Region:Middle East

Author(s):Rebecca

Product Code:KRAD0328

Pages:89

Published On:August 2025

By Type:The car rental market is segmented into Economy Cars, Luxury Cars, SUVs, Vans, Electric Vehicles, Hybrid Vehicles, Executive Cars, Multi Utility Vehicles (MUVs), and Others. Economy Cars hold the largest share due to their affordability and practicality for budget-conscious consumers. Luxury Cars and SUVs are increasingly popular among business travelers and tourists seeking enhanced comfort and style. The growing adoption of Electric and Hybrid Vehicles reflects a rising consumer preference for sustainable mobility options.

By Application:The market is categorized into Leisure/Tourism and Business/Commercial applications. Leisure/Tourism is the largest segment, driven by the influx of tourists in the GCC region, especially in the UAE and Qatar. Business/Commercial applications remain significant, as companies require rental vehicles for corporate travel and events. The ongoing trend of remote work and increased business travel continues to support demand in this segment.

The GCC car rental market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Global Holdings, Inc., Avis Budget Group, Inc., Enterprise Holdings, Inc., Sixt SE, Europcar Mobility Group, Thrifty Car Rental, Dollar Rent A Car, National Car Rental, Alamo Rent A Car, Localiza Rent a Car, Green Motion Car and Van Rental, Fast Rent A Car (UAE), Yelo (Saudi Arabia), eZhire (UAE), Shift Car Rental (UAE), Budget Rent a Car (Middle East), Autolease (Qatar), Al Mulla Rental & Leasing (Kuwait), Al Wefaq Rent A Car (Saudi Arabia), Payless Car Rental (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC car rental market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The shift towards sustainable practices, including electric vehicle rentals, is expected to gain momentum as environmental awareness increases. Additionally, the integration of contactless rental services will enhance customer convenience, catering to the growing demand for seamless experiences. As urbanization continues, rental companies will likely explore underserved markets, creating new growth avenues and adapting to changing consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy Cars Luxury Cars SUVs Vans Electric Vehicles Hybrid Vehicles Executive Cars Multi Utility Vehicles (MUVs) Others |

| By Application | Leisure/Tourism Business/Commercial |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators |

| By Rental Duration | Short-term Rentals Long-term Rentals Operating Leases |

| By Booking Channel | Online Platforms Offline Counters Travel Agencies Direct Rentals |

| By Payment Method | Credit/Debit Cards Mobile Payments Cash Payments |

| By Vehicle Age | New Vehicles Used Vehicles |

| By Geographic Coverage | Saudi Arabia United Arab Emirates Kuwait Qatar Bahrain Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 120 | Tourists, Travel Agents |

| Corporate Car Rentals | 90 | Business Travelers, Corporate Travel Managers |

| Luxury Vehicle Rentals | 60 | High-net-worth Individuals, Event Planners |

| Long-term Rentals | 50 | Expatriates, Relocation Specialists |

| Ride-sharing and Alternative Mobility | 40 | Urban Commuters, Mobility Service Providers |

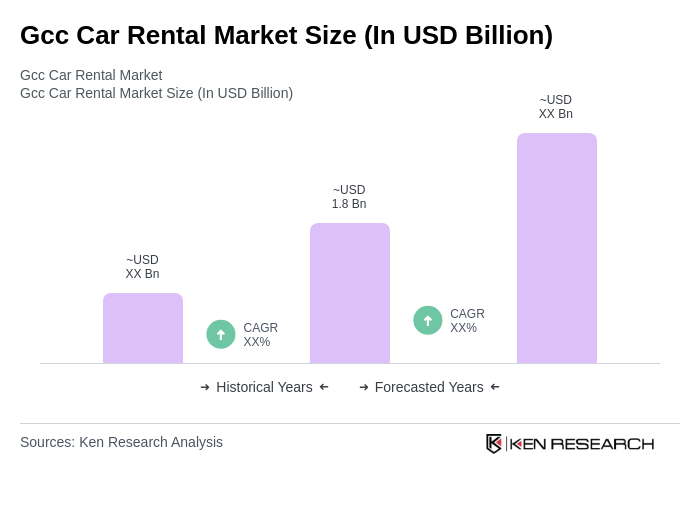

The GCC car rental market is valued at approximately USD 1.8 billion, driven by increasing tourism, business travel, and urbanization in the region. This growth reflects a rising demand for flexible transportation options among consumers.