Others |

| By Application | Customer Onboarding Claims Management Policy Issuance Customer Retention Others |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Customer Segment | Retail Customers Corporate Clients High-Net-Worth Individuals Others |

| By Policy Type | Life Insurance Health Insurance Property Insurance Auto Insurance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance AI Integration | 50 | Product Managers, Data Analysts |

| Health Insurance AI Applications | 45 | IT Managers, Claims Managers |

| Property Insurance Risk Assessment | 40 | Underwriters, Risk Managers |

| AI in Fraud Detection | 55 | Fraud Analysts, Compliance Officers |

| Customer Experience Enhancement through AI | 50 | Customer Service Managers, Marketing Managers |

The GCC AI in Insurance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies aimed at enhancing operational efficiency, customer experience, and claims processing.