Region:Middle East

Author(s):Dev

Product Code:KRAC4732

Pages:90

Published On:October 2025

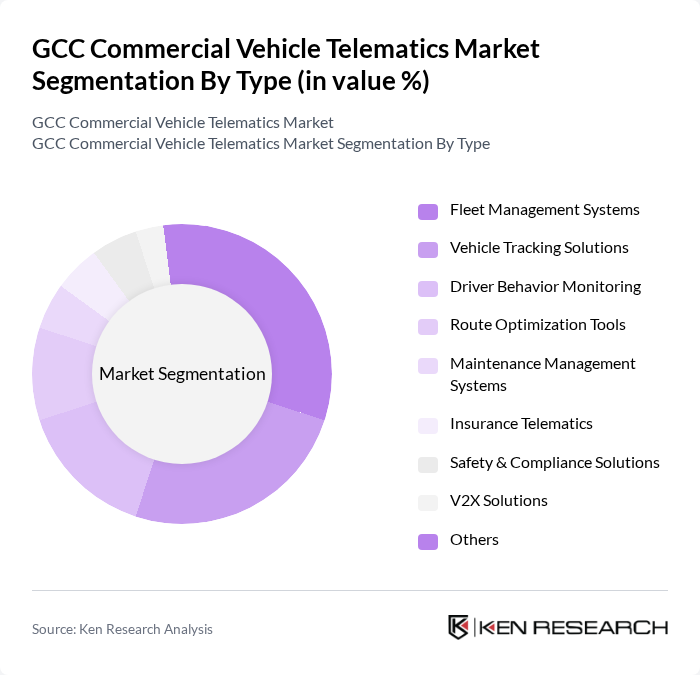

By Type:The market is segmented into various types, including Fleet Management Systems, Vehicle Tracking Solutions, Driver Behavior Monitoring, Route Optimization Tools, Maintenance Management Systems, Insurance Telematics, Safety & Compliance Solutions, V2X Solutions, and Others.Fleet Management Systemsare currently the leading sub-segment due to their comprehensive capabilities in managing vehicle operations, reducing costs, and improving efficiency. The demand for real-time analytics, route optimization, and compliance monitoring is driving the adoption of these solutions .

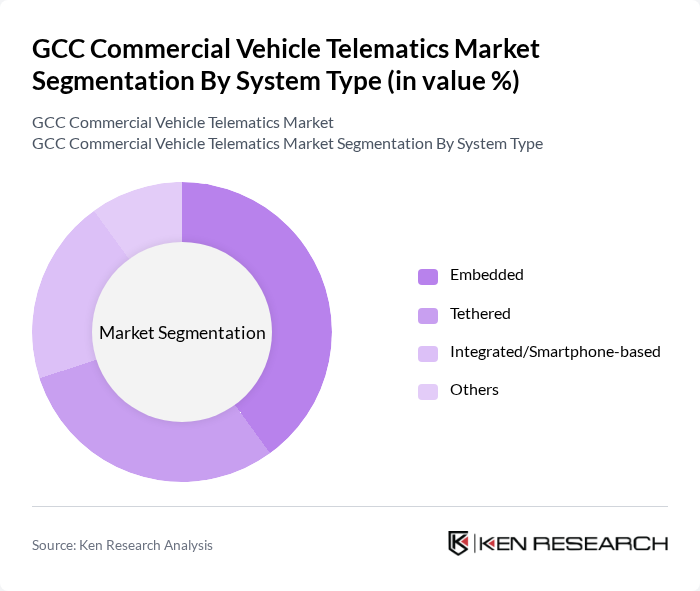

By System Type:The segmentation by system type includes Embedded, Tethered, Integrated/Smartphone-based, and Others.Embedded systemsare leading the market due to their seamless integration with vehicle hardware, reliability, and ability to deliver advanced features directly through factory-installed units. These systems are preferred for their tamper-resistance and real-time data delivery, which enhance operational efficiency and safety .

The GCC Commercial Vehicle Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Verizon Connect, Fleet Complete, Teletrac Navman, Omnicomm, TomTom Telematics, Zubie, Gurtam, MiX Telematics, Samsara, CalAmp, Navman Wireless, Inseego Corp., Agero, Fleetio, Location Solutions, Trakker Middle East, Falcon-i, Trackimo, Cartrack, Ruptela, Teltonika, Webfleet Solutions, Fleet Management Systems International (FMSi), Gulf Telematics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC commercial vehicle telematics market appears promising, driven by technological advancements and increasing regulatory support. As the region moves towards smart city initiatives, the integration of telematics with IoT and AI technologies is expected to enhance operational efficiencies. Furthermore, the growing emphasis on sustainability will likely accelerate the adoption of telematics solutions, enabling fleet operators to monitor emissions and optimize routes, ultimately contributing to a greener transportation landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Systems Vehicle Tracking Solutions Driver Behavior Monitoring Route Optimization Tools Maintenance Management Systems Insurance Telematics Safety & Compliance Solutions V2X Solutions Others |

| By System Type | Embedded Tethered Integrated/Smartphone-based Others |

| By Provider Type | OEM Aftermarket |

| By End-Use Industry | Transportation and Logistics Construction Public Transportation Oil and Gas Government & Utilities Travel & Tourism Others |

| By Vehicle Type | Light Commercial Vehicles Heavy-Duty Trucks Buses Vans Others |

| By Application | Fleet Tracking Asset Management Driver Safety Compliance Monitoring Predictive Maintenance Fuel Management Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Wholesale E-commerce Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Companies | 100 | Fleet Managers, Operations Directors |

| Telematics Solution Providers | 60 | Product Managers, Sales Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Transportation Analysts |

| End-users of Telematics Systems | 50 | Logistics Coordinators, IT Managers |

| Industry Experts and Consultants | 20 | Market Analysts, Technology Advisors |

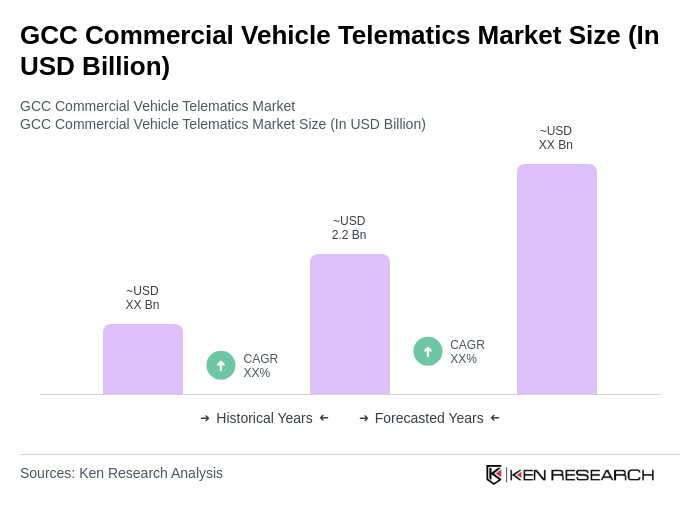

The GCC Commercial Vehicle Telematics Market is valued at approximately USD 2.2 billion, driven by the increasing demand for fleet management solutions, enhanced safety measures, and real-time vehicle tracking, particularly in the logistics and transportation sectors.