Region:Middle East

Author(s):Dev

Product Code:KRAC3352

Pages:89

Published On:October 2025

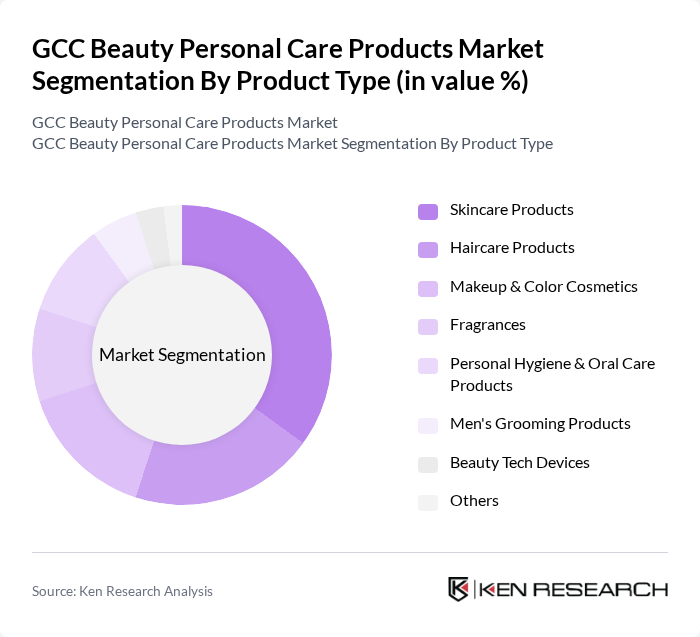

By Product Type:The product type segmentation includes various categories such as skincare products, haircare products, makeup & color cosmetics, fragrances, personal hygiene & oral care products, men's grooming products, beauty tech devices, and others. Among these, skincare products dominate the market due to the increasing awareness of skin health and the rising demand for anti-aging and moisturizing products. Consumers are increasingly investing in skincare routines, leading to a significant market share for this segment. The market is also witnessing growing consumer interest in natural ingredients, vegan and plant-based formulations, and personalized beauty solutions that cater to individual skin types and preferences.

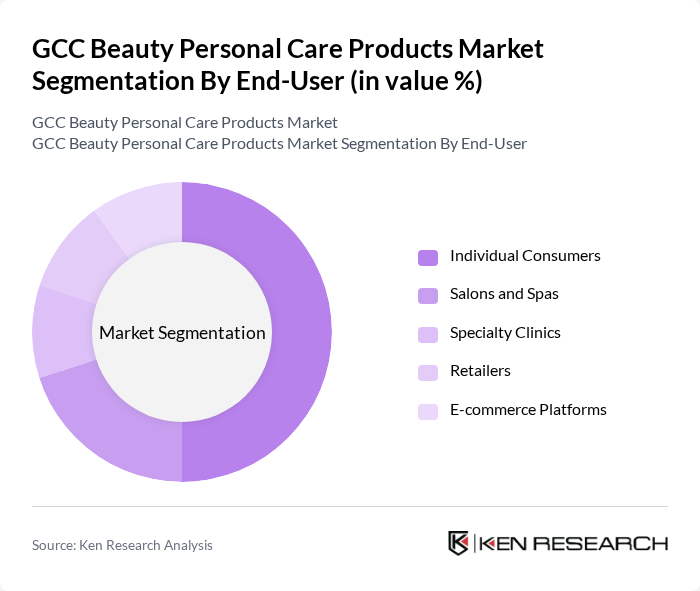

By End-User:The end-user segmentation encompasses individual consumers, salons and spas, specialty clinics, retailers, and e-commerce platforms. Individual consumers represent the largest segment, driven by the growing trend of self-care and personal grooming. The rise of social media and beauty influencers has also significantly influenced consumer behavior, leading to increased spending on beauty products among individuals. E-commerce platforms have emerged as critical distribution channels, with expanding digital infrastructure and online retail penetration reshaping how beauty products reach consumers across the GCC.

The GCC Beauty Personal Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Procter & Gamble Gulf FZE, Unilever Gulf FZE, Estée Lauder Middle East, Shiseido Company, Limited, Coty Inc., Beiersdorf AG, Revlon Inc., Avon Products, Inc., Amway Corporation, Mary Kay Inc., Oriflame Cosmetics S.A., Henkel AG & Co. KGaA, Johnson & Johnson Middle East, Natura & Co, Dabur International Ltd., Madi International, Saudi Perfume & Cosmetics Co. Ltd. (Swiss Arabian), Al Jamal Group, Faces (Chalhoub Group) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC beauty personal care products market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability will likely shape product development, with brands prioritizing eco-friendly ingredients and packaging. Additionally, the integration of beauty tech, such as augmented reality for virtual try-ons, is expected to enhance the shopping experience. As consumers become more discerning, brands that innovate and adapt to these trends will capture a larger share of the market, ensuring robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skincare Products Haircare Products Makeup & Color Cosmetics Fragrances Personal Hygiene & Oral Care Products Men's Grooming Products Beauty Tech Devices Others |

| By End-User | Individual Consumers Salons and Spas Specialty Clinics Retailers E-commerce Platforms |

| By Distribution Channel | Online Retail (E-commerce) Supermarkets/Hypermarkets Specialty Stores Pharmacies & Drug Stores Direct Sales Wholesale/Distributors |

| By Price Range | Premium Products Mid-range Products Mass/Budget Products |

| By Packaging Type | Bottles Tubes Jars Sachets Pumps & Sprays |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Vegan/Plant-Based Ingredients |

| By Brand Type | Local Brands International Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 100 | Women aged 18-45, Skincare Enthusiasts |

| Haircare Product Retailers | 60 | Store Managers, Beauty Advisors |

| Cosmetics Brand Managers | 40 | Marketing Executives, Product Development Managers |

| Online Beauty Product Shoppers | 90 | Frequent Online Shoppers, E-commerce Users |

| Health and Beauty Influencers | 50 | Social Media Influencers, Beauty Bloggers |

The GCC Beauty Personal Care Products Market is valued at approximately USD 10 billion, driven by increasing disposable incomes, a rising population, and a growing interest in personal grooming and wellness among consumers.