GCC Facial Injectables Market Overview

- The GCC Facial Injectables Market is valued at USD 5.4 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for non-surgical aesthetic procedures, rising disposable incomes, and a growing acceptance of cosmetic treatments among both men and women. The market has seen a significant uptick in the popularity of facial injectables, particularly in urban areas where beauty standards are evolving. Additional growth drivers include the expansion of dermatology clinics, medical spas, and aesthetic centers, as well as technological advancements in injection devices and procedural safety tools. Strong marketing strategies by leading aesthetic companies and a surge in the number of trained practitioners further support market expansion .

- Key players in this market include the UAE and Saudi Arabia, which dominate due to their advanced healthcare infrastructure, high per capita income, and a strong presence of aesthetic clinics and medical spas. The UAE, particularly Dubai, is recognized for its luxury lifestyle and high demand for cosmetic enhancements, while Saudi Arabia has a large population increasingly interested in aesthetic procedures. The wider availability of long-acting and combination fillers, along with rising aesthetic awareness and clinic infrastructure, continues to drive demand in these countries .

- In 2023, the Saudi Food and Drug Authority (SFDA) issued the “Regulation for Cosmetic Products and Devices, 2023,” which mandates that all practitioners performing facial injectable procedures obtain specific certifications and comply with strict operational guidelines. The regulation covers product registration, practitioner licensing, and safety monitoring, ensuring that only qualified professionals administer these treatments and that all products meet defined quality standards. This initiative aims to protect consumers and promote best practices within the industry .

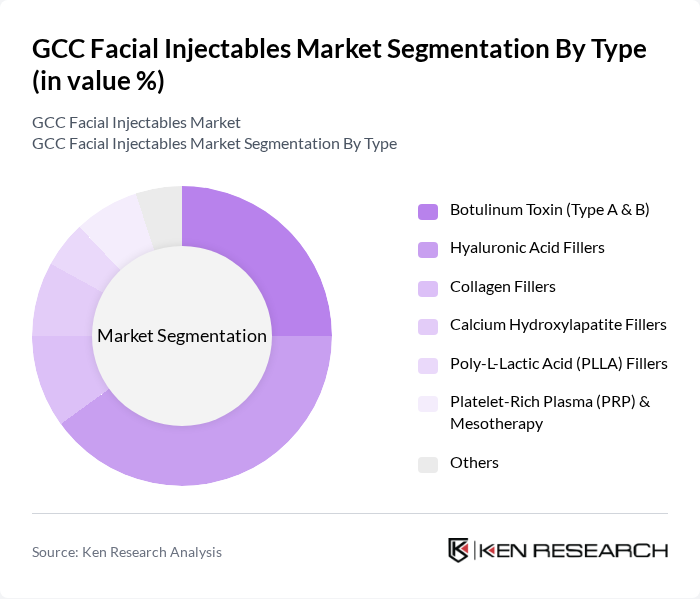

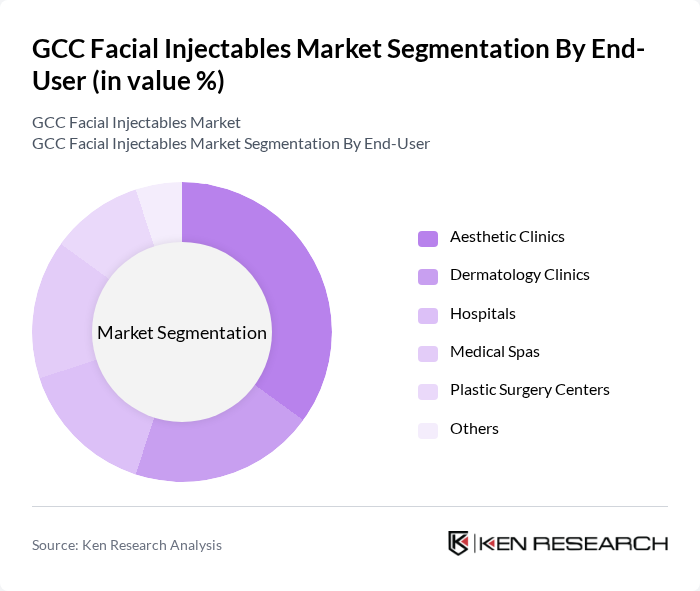

GCC Facial Injectables Market Segmentation

By Type:The market is segmented into various types of injectables, including Botulinum Toxin (Type A & B), Hyaluronic Acid Fillers, Collagen Fillers, Calcium Hydroxylapatite Fillers, Poly-L-Lactic Acid (PLLA) Fillers, Platelet-Rich Plasma (PRP) & Mesotherapy, and Others. Among these,Hyaluronic Acid Fillersare currently dominating the market due to their versatility, immediate results, and minimal downtime, making them a preferred choice for consumers seeking facial rejuvenation. The increasing trend of lip enhancement and cheek augmentation has further propelled the demand for these fillers. Hyaluronic acid fillers are favored for their safety profile and reversibility, contributing to their leading position .

