Region:Middle East

Author(s):Dev

Product Code:KRAC8862

Pages:91

Published On:November 2025

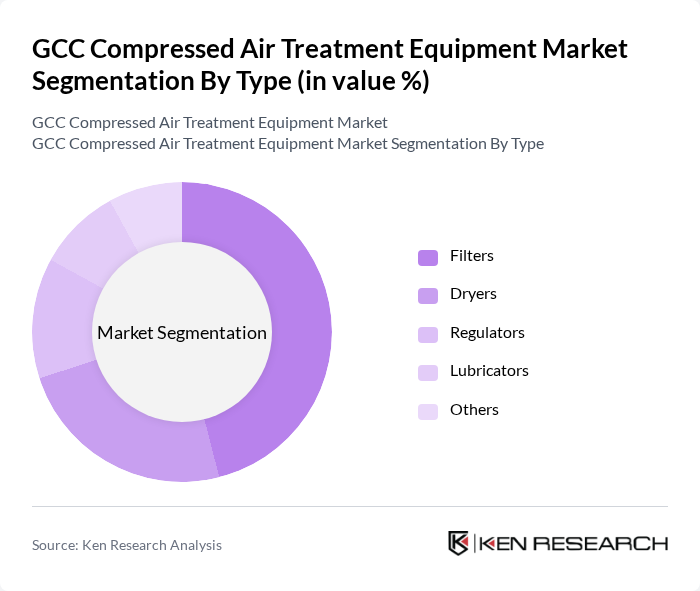

By Type:The market is segmented into filters, dryers, regulators, lubricators, and others. Filters remain the most dominant sub-segment, accounting for the largest share due to their essential role in removing contaminants such as oil, dust, and moisture from compressed air systems. The growing emphasis on maintaining air purity and compliance with stringent industrial standards drives demand for high-performance filters, which are critical for equipment longevity and operational reliability.

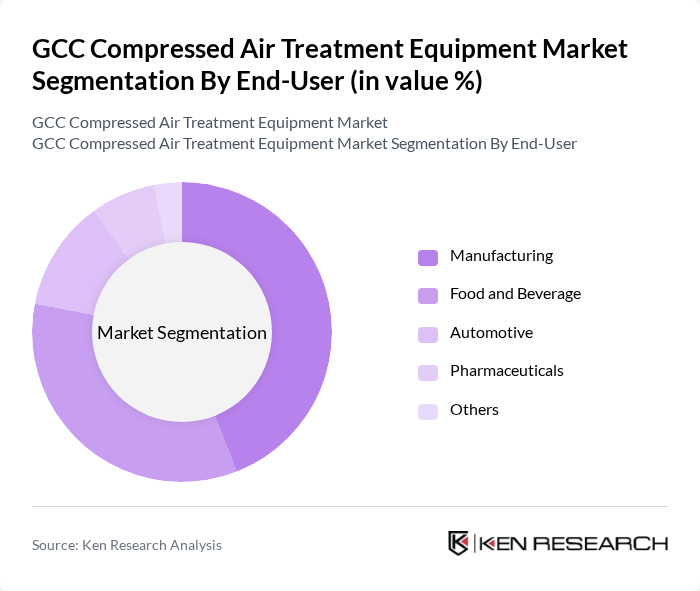

By End-User:The end-user segmentation includes manufacturing, automotive, food and beverage, pharmaceuticals, and others. The manufacturing sector leads the market, driven by the need for reliable compressed air systems in production and automation processes. The food and beverage industry is also a major contributor, propelled by strict hygiene and safety requirements for air purity in processing and packaging. Automotive and pharmaceutical sectors continue to expand their usage of advanced compressed air treatment solutions for quality control and compliance.

The GCC Compressed Air Treatment Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco Middle East, Ingersoll Rand Gulf, Sullair Middle East, Parker Hannifin Gulf, Donaldson Gulf, Boge Compressors Middle East, Airmatic Middle East, Gardner Denver Gulf, CompAir Gulf, Quincy Compressor Middle East, Kaeser Compressors Gulf, Festo Gulf, Hitachi Industrial Equipment Gulf, Siemens Middle East, Mitsubishi Electric Gulf contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC compressed air treatment equipment market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt IoT-enabled solutions, the integration of smart technologies will enhance operational efficiency and reduce energy consumption. Furthermore, the push for compliance with stricter environmental regulations will likely accelerate the adoption of innovative air treatment systems, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Filters Dryers Regulators Lubricators Others |

| By End-User | Manufacturing Automotive Food and Beverage Pharmaceuticals Others |

| By Region | Saudi Arabia UAE Qatar Kuwait |

| By Application | Industrial Processes HVAC Systems Pneumatic Tools Others |

| By Technology | Membrane Technology Refrigerated Drying Desiccant Drying Others |

| By Investment Source | Private Investments Government Funding Joint Ventures Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Equipment Usage | 100 | Production Managers, Facility Engineers |

| Oil & Gas Industry Applications | 80 | Procurement Managers, Operations Supervisors |

| Food Processing Equipment Needs | 60 | Quality Control Managers, Maintenance Supervisors |

| Pharmaceutical Sector Compliance | 50 | Regulatory Affairs Managers, Production Leads |

| Energy Efficiency Initiatives | 40 | Sustainability Officers, Energy Managers |

The GCC Compressed Air Treatment Equipment Market is valued at approximately USD 9.4 billion, reflecting a robust growth trajectory driven by increasing industrial automation and the demand for energy-efficient solutions across various sectors.