Region:Middle East

Author(s):Dev

Product Code:KRAB7258

Pages:84

Published On:October 2025

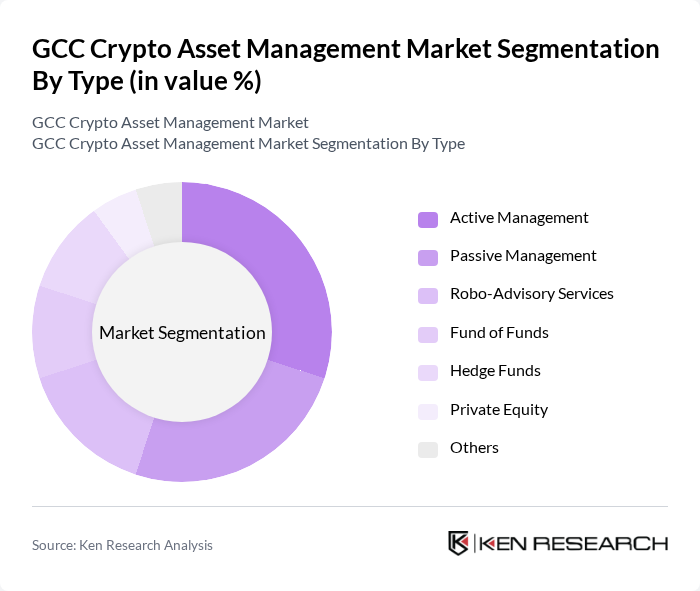

By Type:The market is segmented into various types of management strategies, including Active Management, Passive Management, Robo-Advisory Services, Fund of Funds, Hedge Funds, Private Equity, and Others. Active Management is gaining traction as investors seek personalized strategies to maximize returns in a volatile market. Passive Management is also popular due to its cost-effectiveness and simplicity. Robo-Advisory Services are emerging as a convenient option for tech-savvy investors looking for automated solutions.

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Family Offices, Corporates, Government Entities, and Others. Individual Investors are increasingly participating in the crypto market, driven by the accessibility of trading platforms and the potential for high returns. Institutional Investors are also entering the market, seeking to diversify their portfolios and capitalize on the growing acceptance of digital assets.

The GCC Crypto Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Binance, BitOasis, FTX Trading Ltd., Kraken, eToro, CoinMENA, Abu Dhabi Global Market (ADGM), Dubai Multi Commodities Centre (DMCC), Crypto.com, Huobi Global, OKEx, KuCoin, Gemini, Bybit, CEX.IO contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC crypto asset management market appears promising, driven by increasing institutional interest and a growing retail investor base. As regulatory frameworks become more defined, the market is likely to see enhanced participation from both local and international players. Additionally, technological advancements in blockchain and security measures will play a crucial role in shaping the market landscape, fostering innovation and trust among investors, and potentially leading to a more stable investment environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Management Passive Management Robo-Advisory Services Fund of Funds Hedge Funds Private Equity Others |

| By End-User | Individual Investors Institutional Investors Family Offices Corporates Government Entities Others |

| By Investment Strategy | Long-Term Holding Short-Term Trading Arbitrage Market Making Others |

| By Asset Class | Cryptocurrencies Tokens Stablecoins Digital Assets Others |

| By Distribution Channel | Direct Sales Online Platforms Financial Advisors Brokerages Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Risk Appetite | High Risk Medium Risk Low Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Crypto Investments | 100 | Portfolio Managers, Investment Analysts |

| Retail Crypto Asset Management | 80 | Individual Investors, Financial Advisors |

| Regulatory Compliance in Crypto | 60 | Compliance Officers, Legal Advisors |

| Crypto Fund Performance Analysis | 70 | Fund Managers, Risk Analysts |

| Emerging Trends in Crypto Adoption | 90 | Market Researchers, Trend Analysts |

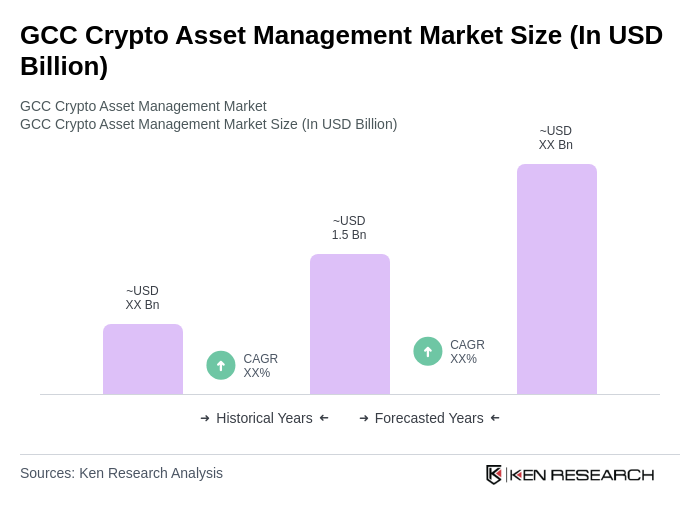

The GCC Crypto Asset Management Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased cryptocurrency adoption and institutional investment in the region.