By End-User:The end-user segmentation includes Aesthetic Clinics, Dermatology Clinics, Hospitals, Medical Spas, Plastic Surgery Centers, and Others.Aesthetic Clinicsare leading this segment, driven by the increasing number of specialized clinics offering a wide range of cosmetic procedures. The rise in consumer awareness about aesthetic treatments and the convenience of accessing these services in dedicated clinics have contributed to their dominance in the market. The growing presence of medical spas and dermatology clinics also supports market expansion, reflecting consumer preference for specialized and accessible treatment environments .

GCC Facial Injectables Market Competitive Landscape

The GCC Facial Injectables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan (AbbVie), Galderma, Merz Aesthetics, Ipsen, Medytox, Prollenium Medical Technologies, Teoxane, Suneva Medical, Revance Therapeutics, Bloomage Biotechnology, Sinclair Pharma, Croma-Pharma, Laboratoires Vivacy, BioScience GmbH, and APTAR Group contribute to innovation, geographic expansion, and service delivery in this space.

GCC Facial Injectables Market Industry Analysis

Growth Drivers

- Increasing Demand for Aesthetic Procedures:The GCC region has witnessed a significant rise in the demand for aesthetic procedures, with the market valued at approximately $1.8 billion in future. This growth is driven by a cultural shift towards beauty and self-care, with over 70% of individuals aged 18-35 expressing interest in cosmetic enhancements. The increasing disposable income, projected to reach $34,000 per capita in future, further fuels this trend, making aesthetic treatments more accessible to a broader demographic.

- Rising Awareness of Non-Surgical Treatments:Non-surgical treatments, particularly facial injectables, are gaining traction in the GCC, with a reported 50% increase in procedures in future. This surge is attributed to heightened awareness through social media and influencer marketing, which has educated consumers about the benefits and safety of these treatments. As of future, the number of clinics offering these services is expected to exceed 1,500, reflecting the growing acceptance and demand for non-invasive options.

- Technological Advancements in Injectables:The GCC market is benefiting from rapid technological advancements in injectables, with new formulations and delivery systems enhancing efficacy and safety. In future, over 30 new products were launched, focusing on longer-lasting results and reduced side effects. The investment in R&D is projected to reach $250 million in future, indicating a strong commitment to innovation that will likely attract more consumers seeking effective aesthetic solutions.

Market Challenges

- Regulatory Hurdles:The GCC facial injectables market faces significant regulatory challenges, with stringent licensing requirements for practitioners. As of future, only 40% of clinics met the new regulatory standards, which were implemented to ensure patient safety. This has resulted in a slower market entry for new providers and products, potentially limiting consumer access to innovative treatments and stifling market growth in the region.

- Consumer Misconceptions About Safety:Despite the growing popularity of facial injectables, misconceptions regarding their safety persist among consumers. A survey conducted in future revealed that 50% of potential clients expressed concerns about side effects and long-term impacts. This skepticism can hinder market growth, as potential clients may opt for traditional beauty treatments over injectables, impacting overall demand and limiting the market's expansion potential.

GCC Facial Injectables Market Future Outlook

The future of the GCC facial injectables market appears promising, driven by increasing consumer acceptance and advancements in technology. As the market evolves, a shift towards personalized treatment plans is anticipated, catering to individual aesthetic goals. Additionally, the integration of digital platforms for consultations is expected to enhance accessibility and convenience, allowing consumers to engage with providers more effectively. This trend will likely foster a more informed consumer base, ultimately driving market growth and innovation in the sector.

Market Opportunities

- Expansion of Product Offerings:There is a significant opportunity for companies to expand their product lines, introducing innovative injectables that cater to diverse consumer needs. With the market projected to see a 25% increase in demand for specialized treatments in future, companies that diversify their offerings can capture a larger market share and enhance customer loyalty.

- Collaborations with Influencers and Celebrities:Collaborating with influencers and celebrities presents a lucrative opportunity for brands to enhance visibility and credibility. In future, campaigns featuring influencers resulted in a 40% increase in consumer engagement. By leveraging these partnerships, companies can effectively reach target demographics, driving awareness and adoption of facial injectables in the GCC market.