GCC AI Predictive Analytics for Banking and Finance Market Overview

- The GCC AI Predictive Analytics for Banking and Finance Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of AI technologies in financial institutions, enhancing decision-making processes and operational efficiencies. The demand for predictive analytics solutions is fueled by the need for improved risk management, customer insights, and fraud detection capabilities.

- Key players in this market include the United Arab Emirates and Saudi Arabia, which dominate due to their advanced banking infrastructure and significant investments in technology. The UAE's financial sector is characterized by a high level of digital transformation, while Saudi Arabia's Vision 2030 initiative promotes innovation in financial services, making these countries pivotal in the AI predictive analytics landscape.

- In 2023, the Central Bank of the UAE implemented a regulatory framework aimed at enhancing the use of AI in banking. This framework encourages financial institutions to adopt AI-driven solutions for risk assessment and customer service, ensuring compliance with international standards while fostering innovation in the sector.

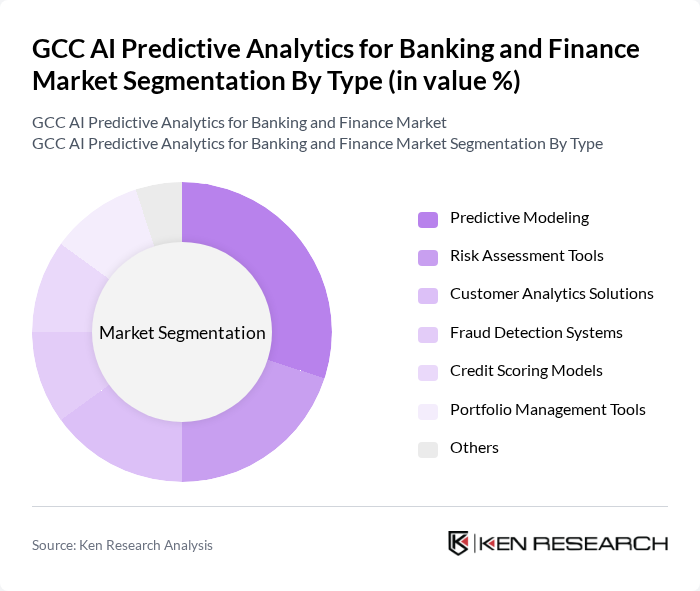

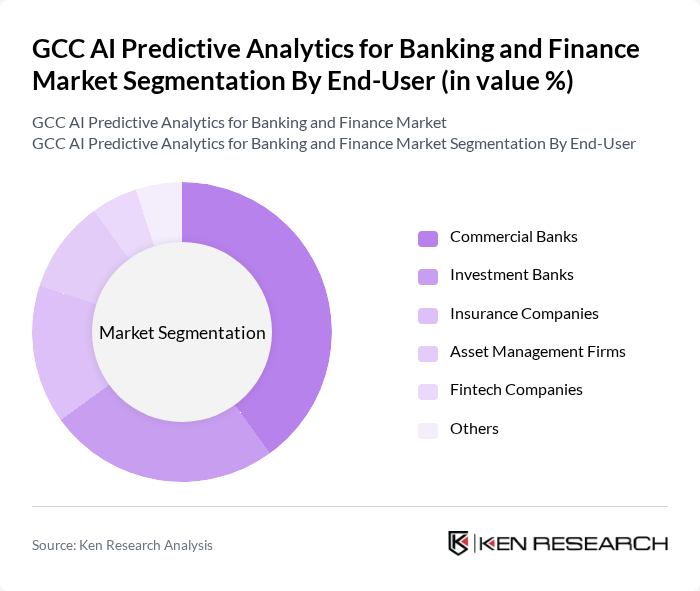

GCC AI Predictive Analytics for Banking and Finance Market Segmentation

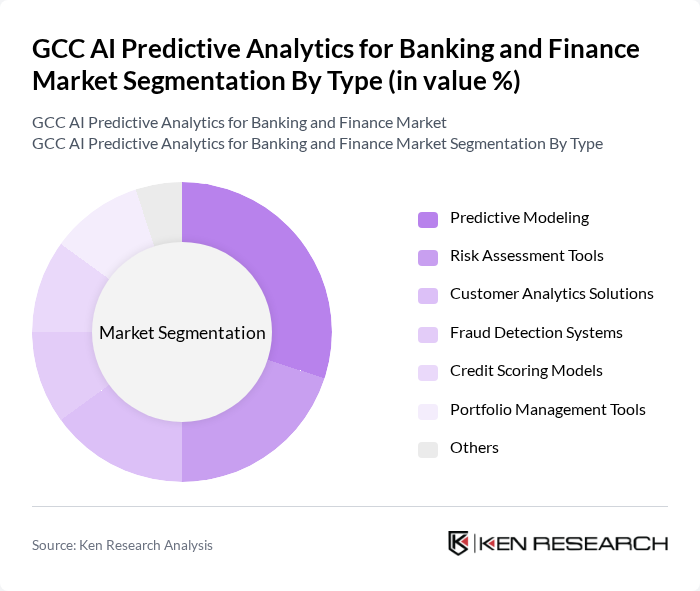

By Type:The market is segmented into various types, including Predictive Modeling, Risk Assessment Tools, Customer Analytics Solutions, Fraud Detection Systems, Credit Scoring Models, Portfolio Management Tools, and Others. Among these, Predictive Modeling is leading due to its ability to forecast trends and behaviors, which is crucial for financial institutions aiming to enhance their strategic decision-making. The increasing reliance on data-driven insights is propelling the demand for predictive modeling solutions.

