Region:Middle East

Author(s):Shubham

Product Code:KRAD5362

Pages:99

Published On:December 2025

Cleaning Devices Market.png)

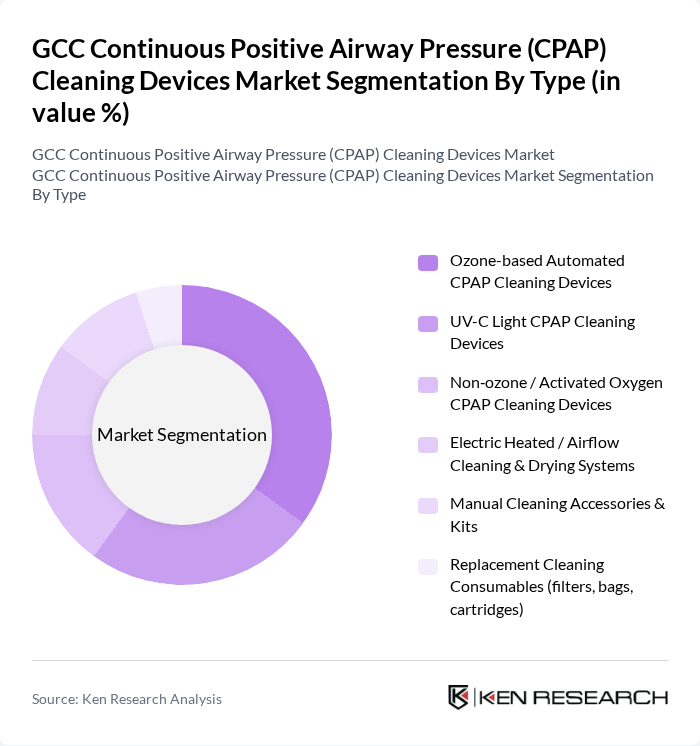

By Type:The market is segmented into various types of CPAP cleaning devices, including ozone-based automated cleaning devices, UV-C light cleaning devices, non-ozone/activated oxygen cleaning devices, electric heated/airflow cleaning and drying systems, manual cleaning accessories and kits, and replacement cleaning consumables such as filters, bags, and cartridges. Among these, ozone-based automated cleaning devices are gaining traction due to their effectiveness in eliminating bacteria and viruses, making them a preferred choice for many users.

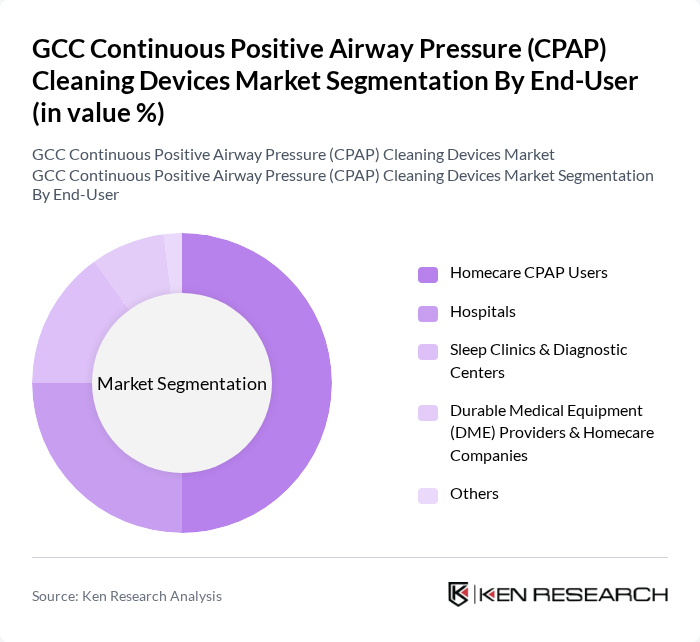

By End-User:The end-user segmentation includes homecare CPAP users, hospitals, sleep clinics and diagnostic centers, durable medical equipment (DME) providers, and other users. Homecare CPAP users represent the largest segment, driven by the growing trend of at-home healthcare solutions and the increasing number of patients diagnosed with sleep apnea who prefer using CPAP devices at home.

The GCC Continuous Positive Airway Pressure (CPAP) Cleaning Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as SoClean Inc., 3B Medical, Inc. (Luna & Lumin brands), Sunset Healthcare Solutions Inc., VirtuOx, Inc. (VirtuCLEAN), Sleep8 Inc., Contour Products, Inc., Shenzhen Bangxing Rubber Technology Co., Ltd. (Paptizer / related CPAP cleaners), Best in Rest (CPAP Cleaning Systems), Medline Industries, LP (CPAP Cleaning Accessories & Kits), AG Industries (a Respironics Company) – CPAP Cleaning Consumables, Philips Respironics – CPAP Hygiene & Cleaning Accessories, ResMed – CPAP Mask & Tubing Cleaning Accessories, Fisher & Paykel Healthcare – CPAP Mask & Circuit Cleaning Solutions, Local GCC Distributors of CPAP Cleaning Devices (e.g., Bin Ali Medical Supplies, UAE; Gulf & World Traders, UAE), Leading E?commerce & Pharmacy Private Labels Offering CPAP Cleaning Products in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CPAP cleaning devices market in the GCC region appears promising, driven by increasing healthcare investments and a growing focus on patient safety. As technological innovations continue to emerge, the market is likely to see a shift towards more automated and user-friendly cleaning solutions. Additionally, the integration of IoT technology in these devices will enhance monitoring and maintenance, further encouraging adoption among users. Overall, the market is poised for significant growth as awareness and demand for hygiene in CPAP usage rise.

| Segment | Sub-Segments |

|---|---|

| By Type | Ozone-based Automated CPAP Cleaning Devices UV-C Light CPAP Cleaning Devices Non?ozone / Activated Oxygen CPAP Cleaning Devices Electric Heated / Airflow Cleaning & Drying Systems Manual Cleaning Accessories & Kits Replacement Cleaning Consumables (filters, bags, cartridges) |

| By End-User | Homecare CPAP Users Hospitals Sleep Clinics & Diagnostic Centers Durable Medical Equipment (DME) Providers & Homecare Companies Others |

| By Distribution Channel | E?commerce Marketplaces (Amazon, Noon, etc.) Hospital Pharmacies & Sleep Clinics Retail Pharmacies & Medical Supply Stores Direct Sales by Manufacturers / Local Importers Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Price Range | Entry?level (? USD 150) Mid?Range (USD 151 – 300) Premium (? USD 301) Subscription / Service?based Models |

| By Brand Positioning | Global CPAP Cleaning Brands Regional / Local GCC Brands Private Labels of Pharmacies & Retailers OEM / White?label Devices |

| By Technology | Fully Automated Plug?and?Play Systems Portable / Travel CPAP Cleaning Devices Smart / Connected Cleaning Devices (App?enabled, IoT) Hybrid / Multi?technology Systems Manual / Non?powered Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Respiratory Therapists, Sleep Specialists |

| CPAP Device Manufacturers | 50 | Product Managers, Sales Directors |

| Patients Using CPAP Devices | 150 | End-users, Caregivers |

| Healthcare Distributors | 70 | Supply Chain Managers, Distribution Heads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The GCC Continuous Positive Airway Pressure (CPAP) Cleaning Devices Market is valued at approximately USD 20 million, driven by the rising prevalence of sleep apnea and increased awareness regarding CPAP hygiene among users in the region.