Region:Middle East

Author(s):Rebecca

Product Code:KRAD7548

Pages:93

Published On:December 2025

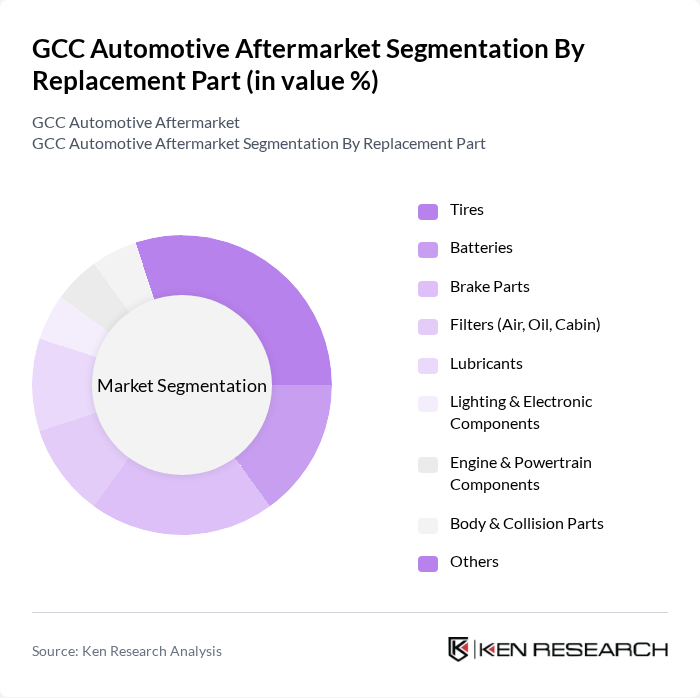

By Replacement Part:The replacement parts segment is crucial in the automotive aftermarket, encompassing various components essential for vehicle maintenance and repair. The subsegments include Tires, Batteries, Brake Parts, Filters (Air, Oil, Cabin), Lubricants, Lighting & Electronic Components, Engine & Powertrain Components, Body & Collision Parts, and Others. Among these, Tires are the leading revenue-generating subsegment in the GCC aftermarket, reflecting their high replacement frequency and critical role in safety and performance, with brake-related components also representing a major recurring spend category. The increasing focus on vehicle performance, adherence to OEM-recommended service intervals, and tightening safety and inspection norms drives demand for high-quality replacement parts, including premium tires, advanced brake systems, synthetic lubricants, and electronically controlled components.

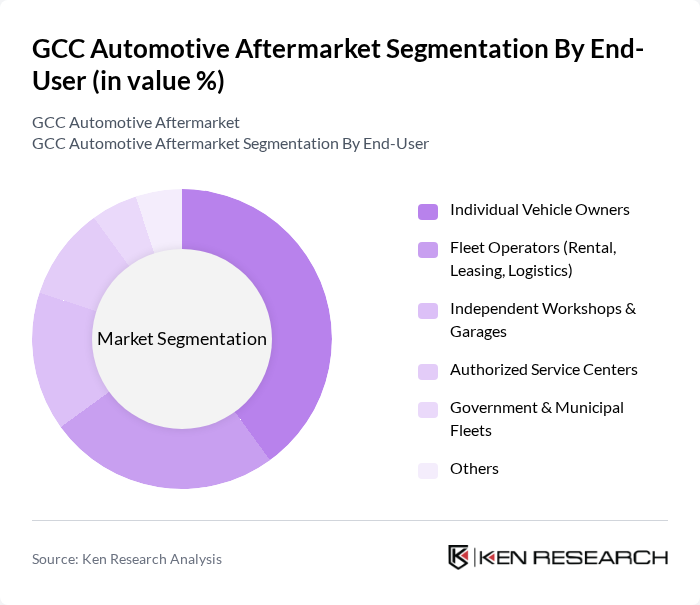

By End-User:The end-user segment of the automotive aftermarket includes various customer categories such as Individual Vehicle Owners, Fleet Operators (Rental, Leasing, Logistics), Independent Workshops & Garages, Authorized Service Centers, Government & Municipal Fleets, and Others. Individual Vehicle Owners represent a significant portion of the market, supported by high passenger vehicle ownership rates, the expansion of urban commuting, and growing awareness of scheduled maintenance and warranty-compliant servicing. Fleet Operators also contribute substantially due to their need for regular servicing, predictable uptime, total-cost-of-ownership optimization, and parts replacement to maintain operational efficiency across leasing, rental, ride-hailing, and logistics fleets, often under structured service contracts.

The GCC Automotive Aftermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automotive (UAE), Abdul Latif Jameel Motors (Saudi Arabia), Al Tayer Motors (UAE), Al-Sayer Holding (Al-Sayer Group, Kuwait), Petromin Corporation (Saudi Arabia), ACDelco (General Motors Aftermarket, GCC), Robert Bosch Middle East FZE, Denso Corporation – Middle East & North Africa, Continental Middle East, Bridgestone Middle East & Africa FZE, Michelin Group – GCC, ZF Services Middle East, Valeo Service Middle East, Midas (GCC Franchise Network), PitStop Arabia (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC automotive aftermarket is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As electric vehicles gain traction, the demand for specialized aftermarket services will increase, creating new revenue streams. Additionally, the rise of digital platforms for service booking will enhance customer engagement and streamline operations. Companies that adapt to these trends and invest in innovative solutions will likely thrive in this competitive landscape, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Replacement Part | Tires Batteries Brake Parts Filters (Air, Oil, Cabin) Lubricants Lighting & Electronic Components Engine & Powertrain Components Body & Collision Parts Others |

| By End-User | Individual Vehicle Owners Fleet Operators (Rental, Leasing, Logistics) Independent Workshops & Garages Authorized Service Centers Government & Municipal Fleets Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles & Buses Off-Highway & Specialty Vehicles Electric & Hybrid Vehicles |

| By Distribution Channel | OEM-Authorized Service Centers Independent Aftermarket Workshops Spare Parts Retailers Wholesale Distributors Online & E-commerce Platforms |

| By Service Type | Routine Maintenance (Oil Change, Filters, Tires) Mechanical & Electrical Repair Services Body Repair & Paint Services Diagnostic & Telematics-Enabled Services Customization, Accessories & Detailing |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Customer Segment | Retail (B2C) Customers B2B Commercial Customers Government & Public Sector Institutional & Large Enterprise Fleets Ride-Hailing & Mobility Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Parts Retailers | 120 | Store Managers, Sales Representatives |

| Independent Repair Shops | 100 | Shop Owners, Lead Technicians |

| OEM Service Centers | 80 | Service Managers, Customer Relations Officers |

| Aftermarket Product Manufacturers | 70 | Product Development Managers, Marketing Directors |

| Consumer Insights on Automotive Services | 100 | Car Owners, Fleet Managers |

The GCC Automotive Aftermarket is valued at approximately USD 12 billion, driven by factors such as increasing vehicle ownership, rising disposable incomes, and a growing preference for preventive maintenance and repair services across the region.