By End-User:The end-user segmentation includes Commercial Banks, Investment Banks, Insurance Companies, Asset Management Firms, Fintech Companies, and Others. Commercial Banks are the dominant segment, driven by their extensive use of predictive analytics for customer segmentation, risk management, and operational efficiency. The increasing competition in the banking sector is pushing these institutions to leverage advanced analytics for better customer engagement and service delivery.

GCC AI Predictive Analytics for Banking and Finance Market Competitive Landscape

The GCC AI Predictive Analytics for Banking and Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAS Institute Inc., Microsoft Corporation, Oracle Corporation, SAP SE, FICO, TIBCO Software Inc., QlikTech International AB, Tableau Software, LLC, Palantir Technologies Inc., DataRobot, Inc., Alteryx, Inc., RapidMiner, Inc., ThoughtSpot, Inc., Sisense Inc. contribute to innovation, geographic expansion, and service delivery in this space.

GCC AI Predictive Analytics for Banking and Finance Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making:The GCC banking sector is witnessing a surge in demand for data-driven decision-making, with the region's financial institutions investing approximately $1.7 billion in analytics technologies in future. This investment is driven by the need to enhance operational efficiency and improve customer insights. According to the World Bank, the region's GDP growth is projected at 3.8%, further fueling the need for advanced analytics to support strategic initiatives and optimize resource allocation.

- Enhanced Customer Experience through Personalization:In future, the GCC banking industry is expected to allocate around $900 million towards AI-driven personalization strategies. This focus on enhancing customer experience is supported by a 25% increase in digital banking users, as reported by the International Monetary Fund. Financial institutions are leveraging predictive analytics to tailor services, resulting in improved customer satisfaction and retention rates, which are crucial for maintaining competitive advantage in a rapidly evolving market.

- Regulatory Compliance and Risk Management Needs:The GCC banking sector is facing stringent regulatory requirements, with compliance costs projected to reach $1.2 billion in future. Financial institutions are increasingly adopting AI predictive analytics to streamline compliance processes and enhance risk management capabilities. The Central Bank of the UAE has emphasized the importance of technology in meeting these regulatory demands, driving investments in AI solutions that can effectively monitor and mitigate risks associated with financial transactions.

Market Challenges

- Data Privacy and Security Concerns:Data privacy remains a significant challenge for the GCC banking sector, with 75% of consumers expressing concerns over data security in financial transactions. The implementation of stringent data protection laws, such as the UAE's Data Protection Law, has increased compliance costs for banks, estimated at $600 million in future. This challenge necessitates robust security measures, which can hinder the rapid adoption of AI predictive analytics solutions.

- High Implementation Costs:The initial investment required for implementing AI predictive analytics solutions in the GCC banking sector is substantial, with costs averaging around $2.2 million per institution in future. This financial barrier can deter smaller banks from adopting advanced technologies, limiting their ability to compete effectively. Additionally, ongoing maintenance and training costs further exacerbate the challenge, making it essential for banks to evaluate the long-term return on investment before proceeding.

GCC AI Predictive Analytics for Banking and Finance Market Future Outlook

The future of AI predictive analytics in the GCC banking sector appears promising, driven by technological advancements and increasing digitalization. As banks continue to embrace AI solutions, the focus will shift towards enhancing operational efficiency and customer engagement. The integration of AI with emerging technologies, such as blockchain, is expected to create new avenues for innovation. Furthermore, the growing emphasis on real-time analytics will enable financial institutions to respond swiftly to market changes, ensuring they remain competitive in a dynamic landscape.

Market Opportunities

- Expansion of Digital Banking Services:The GCC region is experiencing a rapid expansion of digital banking services, with over 65% of consumers preferring online banking options in future. This shift presents a significant opportunity for banks to leverage AI predictive analytics to enhance service offerings and improve customer engagement, ultimately driving growth and profitability in a competitive market.

- Integration of AI with Blockchain Technology:The convergence of AI and blockchain technology is poised to revolutionize the GCC banking sector. With an estimated $350 million investment in blockchain initiatives in future, banks can utilize AI predictive analytics to enhance transaction security and streamline operations, creating a more efficient and transparent financial ecosystem that meets evolving customer demands.