Region:Middle East

Author(s):Dev

Product Code:KRAB7985

Pages:92

Published On:October 2025

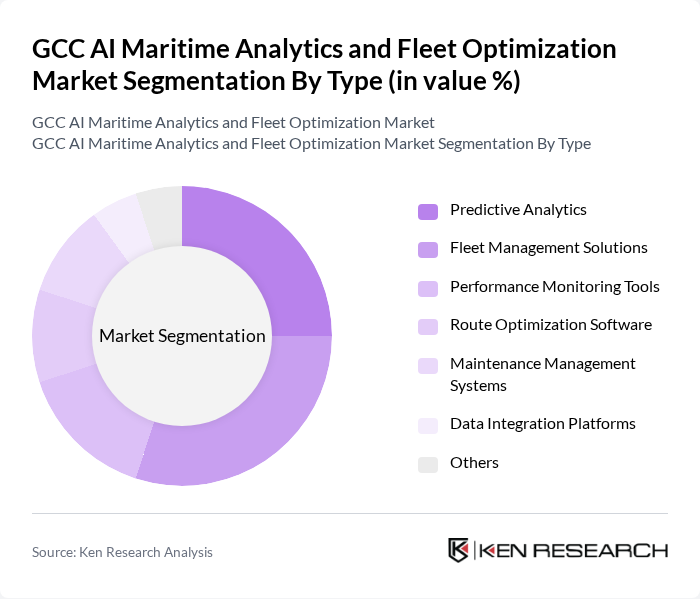

By Type:The market is segmented into various types, including Predictive Analytics, Fleet Management Solutions, Performance Monitoring Tools, Route Optimization Software, Maintenance Management Systems, Data Integration Platforms, and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency and decision-making in maritime operations.

The Fleet Management Solutions sub-segment is currently dominating the market due to the increasing need for efficient fleet operations and cost management. Companies are increasingly investing in comprehensive fleet management systems that provide real-time tracking, maintenance scheduling, and performance analytics. This trend is driven by the growing emphasis on operational efficiency and the need to reduce downtime, making fleet management solutions essential for maritime operators.

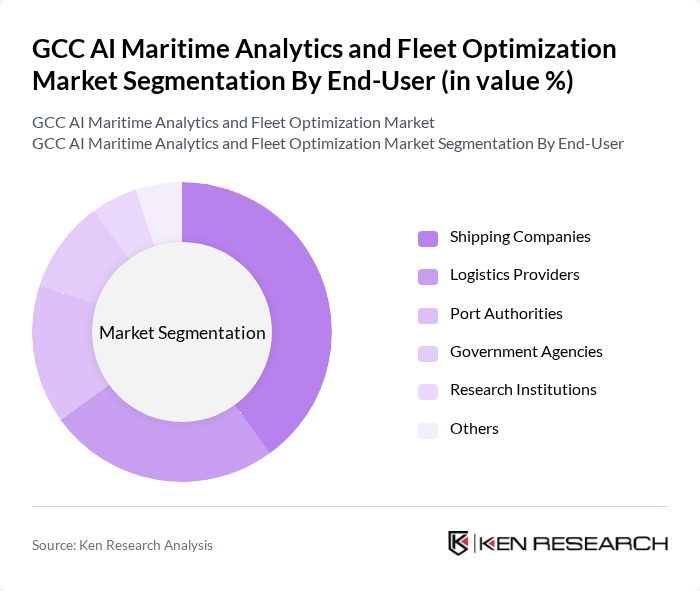

By End-User:The market is segmented by end-users, including Shipping Companies, Logistics Providers, Port Authorities, Government Agencies, Research Institutions, and Others. Each end-user category has unique requirements and applications for AI maritime analytics and fleet optimization solutions.

Shipping Companies are the leading end-users in the market, driven by the need for enhanced operational efficiency and cost reduction. These companies are increasingly adopting AI-driven analytics to optimize their fleet operations, improve route planning, and enhance cargo tracking capabilities. The growing competition in the shipping industry further propels the demand for advanced analytics solutions to maintain a competitive edge.

The GCC AI Maritime Analytics and Fleet Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, DNV GL, Kongsberg Gruppen, Wärtsilä Corporation, ABB Ltd., MarineTraffic, Navis LLC, Inmarsat Global Limited, Rolls-Royce Holdings plc, FleetMon GmbH, Teledyne Technologies Incorporated, Trimble Inc., ORBCOMM Inc., C-Map contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI maritime analytics and fleet optimization market appears promising, driven by technological advancements and increasing regulatory pressures. As the industry moves towards greater automation, the adoption of AI technologies is expected to accelerate, enhancing operational efficiencies and safety standards. Furthermore, the push for sustainable practices will likely lead to innovative solutions that reduce emissions and improve resource management. Companies that embrace these changes will be better positioned to thrive in a competitive landscape, ensuring long-term growth and profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Fleet Management Solutions Performance Monitoring Tools Route Optimization Software Maintenance Management Systems Data Integration Platforms Others |

| By End-User | Shipping Companies Logistics Providers Port Authorities Government Agencies Research Institutions Others |

| By Application | Cargo Tracking Fleet Performance Analysis Compliance Monitoring Risk Management Operational Efficiency Improvement Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Fleet Management | 100 | Fleet Managers, Operations Directors |

| Port Authority Operations | 80 | Port Managers, Logistics Coordinators |

| AI Technology Providers in Maritime | 70 | Product Managers, Business Development Executives |

| Regulatory Compliance in Maritime Operations | 60 | Compliance Officers, Legal Advisors |

| Maritime Analytics and Optimization Services | 90 | Data Scientists, AI Analysts |

The GCC AI Maritime Analytics and Fleet Optimization Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in maritime operations, enhancing efficiency and reducing operational costs.