Region:Middle East

Author(s):Shubham

Product Code:KRAB7285

Pages:100

Published On:October 2025

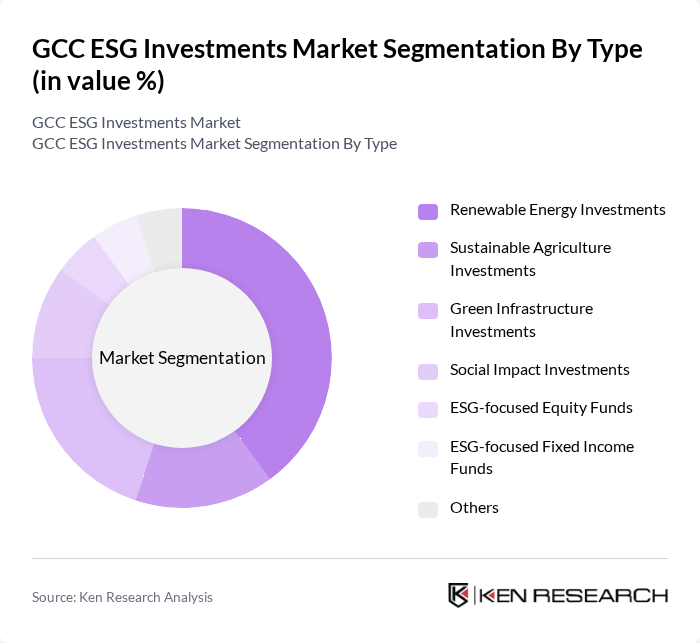

By Type:The market is segmented into various types of investments, including Renewable Energy Investments, Sustainable Agriculture Investments, Green Infrastructure Investments, Social Impact Investments, ESG-focused Equity Funds, ESG-focused Fixed Income Funds, and Others. Among these, Renewable Energy Investments are currently leading the market due to the GCC's abundant solar and wind resources, coupled with government incentives promoting clean energy projects. Sustainable Agriculture Investments are also gaining traction as food security becomes a priority in the region.

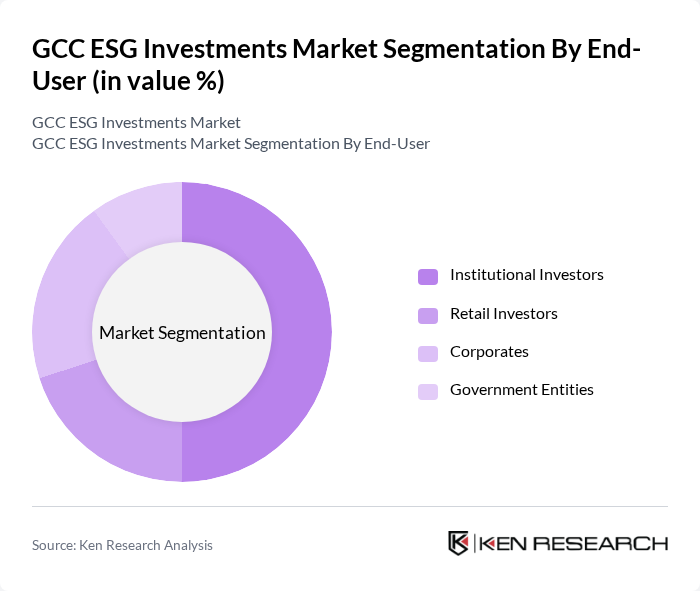

By End-User:The end-user segmentation includes Institutional Investors, Retail Investors, Corporates, and Government Entities. Institutional Investors dominate the market, driven by their significant capital and commitment to sustainable investment strategies. Corporates are increasingly aligning their operations with ESG principles, while Government Entities are actively promoting ESG investments through various initiatives and regulations.

The GCC ESG Investments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Qatar Investment Authority, Saudi Public Investment Fund, Dubai Investments PJSC, Emirates NBD, First Abu Dhabi Bank, National Bank of Kuwait, Bahrain Mumtalakat Holding Company, Oman Investment Authority, Kuwait Investment Authority, Abu Dhabi National Oil Company, Saudi Aramco, Qatar National Bank, Al Rajhi Bank, Gulf Investment Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC ESG investments market appears promising, driven by increasing regulatory frameworks and heightened investor awareness. As governments continue to implement supportive policies, the region is likely to see a significant uptick in sustainable investments. Additionally, the integration of advanced technologies in ESG reporting will enhance transparency and accountability, fostering greater investor confidence. The ongoing shift towards sustainability is expected to reshape the investment landscape, creating a more resilient and diversified economy in the GCC.

| Segment | Sub-Segments |

|---|---|

| By Type | Renewable Energy Investments Sustainable Agriculture Investments Green Infrastructure Investments Social Impact Investments ESG-focused Equity Funds ESG-focused Fixed Income Funds Others |

| By End-User | Institutional Investors Retail Investors Corporates Government Entities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Climate Change Mitigation Resource Efficiency Social Equity Corporate Governance |

| By Policy Support | Subsidies for Renewable Energy Tax Exemptions for Green Investments Renewable Energy Certificates (RECs) |

| By Risk Profile | Low-Risk Investments Medium-Risk Investments High-Risk Investments |

| By Geographic Focus | GCC Countries Emerging Markets Developed Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate ESG Investment Strategies | 100 | Investment Managers, CFOs, Sustainability Directors |

| Government Policy Impact on ESG | 80 | Policy Makers, Regulatory Officials, Economic Advisors |

| Sector-Specific ESG Adoption | 75 | Industry Analysts, Sector Leaders, Compliance Officers |

| NGO Perspectives on ESG Investments | 60 | NGO Executives, Environmental Advocates, Community Leaders |

| Investor Sentiment and ESG Trends | 90 | Institutional Investors, Fund Managers, Financial Analysts |

The GCC ESG Investments Market is valued at approximately USD 20 billion, reflecting a significant growth trend driven by increased awareness of environmental, social, and governance factors among investors and supportive government initiatives promoting sustainable practices.