GCC Bathtub Market Overview

- The GCC Bathtub Market is valued at USD 1.1 billion, based on a five-year historical analysis. This assessment aligns with the share of the GCC within the global bathtub market, which has been estimated at around USD 9.9–10.7 billion for recent years, supported by strong demand from premium bathroom fittings and renovation activities. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing focus on luxury home amenities across the GCC, where high-end residential and hospitality projects typically feature premium bathtubs and spa-like bathrooms. The demand for bathtubs has surged as consumers and developers seek to enhance living and guest experiences, particularly in the residential and hospitality sectors, supported by active pipelines of upscale hotels, branded residences, and mixed-use developments in the UAE, Saudi Arabia, and Qatar.

- Key players in this market include the United Arab Emirates, Saudi Arabia, and Qatar. The UAE leads due to its booming real estate sector and high tourism rates, with cities such as Dubai and Abu Dhabi seeing sustained investment in luxury hotels, serviced apartments, and high-end residential towers that emphasize premium bathroom fixtures. Saudi Arabia’s ongoing infrastructure and real estate projects under national transformation programs—such as large-scale mixed-use developments, tourism giga-projects, and hospitality expansions—are driving higher specification standards for bathrooms, including bathtubs in upper-midscale and luxury segments. Qatar’s investments in hospitality, residential, and tourism infrastructure around major events, including preparations for the FIFA World Cup, have also supported demand for high-quality bathroom fittings and bathtubs in hotels and serviced residences.

- Water efficiency and conservation requirements in the GCC are increasingly shaping bathtub design and purchasing decisions. In the United Arab Emirates, for example, the Estidama Pearl Rating System and the Abu Dhabi International Building Codes, issued by the Abu Dhabi Department of Municipalities and Transport, mandate water-efficient plumbing fixtures and set maximum flow rates and water-use requirements for residential and commercial buildings, encouraging the use of efficient bathtubs and fittings in new developments. Similarly, national building codes and green building frameworks in other GCC countries (such as the Saudi Building Code’s water-efficiency provisions and Qatar’s GSAS standards) promote low-flow sanitary ware, which is directing demand towards bathtubs designed with lower water volumes, integrated flow controls, and compatibility with water-saving fittings.

