Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0146

Pages:83

Published On:August 2025

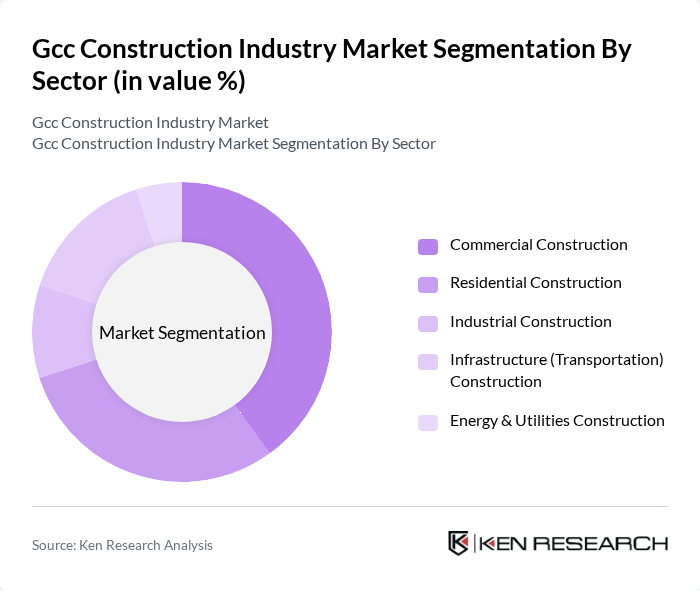

By Sector:

The GCC construction industry is segmented into Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, and Energy & Utilities Construction. Among these, the Commercial Construction sector remains a key market driver, supported by the increasing demand for office spaces, retail outlets, and hospitality projects due to economic growth, tourism, and business expansion. The Residential Construction sector closely follows, propelled by population growth, urbanization, and government-led affordable housing initiatives. The Infrastructure sector is also gaining momentum, particularly with ongoing government projects to enhance transportation networks, logistics, and public utilities. The Industrial and Energy & Utilities sectors are supported by investments in manufacturing facilities and renewable energy projects, respectively .

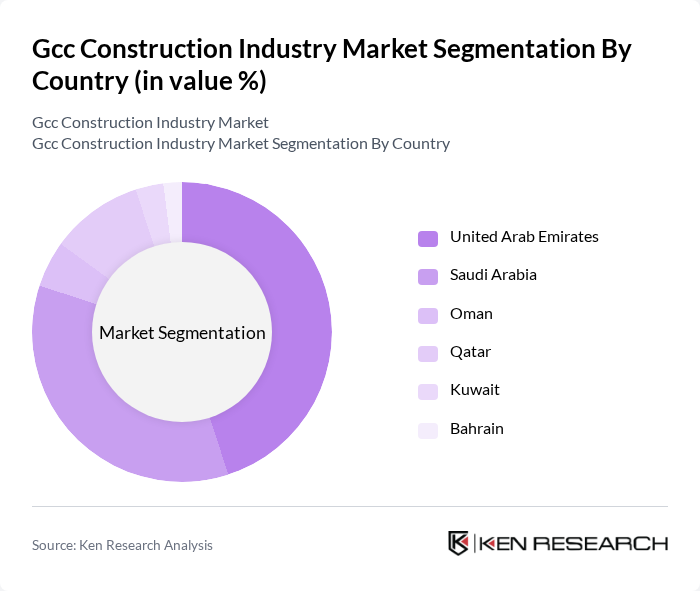

By Country:

The GCC construction industry is also segmented by country, with significant contributions from the United Arab Emirates, Saudi Arabia, Oman, Qatar, Kuwait, and Bahrain. The United Arab Emirates leads the market, driven by ambitious construction projects, tourism, and smart city developments, particularly in Dubai and Abu Dhabi. Saudi Arabia follows closely, with its Vision 2030 plan promoting extensive infrastructure, urban development, and giga-projects such as NEOM and the Red Sea Project. Qatar remains a key player, especially following major infrastructure enhancements for the FIFA World Cup and ongoing urban development. Oman, Kuwait, and Bahrain contribute through targeted investments in infrastructure, logistics, and residential projects .

The GCC construction industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabtec Construction LLC, ACCIONA, Saudi Binladin Group, El Seif Engineering Contracting Company, Al Habtoor Group, Strabag SE, Larsen & Toubro Limited, China State Construction Engineering Corporation, Vinci Construction, Bouygues Construction, KEO International Consultants, Hill International, Turner Construction Company, AECOM, Faithful+Gould, Nesma & Partners Contracting Co. Ltd., ALEC Engineering and Contracting LLC, Almabani General Contractors, Khansaheb Civil Engineering LLC, Arabian Construction Company (ACC), ASGC Construction, and Albawani Group contribute to innovation, geographic expansion, and service delivery in this space .

The GCC construction industry is poised for significant growth, driven by ongoing infrastructure investments and urbanization trends. As governments prioritize sustainable development and smart city initiatives, the demand for innovative construction solutions will increase. Additionally, the integration of advanced technologies such as Building Information Modeling (BIM) and automation will enhance project efficiency. However, addressing labor shortages and material cost fluctuations will be crucial for maintaining momentum in the sector. Overall, the outlook remains positive, with substantial opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Sector | Commercial Construction Residential Construction Industrial Construction Infrastructure (Transportation) Construction Energy & Utilities Construction |

| By Country | United Arab Emirates Saudi Arabia Oman Qatar Kuwait Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Engineers |

| Commercial Building Developments | 90 | Construction Executives, Architects |

| Infrastructure Projects (Roads, Bridges) | 80 | Government Officials, Civil Engineers |

| Green Building Initiatives | 60 | Sustainability Consultants, Project Leads |

| Construction Material Suppliers | 50 | Supply Chain Managers, Procurement Officers |

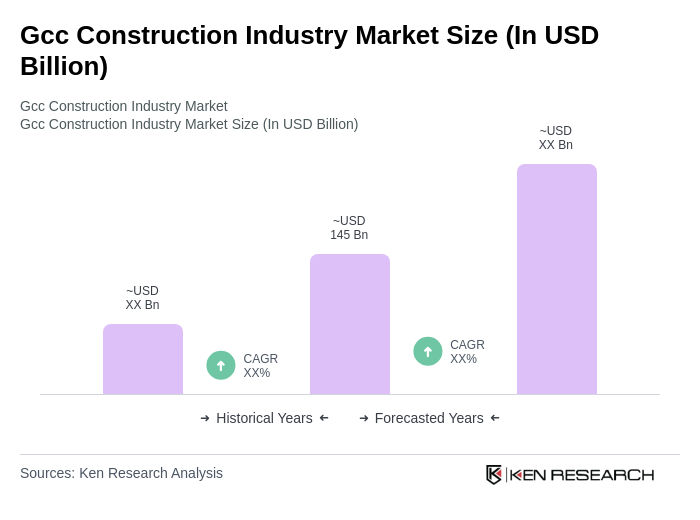

The GCC construction industry market is valued at approximately USD 145 billion, driven by rapid urbanization, government investments in infrastructure, and increasing demand for residential, commercial, and industrial spaces.