Region:Middle East

Author(s):Rebecca

Product Code:KRAD2804

Pages:82

Published On:November 2025

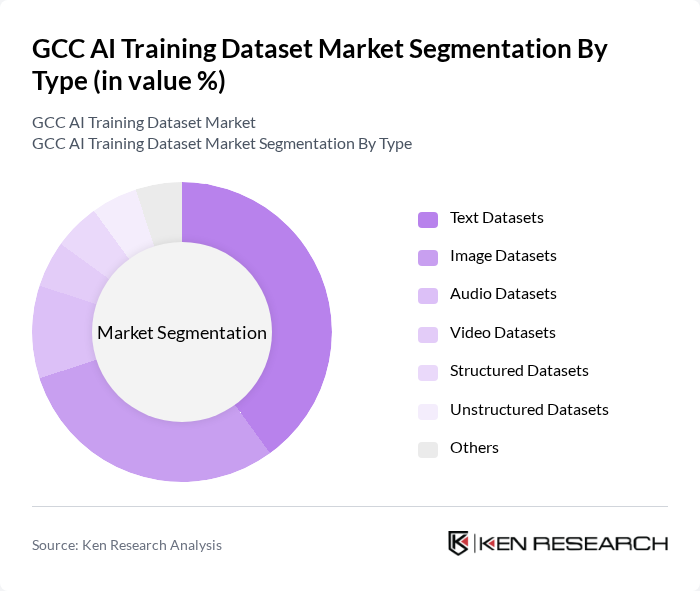

By Type:The market is segmented into text, image, audio, video, structured, unstructured, and others. Text datasets lead the market, driven by their extensive use in natural language processing applications such as chatbots, virtual assistants, and sentiment analysis. The demand for high-quality text data is further amplified by the adoption of AI-powered customer service and document automation. Image datasets also hold a significant share, propelled by applications in computer vision, facial recognition, and smart city surveillance systems .

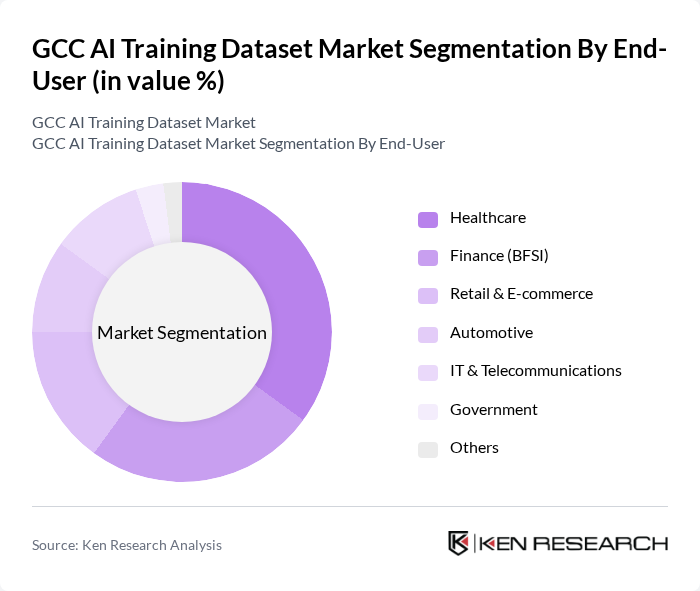

By End-User:The end-user segmentation includes healthcare, finance (BFSI), retail & e-commerce, automotive, IT & telecommunications, government, and others. The healthcare sector is the dominant end-user, reflecting the region’s focus on AI-powered diagnostics, patient management, and personalized medicine. The finance sector is also significant, leveraging AI for fraud detection, risk assessment, and customer service automation. Retail & e-commerce, automotive, and IT & telecommunications are rapidly growing segments, driven by digital transformation and AI adoption in customer experience, supply chain, and mobility solutions .

The GCC AI Training Dataset Market is characterized by a dynamic mix of regional and international players. Leading participants such as Appen Limited, Scale AI Inc., Telus International AI Data Solutions, CloudFactory Ltd., Google LLC (Google Cloud AI), Microsoft Corporation (Azure AI), Amazon Web Services (AWS), International Business Machines Corporation (IBM Watson), OpenAI, DataRobot, Databricks, Alation, Dataiku, Alteryx, G42 Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC AI training dataset market appears promising, driven by ongoing technological advancements and increasing investments in AI infrastructure. As organizations across various sectors recognize the importance of high-quality datasets, there will be a significant push towards developing robust data governance frameworks. Additionally, the integration of AI with emerging technologies, such as blockchain, will enhance data security and accessibility, further propelling the market's growth trajectory in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Text Datasets Image Datasets Audio Datasets Video Datasets Structured Datasets Unstructured Datasets Others |

| By End-User | Healthcare Finance (BFSI) Retail & E-commerce Automotive IT & Telecommunications Government Others |

| By Application | Natural Language Processing (NLP) Computer Vision Speech Recognition Others |

| By Data Source | Public Datasets Private Datasets Crowdsourced Datasets Proprietary Datasets Others |

| By Deployment Mode | On-Premise Cloud |

| By Geographic Coverage | Local Datasets Regional Datasets Global Datasets Others |

| By Quality Assurance Level | High-Quality Datasets Medium-Quality Datasets Low-Quality Datasets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Training Dataset Providers | 100 | Data Engineers, Product Managers |

| End-Users in Healthcare AI | 60 | Healthcare Analysts, IT Managers |

| Financial Services AI Applications | 50 | Risk Managers, Data Analysts |

| Retail Sector AI Implementations | 70 | Marketing Directors, Data Scientists |

| Government AI Initiatives | 40 | Policy Makers, Technology Advisors |

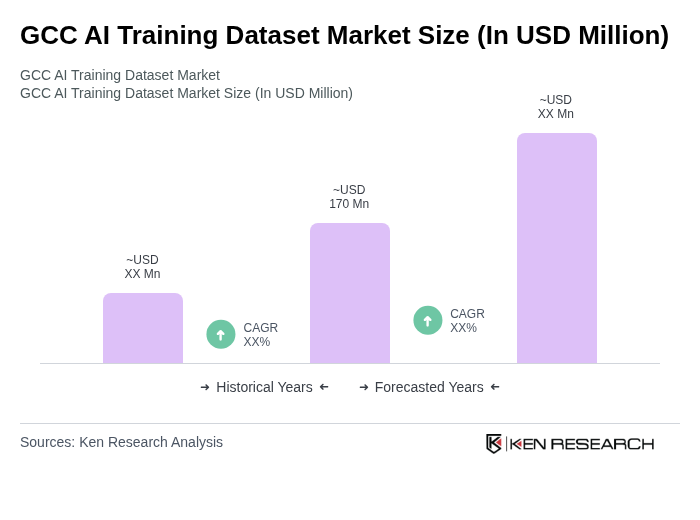

The GCC AI Training Dataset Market is valued at approximately USD 170 million, based on a five-year historical analysis. This figure represents about 6-7% of the global AI training dataset market, which is valued between USD 2.6 billion and USD 3.2 billion.