Region:Middle East

Author(s):Shubham

Product Code:KRAC2243

Pages:96

Published On:October 2025

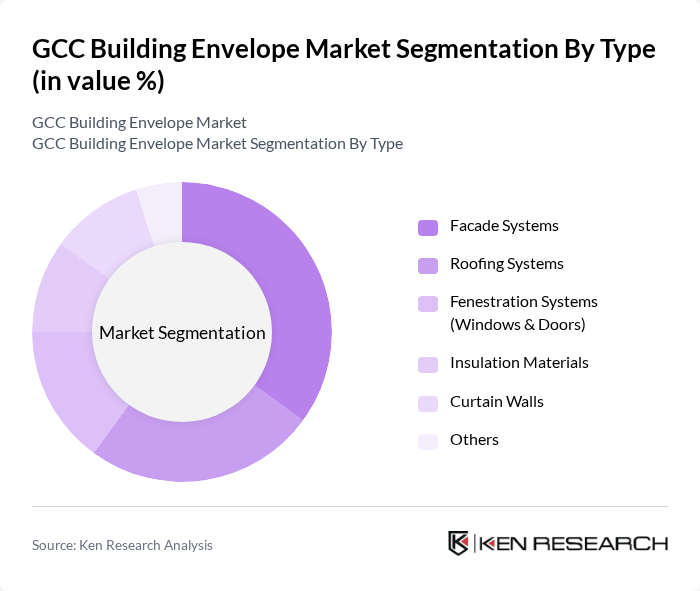

By Type:The market is segmented into various types, including facade systems, roofing systems, fenestration systems (windows & doors), insulation materials, curtain walls, and others. Among these, facade systems are currently dominating the market due to their critical role in enhancing the aesthetic appeal and energy efficiency of buildings. The increasing focus on sustainable architecture, the integration of smart technologies in facade designs, and the adoption of eco-friendly materials are driving this trend.

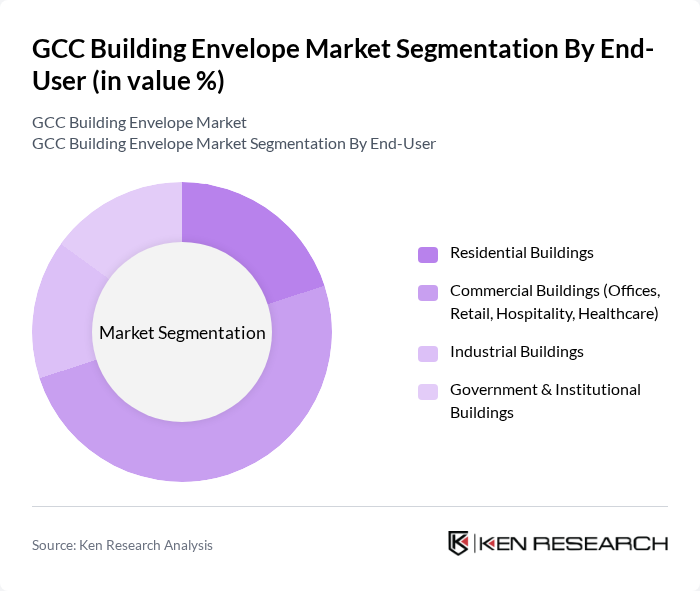

By End-User:The end-user segmentation includes residential buildings, commercial buildings (offices, retail, hospitality, healthcare), industrial buildings, and government & institutional buildings. The commercial buildings segment is leading the market, driven by the increasing demand for modern office spaces and retail environments that prioritize energy efficiency and aesthetic appeal. The rise of mixed-use developments and the adoption of smart building envelope solutions are also contributing to the growth of this segment.

The GCC Building Envelope Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, Kingspan Group, Rockwool International, Alubond USA, Schüco International, Sika AG, Owens Corning, BASF SE, 3M Company, ArcelorMittal, Jotun Group, Knauf Insulation, Boral Limited, Nucor Corporation, PPG Industries, Emirates Glass LLC, Dubai Investments PJSC, AluK Group, Zamil Industrial Investment Company, Gulf Extrusions Co. LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC building envelope market appears promising, driven by increasing urbanization and a strong push for energy efficiency. As governments implement stricter building codes and promote sustainable practices, the demand for innovative building envelope solutions is expected to rise. Additionally, the integration of smart technologies will enhance building performance and energy management. With a focus on sustainability, the market is likely to witness significant advancements, positioning the GCC as a leader in modern construction practices in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Facade Systems Roofing Systems Fenestration Systems (Windows & Doors) Insulation Materials Curtain Walls Others |

| By End-User | Residential Buildings Commercial Buildings (Offices, Retail, Hospitality, Healthcare) Industrial Buildings Government & Institutional Buildings |

| By Application | New Construction Renovation & Retrofitting Maintenance & Repair |

| By Material | Glass Metal (Aluminum, Steel) Concrete & Masonry Wood Composite Materials Liquid Coatings & Membranes |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 100 | Project Managers, Architects |

| Residential Building Developments | 80 | Construction Supervisors, Developers |

| Industrial Facility Construction | 60 | Facility Managers, Engineers |

| Public Infrastructure Projects | 50 | Government Officials, Urban Planners |

| Energy-Efficient Building Initiatives | 70 | Sustainability Consultants, Building Inspectors |

The GCC Building Envelope Market is valued at approximately USD 8 billion, driven by rapid urbanization, increased construction activities, and a focus on energy efficiency in building designs. This market is expected to grow further as demand for advanced building envelope solutions rises.