Region:Middle East

Author(s):Shubham

Product Code:KRAD5329

Pages:87

Published On:December 2025

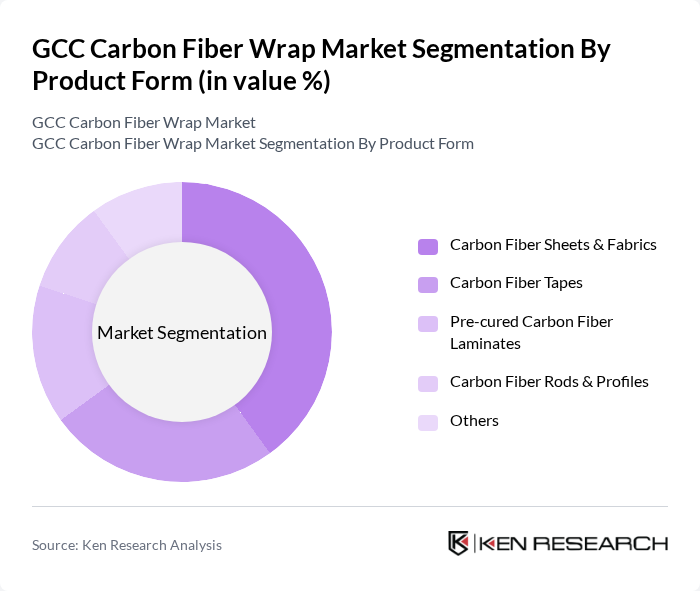

By Product Form:The product form segmentation includes various types of carbon fiber wraps, each catering to specific applications and consumer needs. The dominant subsegment is Carbon Fiber Sheets & Fabrics, which is widely used in construction and automotive sectors due to its versatility, conformability to complex geometries, and ease of on-site installation for strengthening beams, slabs, columns, and bridge decks. Carbon Fiber Tapes and Pre-cured Carbon Fiber Laminates also hold significant market shares, driven by their specific applications in flexural strengthening, crack control, and rehabilitation of concrete and masonry elements where high unidirectional strength and controlled thickness are required. The demand for Carbon Fiber Rods & Profiles is growing, particularly in specialized applications such as near-surface mounted (NSM) reinforcement, anchorage systems, and pre-stressed strengthening solutions, while the 'Others' category includes hybrid fiber systems and customized wrap formats that cater to niche industrial, marine, and high-temperature applications.

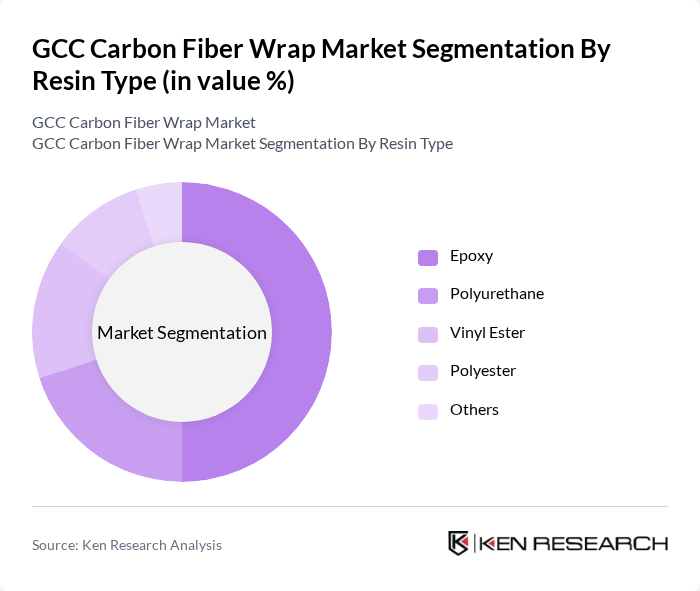

By Resin Type:The resin type segmentation highlights the various resins used in carbon fiber wraps, with Epoxy being the most dominant due to its superior bonding properties to concrete and steel, high mechanical strength, and excellent resistance to moisture and aggressive environments. Polyurethane and Vinyl Ester resins are also significant, offering enhanced flexibility, impact resistance, and strong performance in chemically aggressive or marine environments, respectively, which makes them suitable for pipelines, offshore structures, and industrial facilities. Polyester resins are used in cost-sensitive applications and in situations where ultra-high mechanical performance is less critical, while the 'Others' category includes specialized resin systems such as hybrid or high-temperature formulations tailored for specific industrial, transportation, and energy-sector needs where fire performance, thermal resistance, or rapid curing are key requirements.

The GCC Carbon Fiber Wrap Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sika AG, Mapei S.p.A., Fosroc International Limited, BASF SE (Master Builders Solutions / MBCC legacy portfolio), Simpson Strong-Tie Company Inc., Hilti Corporation, Fibrwrap Construction (Fyfe Co. LLC), Al Gurg Fosroc LLC, Al Muqarram Group, Advanced Composites Solutions LLC (ACS, UAE), Hamad AlOwais Insulation Material Co. LLC, Saudi BASF for Building Materials Co. Ltd. (Saudi Arabia), Arabian Chemical Company (Construction Products Division – Saudi Arabia), Sika Gulf B.S.C. (c), Mapei Construction Chemicals LLC (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC carbon fiber wrap market appears promising, driven by increasing investments in sustainable manufacturing and technological innovations. As industries prioritize lightweight materials for enhanced performance, the demand for carbon fiber wraps is expected to rise significantly. Additionally, the ongoing development of recycling technologies will likely create new avenues for growth, enabling manufacturers to meet environmental standards while reducing production costs and waste, thus fostering a more sustainable market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Carbon Fiber Sheets & Fabrics Carbon Fiber Tapes Pre-cured Carbon Fiber Laminates Carbon Fiber Rods & Profiles Others |

| By Resin Type | Epoxy Polyurethane Vinyl Ester Polyester Others |

| By Application | Structural Strengthening Seismic Retrofitting Rehabilitation & Repair Corrosion Protection & Blast Protection Aesthetic & Surface Wrapping Others |

| By Structure Type | Concrete Structures Masonry Structures Steel Structures Timber Structures Others |

| By End-Use Sector | Construction & Infrastructure Oil & Gas and Petrochemical Facilities Marine & Offshore Power & Water (Utilities) Industrial & Manufacturing Transportation (Automotive, Rail, Aerospace) Others |

| By Installation Method | Hand Layup / Wet Layup Prepreg / Pre-impregnated Systems Vacuum Infusion & Resin Injection Mechanized / Automated Application Others |

| By Country | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Applications | 120 | Project Managers, Structural Engineers |

| Automotive Industry Utilization | 90 | Product Development Engineers, Procurement Managers |

| Aerospace Component Manufacturing | 70 | Quality Assurance Managers, R&D Specialists |

| Marine Applications of Carbon Fiber | 60 | Marine Engineers, Supply Chain Coordinators |

| Consumer Goods and Sports Equipment | 80 | Product Managers, Marketing Directors |

The GCC Carbon Fiber Wrap Market is valued at approximately USD 180 million, reflecting a significant growth trajectory driven by the increasing demand for lightweight and high-strength materials across various sectors, including construction and transportation.