Region:Middle East

Author(s):Dev

Product Code:KRAB6722

Pages:86

Published On:October 2025

By Type:The market is segmented into various types, including Reporting Software, Data Analytics Tools, Compliance Management Solutions, Sustainability Assessment Platforms, Integration Services, Consulting Services, and Others. Among these, Reporting Software is the most dominant segment, driven by the increasing need for efficient data collection and reporting mechanisms. Organizations are prioritizing software solutions that simplify the ESG reporting process, ensuring compliance with regulatory requirements and enhancing data accuracy.

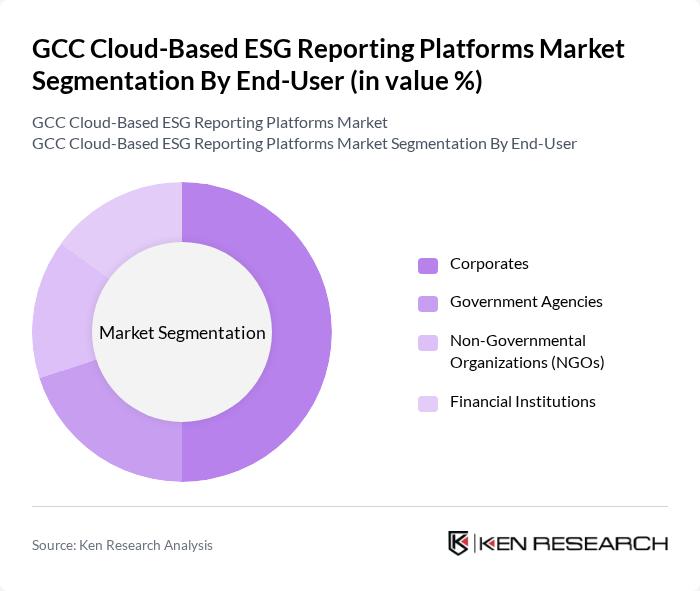

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Governmental Organizations (NGOs), and Financial Institutions. Corporates dominate this segment as they increasingly recognize the importance of ESG reporting in enhancing their brand reputation and attracting investment. The growing trend of responsible investing has led many corporations to adopt ESG frameworks, thereby driving the demand for cloud-based reporting platforms.

The GCC Cloud-Based ESG Reporting Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, IBM Corporation, Enablon (Wolters Kluwer), Sphera Solutions, Inc., EcoAct (Atos Group), Gensuite LLC, FigBytes Inc., Measurabl, Inc., Carbon Trust, Sustainalytics (Morningstar), Diligent Corporation, Verisk Analytics, Inc., Accenture PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cloud-based ESG reporting platforms market appears promising, driven by increasing regulatory demands and a heightened focus on sustainability. As companies strive to meet evolving standards, the integration of advanced technologies such as AI and blockchain will enhance reporting accuracy and transparency. Furthermore, the growing interest from investors in sustainable practices will likely propel the adoption of these platforms, fostering a more robust market environment. By 2025, the landscape is expected to be significantly transformed, with a broader range of companies utilizing these solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Reporting Software Data Analytics Tools Compliance Management Solutions Sustainability Assessment Platforms Integration Services Consulting Services Others |

| By End-User | Corporates Government Agencies Non-Governmental Organizations (NGOs) Financial Institutions |

| By Industry Vertical | Energy and Utilities Manufacturing Transportation and Logistics Healthcare Retail Construction Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Geographic Presence | GCC Countries International Markets |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Policy Support | Government Subsidies Tax Incentives Grants for ESG Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services ESG Reporting | 100 | Chief Sustainability Officers, Compliance Managers |

| Manufacturing Sector ESG Integration | 80 | Operations Managers, Environmental Compliance Officers |

| Energy Sector Sustainability Practices | 70 | ESG Analysts, Project Managers |

| Technology Firms' ESG Solutions | 90 | Product Development Managers, IT Directors |

| Government and Regulatory Bodies | 60 | Policy Makers, Regulatory Affairs Specialists |

The GCC Cloud-Based ESG Reporting Platforms Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by regulatory pressures for transparency in ESG practices and the demand for sustainable investment solutions.