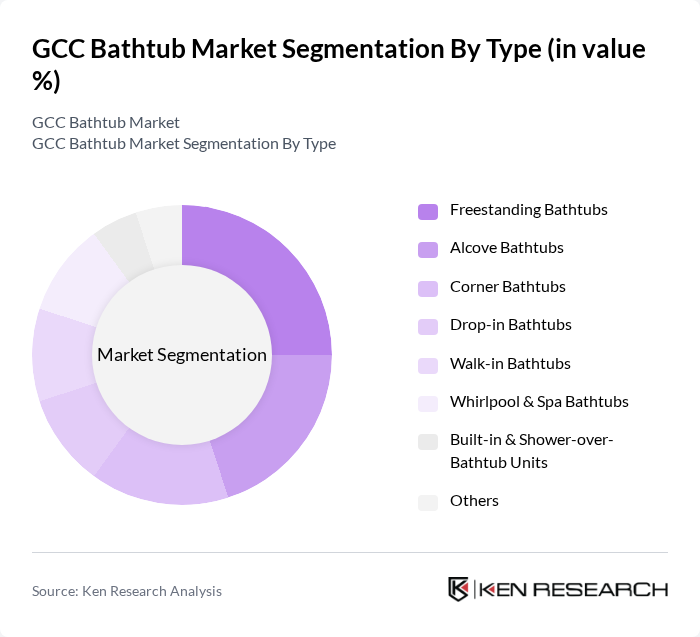

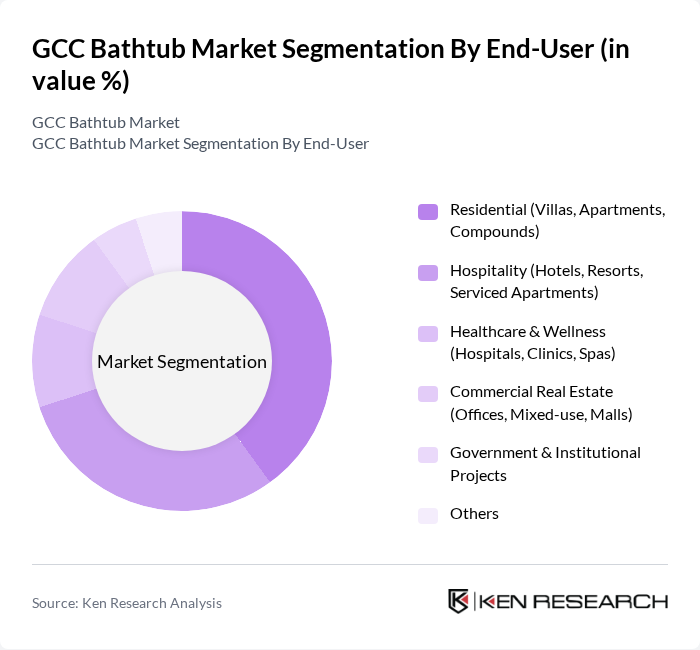

GCC Bathtub Market Segmentation

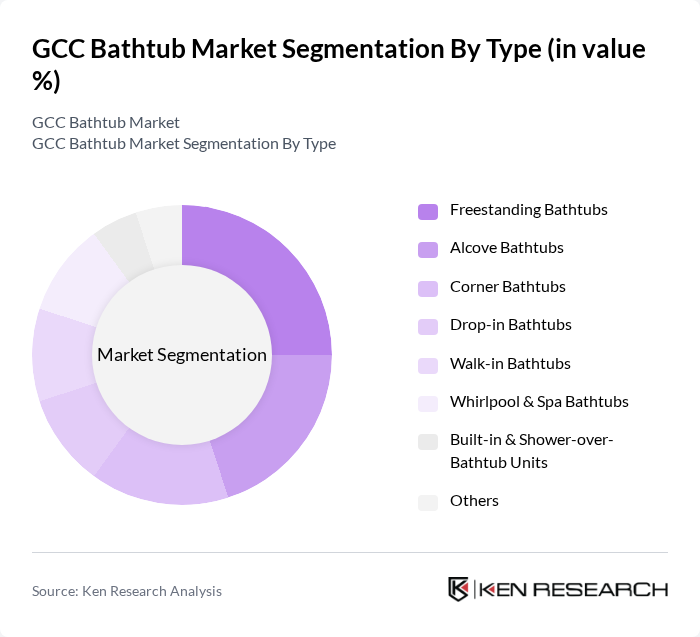

By Type:The bathtub market can be segmented into various types, including Freestanding Bathtubs, Alcove Bathtubs, Corner Bathtubs, Drop-in Bathtubs, Walk-in Bathtubs, Whirlpool & Spa Bathtubs, Built-in & Shower-over-Bathtub Units, and Others. Each type caters to different consumer preferences and installation requirements, influencing market dynamics. Freestanding and whirlpool/spa bathtubs are particularly popular in premium residential and hospitality projects, driven by the global trend towards spa-like bathrooms and higher spending on bathroom aesthetics.

By End-User:The market is segmented based on end-users, including Residential (Villas, Apartments, Compounds), Hospitality (Hotels, Resorts, Serviced Apartments), Healthcare & Wellness (Hospitals, Clinics, Spas), Commercial Real Estate (Offices, Mixed-use, Malls), Government & Institutional Projects, and Others. Each segment reflects distinct consumer needs and purchasing behaviors. Residential and hospitality applications constitute the dominant share of bathtub installations worldwide, driven by renovation cycles, luxury housing demand, and hotel room pipelines, trends that are also evident in GCC markets.

