Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8718

Pages:99

Published On:October 2025

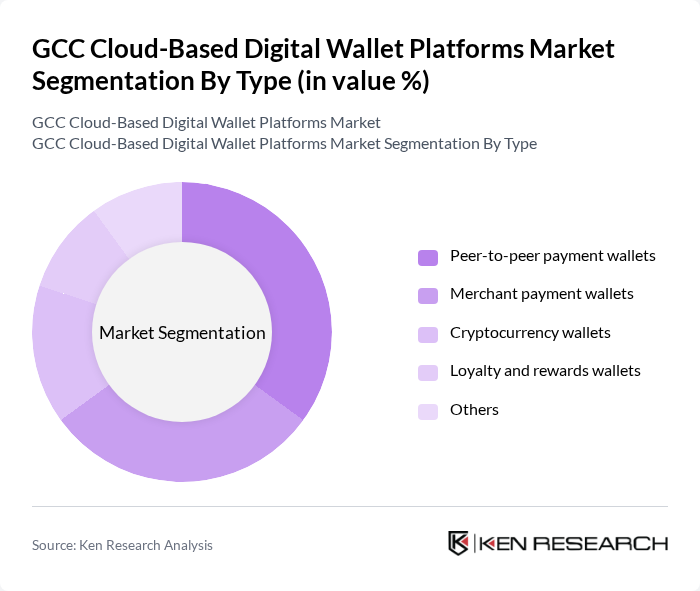

By Type:The market is segmented into various types of digital wallets, including peer-to-peer payment wallets, merchant payment wallets, cryptocurrency wallets, loyalty and rewards wallets, and others. Among these, peer-to-peer payment wallets are gaining significant traction due to their ease of use and the growing trend of social payments among consumers. Merchant payment wallets are also witnessing substantial growth as businesses increasingly adopt digital payment solutions to enhance customer experience and streamline transactions.

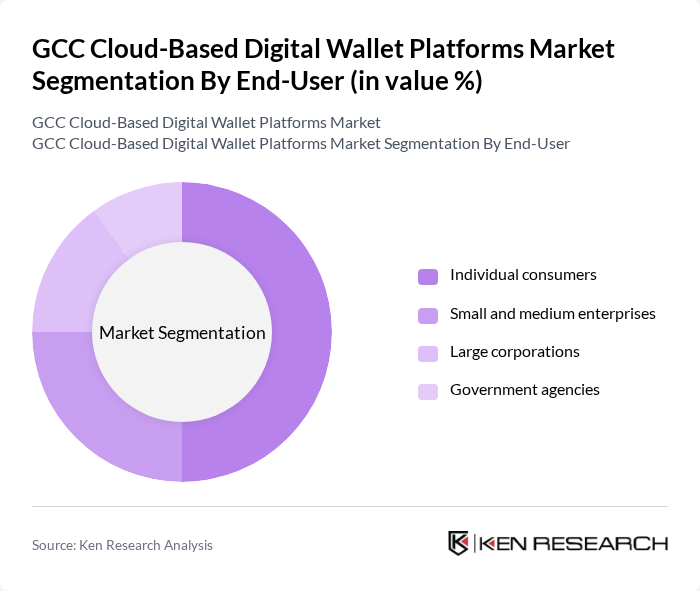

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies. Individual consumers represent the largest segment, driven by the increasing preference for cashless transactions and the convenience of mobile payments. SMEs are also rapidly adopting digital wallets to enhance their payment processes and improve customer engagement, while large corporations leverage these platforms for efficient transaction management.

The GCC Cloud-Based Digital Wallet Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Apple Inc., Google LLC, Samsung Electronics Co., Ltd., Alipay (Ant Group), WeChat Pay (Tencent), STC Pay, QIWI plc, Payoneer Inc., Venmo (PayPal), Skrill (Paysafe Group), Neteller (Paysafe Group), Zelle (Early Warning Services), Revolut Ltd., TransferWise Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cloud-based digital wallet market appears promising, driven by technological advancements and evolving consumer behaviors. As contactless payment solutions gain traction, the integration of AI for fraud detection will enhance security and user experience. Additionally, the rise of cryptocurrency integration is expected to attract tech-savvy consumers, further diversifying the market. Overall, the landscape will likely evolve towards more personalized and secure digital payment solutions, fostering greater adoption across various demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-peer payment wallets Merchant payment wallets Cryptocurrency wallets Loyalty and rewards wallets Others |

| By End-User | Individual consumers Small and medium enterprises Large corporations Government agencies |

| By Payment Method | Credit/debit card payments Bank transfers Mobile carrier billing Others |

| By Distribution Channel | Online platforms Mobile applications Retail outlets Others |

| By Security Features | Biometric authentication Two-factor authentication Encryption technologies Others |

| By Geographic Presence | Urban areas Rural areas Cross-border transactions Others |

| By User Demographics | Age groups Income levels Tech-savviness Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Digital Wallets | 150 | End-users, Tech-savvy Consumers |

| Merchant Acceptance Rates | 100 | Small Business Owners, Retail Managers |

| Regulatory Impact Assessment | 80 | Policy Makers, Financial Regulators |

| Fintech Industry Insights | 70 | Fintech Entrepreneurs, Industry Analysts |

| Technological Adoption Trends | 90 | IT Managers, Digital Transformation Leads |

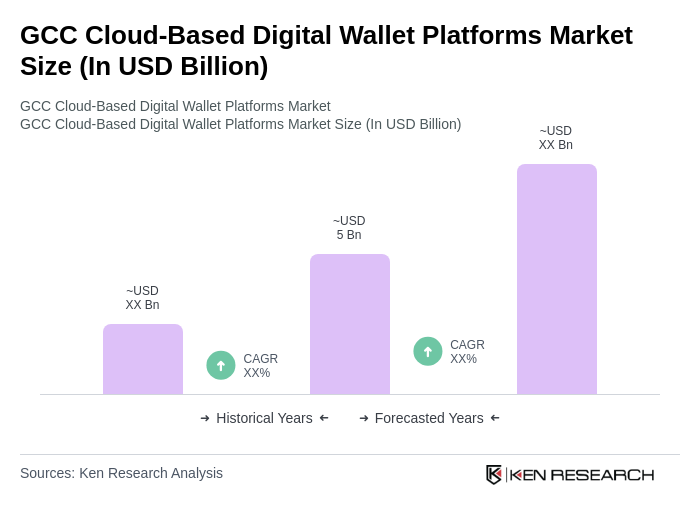

The GCC Cloud-Based Digital Wallet Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions, e-commerce expansion, and rising smartphone penetration in the region.