Region:Middle East

Author(s):Shubham

Product Code:KRAD0649

Pages:80

Published On:August 2025

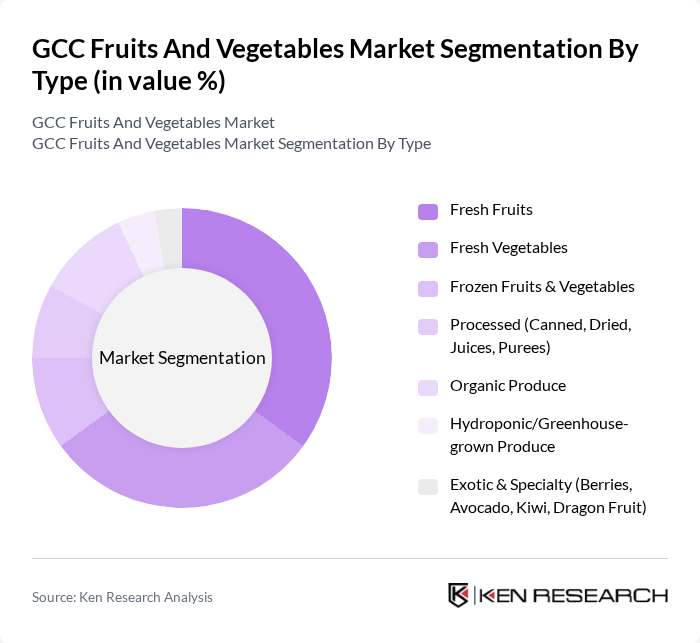

By Type:The market is segmented into various types, including Fresh Fruits, Fresh Vegetables, Frozen Fruits & Vegetables, Processed (Canned, Dried, Juices, Purees), Organic Produce, Hydroponic/Greenhouse-grown Produce, and Exotic & Specialty (Berries, Avocado, Kiwi, Dragon Fruit). Among these, Fresh Fruits and Fresh Vegetables are the leading subsegments, supported by strong household consumption and organized retail availability. Demand for Frozen Fruits & Vegetables continues to grow due to convenience, off-season availability, and improved insulated packaging that preserves quality. The trend toward Organic and Greenhouse-grown produce is gaining traction, driven by food safety, sustainability, and water-efficiency priorities across the region.

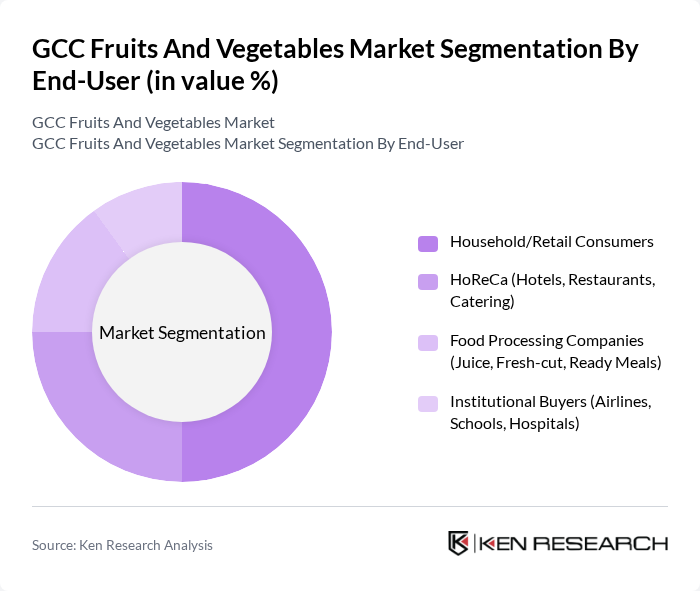

By End-User:The market is segmented by end-users, including Household/Retail Consumers, HoReCa (Hotels, Restaurants, Catering), Food Processing Companies (Juice, Fresh-cut, Ready Meals), and Institutional Buyers (Airlines, Schools, Hospitals). Household/Retail Consumers remain the largest due to daily consumption patterns and the rise of e-grocery and modern trade. HoReCa demand is supported by tourism and foodservice expansion, while processors increasingly source for juices, fresh-cut, and ready-meal applications.

The GCC Fruits And Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Del Monte Foods (UAE) / Fresh Del Monte, Barakat Group (Barakat Quality Plus), NRTC Group (Nassar Al Refaee Trading Company), Kibsons International LLC, Al Foah (Agthia Group) – Dates & Produce, Al Dahra Holding, Lulu Group International (Fresh Produce), Spinneys (UAE) / Spinneys House of Produce, Carrefour (Majid Al Futtaim Retail), Saudi Marketing Company (Farm Superstores), Al Watania Agriculture, Nadec – National Agricultural Development Company, Hassad Food (Qatar), Silal (Abu Dhabi), Pure Harvest Smart Farms contribute to innovation, geographic expansion, and service delivery in this space.

The GCC fruits and vegetables market is poised for transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, demand for organic and locally sourced produce is expected to increase. Additionally, the integration of digital technologies in supply chains will enhance efficiency and transparency. These trends, coupled with government support for local agriculture, will create a more sustainable and resilient market landscape, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits Fresh Vegetables Frozen Fruits & Vegetables Processed (Canned, Dried, Juices, Purees) Organic Produce Hydroponic/Greenhouse-grown Produce Exotic & Specialty (Berries, Avocado, Kiwi, Dragon Fruit) |

| By End-User | Household/Retail Consumers HoReCa (Hotels, Restaurants, Catering) Food Processing Companies (Juice, Fresh-cut, Ready Meals) Institutional Buyers (Airlines, Schools, Hospitals) |

| By Sales Channel | Supermarkets & Hypermarkets Online Grocery & Quick Commerce Traditional Grocers & Wet Markets Specialty & Organic Stores |

| By Distribution Mode | Direct Sourcing (Farms-to-Retail/Foodservice) Importers & Wholesalers Cold Chain Logistics (Reefer Transport & Cold Storage) |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk & Foodservice Packs Retail Packs (Clamshells, Punnets, Nets) Eco-Friendly & Recyclable Packaging |

| By Quality Grade | Export Grade/Grade A Grade B (Value/Processing) Grade C (Processing/Industry) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit Sales | 120 | Store Managers, Category Buyers |

| Wholesale Vegetable Distribution | 100 | Wholesale Distributors, Supply Chain Managers |

| Local Farm Production | 80 | Farm Owners, Agricultural Managers |

| Import/Export Operations | 70 | Logistics Coordinators, Trade Compliance Officers |

| Consumer Purchasing Behavior | 140 | End Consumers, Household Decision Makers |

The GCC Fruits and Vegetables Market is valued at approximately USD 19.5 billion, reflecting a robust growth driven by health consciousness, rising disposable incomes, and the expansion of organized retail and e-grocery services.