Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7330

Pages:95

Published On:October 2025

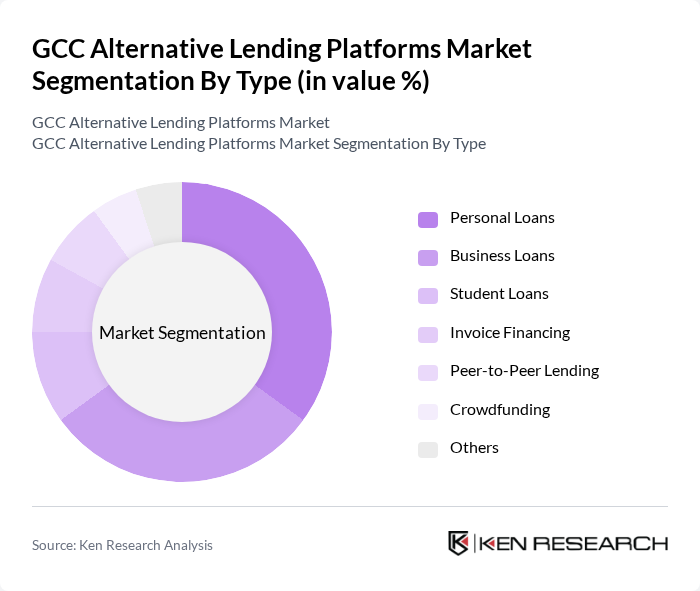

By Type:The market is segmented into various types of lending options, including Personal Loans, Business Loans, Student Loans, Invoice Financing, Peer-to-Peer Lending, Crowdfunding, and Others. Among these, Personal Loans and Business Loans are the most prominent, driven by consumer demand for quick access to funds and the need for SMEs to finance their operations. Personal Loans are particularly popular due to their flexibility and ease of access, while Business Loans cater to the growing number of startups and SMEs in the region.

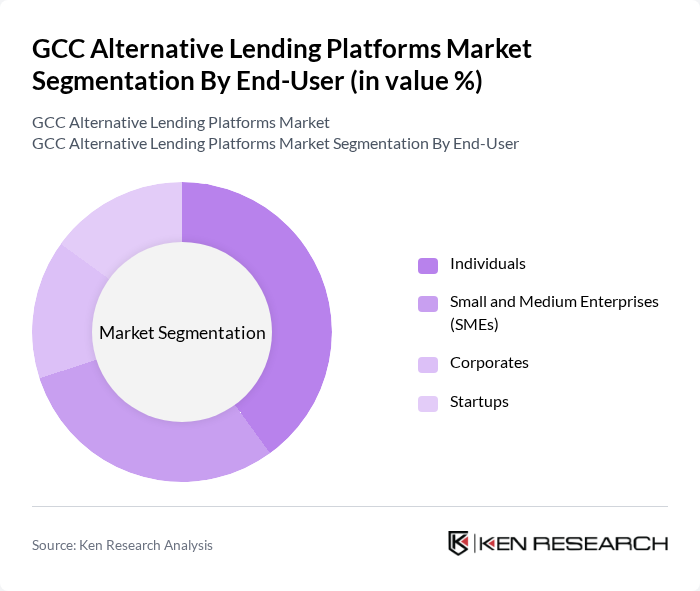

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Startups. Individuals represent the largest segment, driven by the increasing need for personal financing solutions. SMEs are also significant contributors, as they seek alternative funding sources to support their growth and operational needs. Startups are emerging as a vital segment, leveraging alternative lending platforms to secure initial funding and scale their operations.

The GCC Alternative Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, PinPay, YAPILI, RAK Bank, Liwwa, Funding Circle, Kiva, ZestMoney, Tamweelcom, Fawry, EFG Hermes, Nabbesh, Cashalo, Tala, Lendico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC alternative lending market appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt artificial intelligence for credit scoring, the efficiency and accuracy of lending decisions will improve. Additionally, the shift towards mobile lending solutions is expected to enhance accessibility, particularly for underserved populations. These trends indicate a robust growth trajectory, with platforms likely to innovate continuously to meet changing market demands and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Invoice Financing Peer-to-Peer Lending Crowdfunding Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Startups |

| By Loan Amount | Micro Loans Small Loans Medium Loans Large Loans |

| By Repayment Period | Short-term Loans Medium-term Loans Long-term Loans |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Customers High Net-Worth Individuals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Lending Utilization | 150 | Business Owners, Financial Managers |

| Peer-to-Peer Lending Insights | 100 | Platform Users, Investors |

| Invoice Financing Adoption | 80 | Accounts Receivable Managers, CFOs |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Consumer Attitudes Towards Alternative Lending | 90 | Individual Borrowers, Financial Consultants |

The GCC Alternative Lending Platforms Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increasing demand for flexible financing options and the rapid digitalization of financial services in the region.