Region:Middle East

Author(s):Shubham

Product Code:KRAA8644

Pages:85

Published On:November 2025

By Type:The market is segmented into various types of automated parking systems, including fully automated, semi-automated, robotic, puzzle, shuttle, tower, rail guided cart (RGC), and AGV (automated guided vehicle) parking systems. Each type offers unique features and benefits, catering to different consumer needs and preferences. Fully automated systems maximize space and minimize human intervention, while semi-automated and shuttle systems offer cost-effective solutions for medium-density developments. Robotic and AGV systems are increasingly adopted in high-value, space-constrained urban projects for their flexibility and scalability .

By End-User:The end-user segmentation includes residential, commercial, mixed-use developments, airports, hospitals, government and public infrastructure, and others. Each segment has distinct requirements and preferences, influencing the adoption of automated parking systems. Commercial and mixed-use developments lead adoption due to high demand for efficient parking in urban centers, while airports and hospitals increasingly deploy automated systems for operational efficiency and improved user experience .

The GCC Automated Parking Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ParkPlus, Inc., Westfalia Technologies, Inc., Robotic Parking Systems, Inc., Lödige Industries, CityLift Parking, Klaus Multiparking GmbH, Parkmatic, Unitronics Parking Solutions, TIBA Parking Systems, Park Assist (now part of TKH Group), EASYPARK, Wohr Parking Systems, Amano Corporation, Smart Parking Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC automated parking systems market appears promising, driven by increasing urbanization and technological advancements. As cities continue to grow, the demand for efficient parking solutions will rise, prompting further investments in automation. Additionally, the integration of smart technologies will enhance user experiences, making automated systems more appealing. The focus on sustainability and smart city initiatives will also play a crucial role in shaping the market landscape, encouraging innovation and adoption of these systems across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Automated Parking Systems Semi-Automated Parking Systems Robotic Parking Systems Puzzle Parking Systems Shuttle Parking Systems Tower Parking Systems Rail Guided Cart (RGC) Systems AGV (Automated Guided Vehicle) Parking Systems |

| By End-User | Residential Commercial Mixed-Use Developments Airports Hospitals Government & Public Infrastructure Others |

| By Application | Urban Developments Shopping Malls Airports Hospitals Hotels Office Buildings Others |

| By Technology | Sensor-Based Systems Camera-Based Systems RFID Technology IoT-Enabled Systems Software & Analytics Platforms Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| By Policy Support | Subsidies for Automated Systems Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Parking Facility Operators | 100 | Facility Managers, Operations Directors |

| City Planning Departments | 75 | Urban Planners, Transportation Engineers |

| Automated Parking Technology Providers | 60 | Product Managers, Technical Directors |

| End-Users of Automated Systems | 80 | Car Owners, Commuters |

| Regulatory Bodies and Policy Makers | 50 | Policy Analysts, Government Officials |

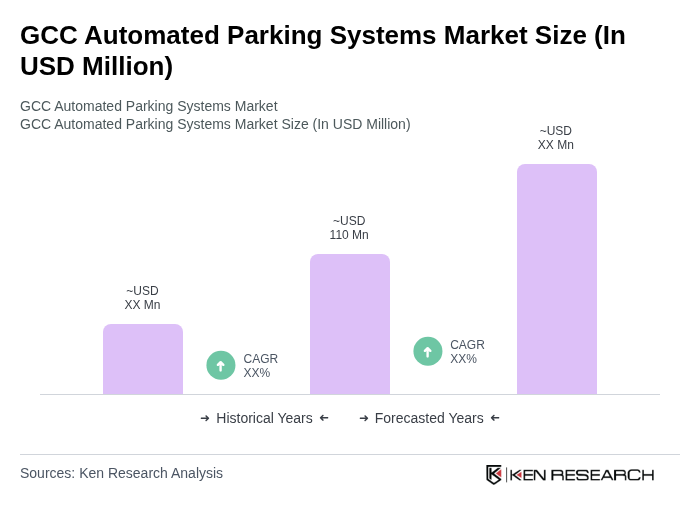

The GCC Automated Parking Systems market is valued at approximately USD 110 million, driven by urbanization, efficient space utilization, and advancements in automation and IoT technologies. This growth reflects the increasing demand for innovative parking solutions in densely populated areas.