GCC Bathtub Market Competitive Landscape

The GCC Bathtub Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roca Sanitario, S.A., TOTO Ltd., LIXIL Group Corporation (INAX, GROHE, American Standard), Duravit AG, Villeroy & Boch AG, Geberit AG, Ideal Standard International NV, Jaquar Group, Kohler Co., Rak Ceramics PJSC, Grohe Middle East (LIXIL Group), Hansgrohe SE, Sanitec / Sphinx (part of Geberit Group), local GCC players and distributors (e.g., Sanipex Group, Al-Majid Jawad Trading, Al-Futtaim Engineering & Technologies), Other Regional Importers & Private Labels Active in GCC Bathtub Segment contribute to innovation, geographic expansion, and service delivery in this space.

GCC Bathtub Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The GCC region has witnessed a significant rise in disposable income, with average household income projected to reach $70,000 in future. This increase allows consumers to invest in luxury home fittings, including bathtubs. The World Bank reports that the region's GDP per capita is expected to grow by 4.2% annually, further enhancing purchasing power. As a result, consumers are more inclined to spend on high-quality and aesthetically pleasing bathroom fixtures, driving market growth.

- Rising Demand for Luxury Home Fittings:The GCC's affluent population is increasingly seeking luxury home fittings, including high-end bathtubs. In future, the luxury home fittings market is anticipated to reach $20 billion, with bathtubs comprising a significant share. This trend is fueled by a growing preference for premium materials and innovative designs. Additionally, the rise of home renovation projects, driven by a desire for personalized living spaces, is propelling the demand for luxurious bathroom products in the region.

- Growth in the Real Estate Sector:The GCC real estate sector is projected to grow by 5% in future, driven by increased investments in residential and commercial properties. This growth is particularly evident in countries like the UAE and Saudi Arabia, where new developments are on the rise. As more properties are constructed, the demand for bathtubs and other bathroom fixtures is expected to surge. The influx of expatriates and tourists also contributes to the need for modern and luxurious bathroom amenities in new housing projects.

Market Challenges

- High Competition Among Manufacturers:The GCC bathtub market is characterized by intense competition, with over 60 manufacturers vying for market share. This saturation leads to price wars, which can erode profit margins. Additionally, established brands face challenges from new entrants offering innovative products at competitive prices. The need for differentiation through quality and design becomes crucial for manufacturers to maintain their market position amidst this competitive landscape.

- Fluctuating Raw Material Prices:The bathtub manufacturing industry is heavily reliant on raw materials such as acrylic and fiberglass, whose prices can be volatile. In future, the cost of acrylic is expected to rise by 12% due to supply chain disruptions and increased demand. This fluctuation can significantly impact production costs and, consequently, retail prices. Manufacturers must navigate these challenges to maintain profitability while ensuring product affordability for consumers.

GCC Bathtub Market Future Outlook

The GCC bathtub market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As the trend towards sustainable living gains momentum, manufacturers are likely to focus on eco-friendly materials and water-efficient designs. Additionally, the integration of smart technology in bathtubs, such as temperature control and hydrotherapy features, is expected to enhance user experience. The expansion of e-commerce platforms will also facilitate greater accessibility to a wider range of products, further stimulating market growth.

Market Opportunities

- Increasing Focus on Sustainable Products:With growing environmental awareness, there is a rising demand for sustainable bathtub options. Manufacturers can capitalize on this trend by developing eco-friendly products that utilize recycled materials and promote water conservation. This shift not only meets consumer expectations but also aligns with government regulations aimed at reducing environmental impact, creating a competitive advantage in the market.

- Technological Advancements in Manufacturing:The adoption of advanced manufacturing technologies, such as 3D printing and automation, presents significant opportunities for efficiency and customization. By leveraging these technologies, manufacturers can reduce production costs and offer personalized bathtub designs that cater to individual consumer preferences. This innovation can enhance product appeal and drive sales in a competitive market landscape.