Region:Middle East

Author(s):Shubham

Product Code:KRAD0677

Pages:82

Published On:August 2025

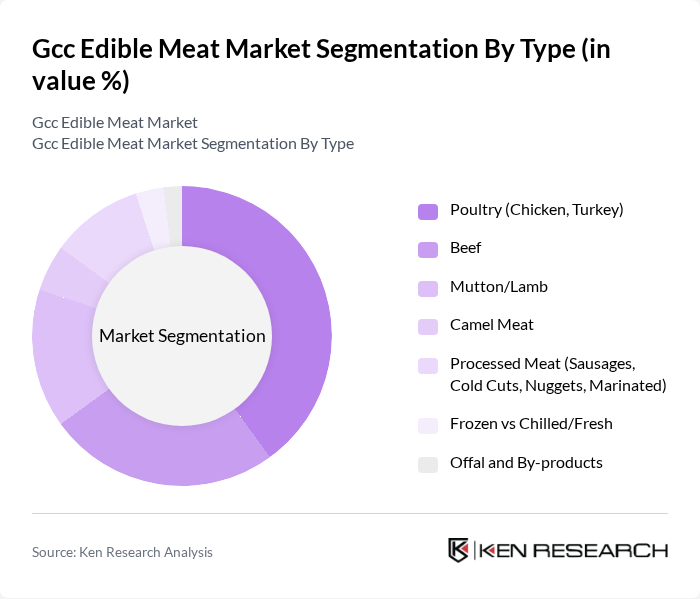

By Type:The edible meat market in the GCC is diverse, encompassing various types of meat products. The primary subsegments include poultry (chicken and turkey), beef, mutton/lamb, camel meat, processed meat (such as sausages, cold cuts, nuggets, and marinated products), frozen vs. chilled/fresh meat, and offal and by-products. Among these, poultry is the leading subsegment due to its affordability, versatility, and increasing consumer preference for healthier protein options. The growing trend of convenience foods has also bolstered the demand for processed meat products.

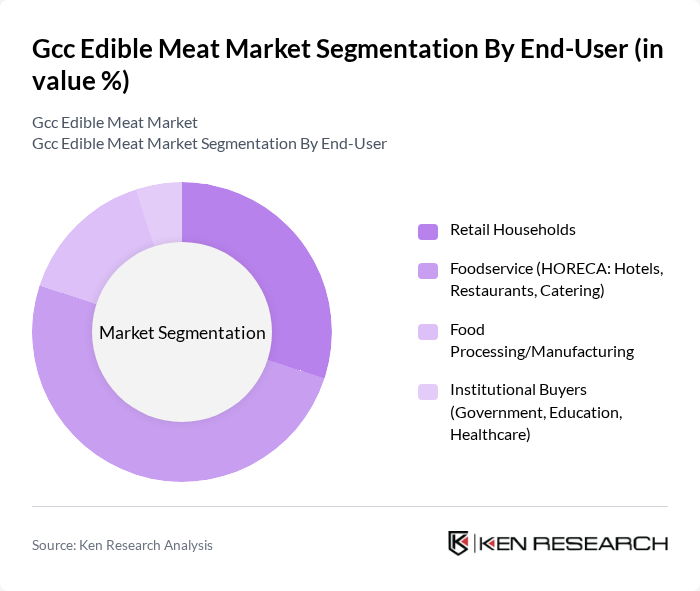

By End-User:The end-user segmentation of the edible meat market includes retail households, foodservice (HORECA: hotels, restaurants, catering), food processing/manufacturing, and institutional buyers (government, education, healthcare). The foodservice sector is the dominant end-user, driven by the increasing number of restaurants and catering services in the region. The growing trend of dining out and the rise of food delivery services have significantly contributed to the demand for meat products in this segment.

The GCC Edible Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tanmiah Food Company (Saudi Arabia), BRF S.A. (Sadia & Perdix brands; GCC presence), The Savola Group (Saudi Arabia) – Afia, Americana stake exposure to meat processing, Siniora Food Industries Company (Jordan/GCC distribution), Al-Watania Poultry (Saudi Arabia), Al Islami Foods (UAE), Al Kabeer Group (UAE/Saudi distribution), Emirates National Food (Al Rawdah) (UAE), Gulf International Poultry (Bahrain), Mezzan Holding Company (Kuwait) – Khazan Foods, Americana Foods (Kuwait/Saudi UAE; processed meats), JBS S.A. (Export supplier to GCC), Almarai Company (Saudi Arabia) – meat subsidiary/logistics exposure, The Organic Meat Company Limited (TOMCL, Pakistan; GCC export), Nadec (National Agricultural Development Company, Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC edible meat market appears promising, driven by evolving consumer preferences and technological advancements. As the region embraces sustainability, the demand for ethically sourced and organic meat is expected to rise. Furthermore, the integration of technology in meat processing and distribution will enhance efficiency and transparency, catering to health-conscious consumers. The anticipated growth in e-commerce will also facilitate access to diverse meat products, reshaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Poultry (Chicken, Turkey) Beef Mutton/Lamb Camel Meat Processed Meat (Sausages, Cold Cuts, Nuggets, Marinated) Frozen vs Chilled/Fresh Offal and By-products |

| By End-User | Retail Households Foodservice (HORECA: Hotels, Restaurants, Catering) Food Processing/Manufacturing Institutional Buyers (Government, Education, Healthcare) |

| By Distribution Channel | Supermarkets/Hypermarkets Independent Grocers/Butcher Shops Online/E-commerce & Quick Commerce Foodservice Distributors/Wholesale (B2B) |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging (MAP) Frozen Bulk and IQF Packs Canned/Retort Tray-sealed & Skin Packs |

| By Price Range | Economy Mid-Range Premium |

| By Source | Import Domestic Production Organic/Free-Range/Halal-Certified Value-Added |

| By Quality | Standard Grade Premium Grade Specialty/Halal Assurance & Traceable |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Meat Sales | 150 | Store Managers, Meat Department Supervisors |

| Food Service Sector | 100 | Restaurant Owners, Executive Chefs |

| Wholesale Meat Distribution | 80 | Wholesale Buyers, Supply Chain Managers |

| Consumer Preferences | 120 | General Consumers, Health-Conscious Shoppers |

| Export Market Insights | 70 | Export Managers, Trade Analysts |

The GCC edible meat market is valued at approximately USD 12 billion, driven by factors such as population growth, rising disposable incomes, and an increasing preference for protein-rich diets among consumers in the region.