Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4427

Pages:95

Published On:October 2025

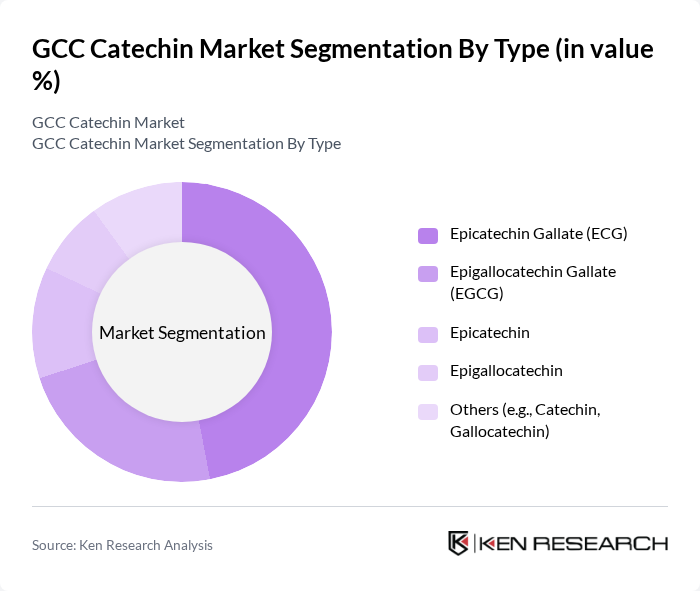

By Type:The catechin market is segmented into various types, including Epicatechin Gallate (ECG), Epigallocatechin Gallate (EGCG), Epicatechin, Epigallocatechin, and others such as Catechin and Gallocatechin. Among these, Epicatechin Gallate (ECG) is the most dominant sub-segment, holding the largest share due to its strong bioactive properties and wide applicability in health-oriented formulations. ECG’s effectiveness in supporting cardiovascular health and its high antioxidant capacity have led to its increased adoption in dietary supplements and wellness products. EGCG remains highly valued for its scientific backing, especially in weight management and cardiovascular health, and is widely incorporated in functional foods and supplements.

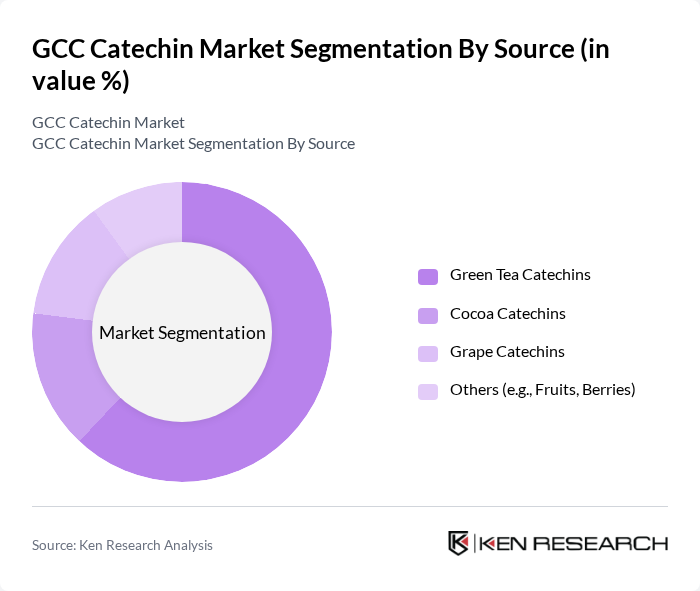

By Source:The sources of catechins include Green Tea Catechins, Cocoa Catechins, Grape Catechins, and others such as fruits and berries. Green Tea Catechins dominate the market, accounting for the majority share due to their high concentration of beneficial compounds and widespread consumer acceptance. The popularity of green tea as a health beverage, coupled with its scientifically recognized antioxidant properties, has led to increased demand for its catechins, making it the leading source in the GCC region.

The GCC Catechin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Taiyo Green Power, DSM Nutritional Products, Indena S.p.A., Sabinsa Corporation, Hunan Sunfull Bio-Tech Co., Ltd., Hunan Nutramax Inc., Chengdu Wagott Bio-Tech Co., Ltd., Hangzhou Greensky Biological Tech Co., Ltd., Pioneer Herb Industrial Co., Ltd., Dongyu Bio-Tech Co., Ltd., Frutarom Ltd., Kemin Industries, Inc., Biosynth Carbosynth, Botaniex Inc., TEAREVO contribute to innovation, geographic expansion, and service delivery in this space.

The GCC catechin market is poised for growth, driven by increasing health awareness and a shift towards natural ingredients. As consumers demand transparency and functional benefits, manufacturers are likely to innovate product formulations that incorporate catechins. Additionally, the rise of e-commerce platforms will facilitate broader access to these products, enhancing market penetration. The focus on sustainability and organic sourcing will further shape the market dynamics, encouraging brands to align with consumer values and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Epicatechin Gallate (ECG) Epigallocatechin Gallate (EGCG) Epicatechin Epigallocatechin Others (e.g., Catechin, Gallocatechin) |

| By Source | Green Tea Catechins Cocoa Catechins Grape Catechins Others (e.g., Fruits, Berries) |

| By Application | Functional Beverages Functional Foods Nutraceuticals Cosmetics and Skincare Pharmaceuticals Others |

| By End-User | Health-conscious Consumers Fitness Enthusiasts Elderly Population Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Stores Pharmacies Others |

| By Region | GCC Countries Middle East (excluding GCC) North Africa Others |

| By Price Range | Premium Mid-range Budget |

| By Packaging Type | Bottles Sachets Bulk Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Heads |

| Dietary Supplement Producers | 100 | Regulatory Affairs Specialists, Marketing Directors |

| Retailers of Health Products | 90 | Store Managers, Category Buyers |

| Cosmetic Manufacturers | 80 | Formulation Chemists, Brand Managers |

| Health and Wellness Influencers | 60 | Nutritionists, Fitness Coaches |

The GCC Catechin Market is valued at approximately USD 20 million, reflecting a growing interest in health benefits associated with catechins, particularly in functional foods and beverages, driven by consumer demand for natural antioxidants and dietary supplements.