Region:Middle East

Author(s):Shubham

Product Code:KRAD6721

Pages:97

Published On:December 2025

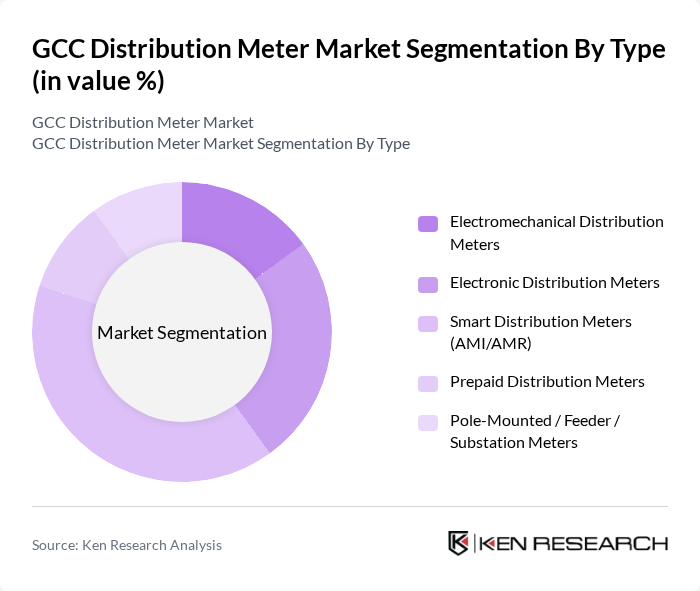

By Type:The segmentation of the market by type includes Electromechanical Distribution Meters, Electronic Distribution Meters, Smart Distribution Meters (AMI/AMR), Prepaid Distribution Meters, and Pole-Mounted / Feeder / Substation Meters, which is consistent with prevailing industry classifications for distribution?grade meters and smart metering hardware. Among these, Smart Distribution Meters are gaining significant traction due to their ability to provide real-time or near real-time data, support two-way communication between utilities and consumers, enable remote connect/disconnect, and facilitate integration of distributed energy resources and renewable energy sources into the grid.

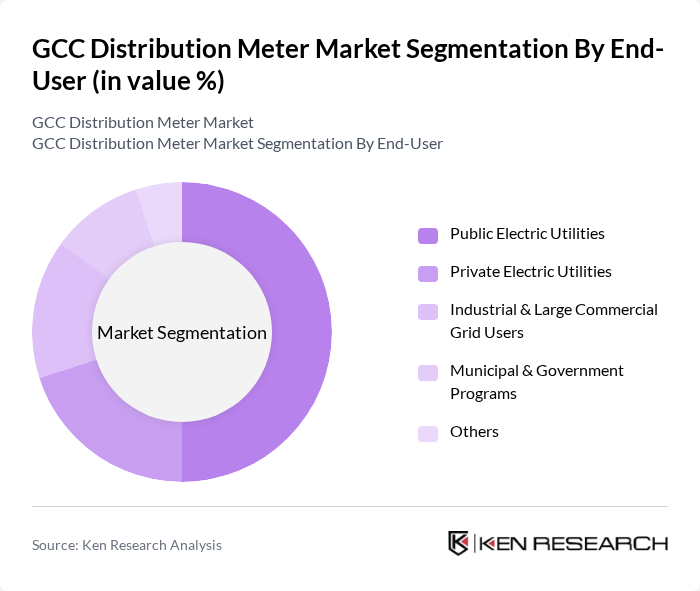

By End-User:The market is segmented by end-user into Public Electric Utilities, Private Electric Utilities, Industrial & Large Commercial Grid Users, Municipal & Government Programs, and Others, which aligns with global and regional distribution meter market coverage where electric utilities represent the primary customer group. Public Electric Utilities are the leading segment, driven by the increasing demand for reliable and efficient energy distribution systems, large-scale AMI programs, and grid modernization initiatives across GCC countries, while the focus on smart grid technologies, outage management, and advanced billing and demand response programs further supports the growth of this segment.

The GCC Distribution Meter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company (GE Vernova – Grid Solutions), Landis+Gyr Group AG, Itron, Inc., Kamstrup A/S, Honeywell International Inc., Wasion Group Holdings Limited, Hexing Electrical Co., Ltd., Holley Technology Ltd., Huawei Technologies Co., Ltd. (Smart Grid & Metering), Ningbo Sanxing Electric Co., Ltd., EMIC Metering (El Sewedy Electrometer), Saudi Electricity Company – Metering & Distribution Subsidiaries contribute to innovation, geographic expansion, and service delivery in this space, with several of these vendors already identified as key players in global and Middle East distribution and smart meter markets.

The future of the GCC distribution meter market appears promising, driven by technological advancements and a strong focus on sustainability. As governments continue to invest in smart grid infrastructure, the integration of IoT technologies will enhance data collection and analytics capabilities. Furthermore, the increasing emphasis on renewable energy sources will necessitate more sophisticated metering solutions. In future, the market is expected to evolve significantly, with utilities adopting innovative technologies to improve efficiency and reliability in energy distribution.

| Segment | Sub-Segments |

|---|---|

| By Type | Electromechanical Distribution Meters Electronic Distribution Meters Smart Distribution Meters (AMI/AMR) Prepaid Distribution Meters Pole?Mounted / Feeder / Substation Meters |

| By End-User | Public Electric Utilities Private Electric Utilities Industrial & Large Commercial Grid Users Municipal & Government Programs Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Communication Technology | Wired (PLC/RS?485) Wireless RF Mesh Cellular (2G/3G/4G/NB?IoT/LTE?M) Hybrid & Others |

| By Application | Feeder Line Monitoring Substation / Transformer Monitoring Distributed Energy Resource (DER) Integration Loss Reduction & Theft Detection Billing and Revenue Assurance |

| By Phase | Single?Phase Distribution Meters Three?Phase Distribution Meters |

| By Procurement / Ownership Model | Utility?Owned CAPEX Deployment Public–Private Partnership (PPP) / BOOT ESCO / Performance?Based Contracts Donor?Funded & Multilateral Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 100 | Procurement Managers, Operations Directors |

| Distribution Meter Manufacturers | 80 | Product Development Managers, Sales Executives |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

| Installation and Maintenance Firms | 70 | Field Technicians, Service Managers |

| Energy Consultants | 60 | Market Analysts, Energy Efficiency Experts |

The GCC Distribution Meter Market is valued at approximately USD 1.0 billion, reflecting a strong demand for smart electric meters driven by energy management needs, renewable energy integration, and government modernization initiatives in the region.