Region:Middle East

Author(s):Rebecca

Product Code:KRAC4719

Pages:95

Published On:October 2025

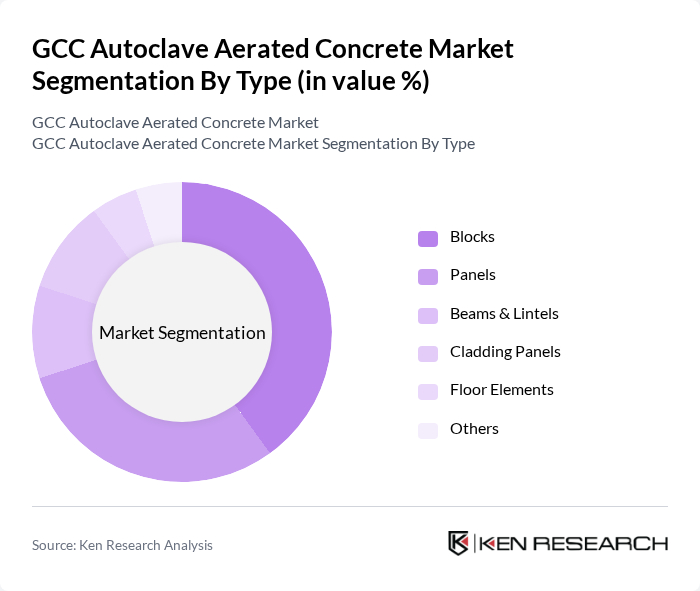

By Type:The market is segmented into various types, including Blocks, Panels, Beams & Lintels, Cladding Panels, Floor Elements, and Others. Among these, Blocks are the most dominant sub-segment due to their versatility and ease of use in various construction applications. The demand for Blocks is driven by their lightweight nature, which reduces transportation costs and simplifies handling on construction sites. Panels are also gaining traction, particularly in commercial and residential projects, due to their quick installation and energy efficiency .

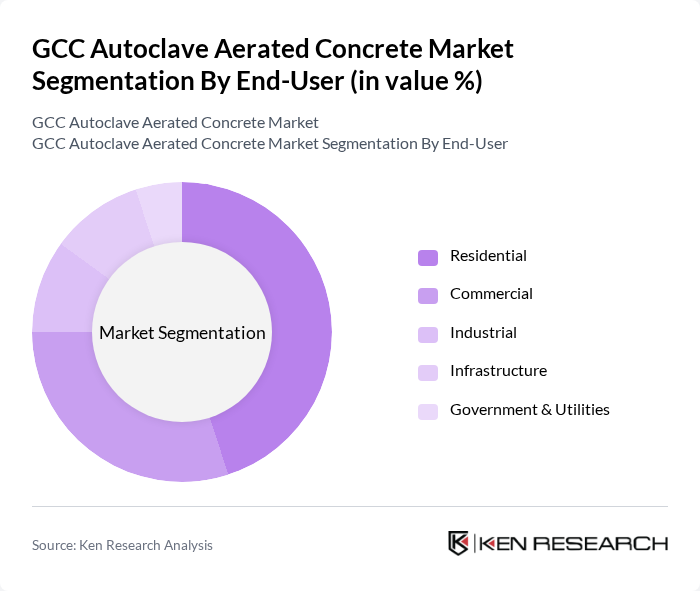

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Infrastructure, and Government & Utilities. The Residential segment leads the market, driven by the increasing demand for affordable housing and sustainable building solutions. The trend towards energy-efficient homes has further propelled the use of autoclave aerated concrete in residential construction. The Commercial segment is also significant, as businesses seek to reduce operational costs through energy-efficient building materials .

The GCC Autoclave Aerated Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi AAC, Gulf Precast Concrete Co. LLC, Emirates Blocks Factory, Qatar Aerated Concrete Industries Co. (QACIC), Al Manhal Group, Tarmac Middle East, AERCON AAC, Xella Middle East, Al-Futtaim Engineering, Al Jazeera Factory for Construction Materials (AAC), Al Mufeed AAC, ACICO Industries Company K.S.C.P., HIL Limited (GCC Operations), Al Shams Factory for AAC, Al Mufeed Building Materials contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC autoclave aerated concrete market appears promising, driven by increasing urbanization and a strong focus on sustainable construction practices. As governments implement stricter building codes and promote eco-friendly materials, AAC is likely to gain traction. Additionally, advancements in technology and manufacturing processes will enhance product offerings, making AAC more accessible. The integration of smart technologies in construction will further elevate the demand for innovative building solutions, positioning AAC as a key player in the evolving construction landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Blocks Panels Beams & Lintels Cladding Panels Floor Elements Others |

| By End-User | Residential Commercial Industrial Infrastructure Government & Utilities |

| By Application | Building Construction Road Construction Roof Insulation Bridge Sub-structure Renovation and Retrofitting Void Filling Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Price Range | Low Medium High |

| By Product Form | Solid Blocks Hollow Blocks Slabs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Engineers |

| Commercial Building Developments | 90 | Architects, Construction Managers |

| Infrastructure Projects | 60 | Government Officials, Urban Planners |

| Manufacturing and Supply Chain | 50 | Procurement Managers, Supply Chain Analysts |

| Sustainability Initiatives in Construction | 40 | Sustainability Consultants, Environmental Engineers |

The GCC Autoclave Aerated Concrete market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for lightweight construction materials and urbanization in the region.