Region:Middle East

Author(s):Shubham

Product Code:KRAD0986

Pages:87

Published On:November 2025

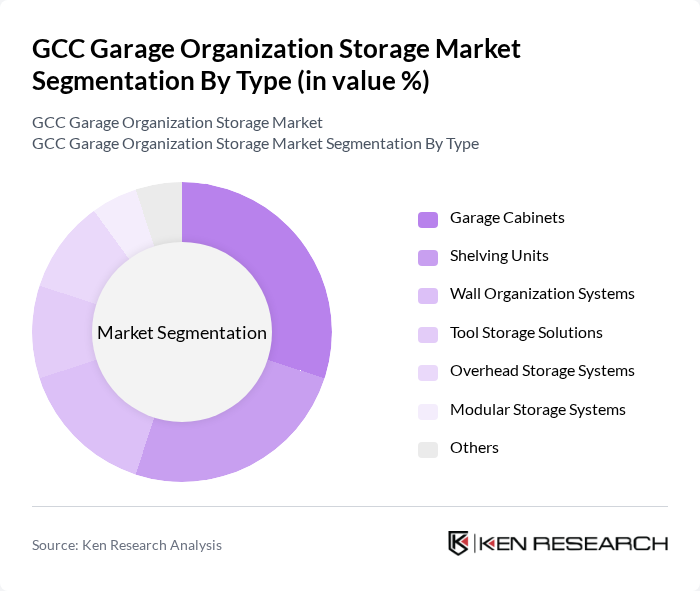

By Type:The market is segmented into various types of garage organization solutions, including Garage Cabinets, Shelving Units, Wall Organization Systems, Tool Storage Solutions, Overhead Storage Systems, Modular Storage Systems, and Others. Garage Cabinets and Shelving Units remain the most popular categories, driven by their versatility, durability, and ability to cater to diverse storage needs. Consumers increasingly prefer customized and modular solutions that fit specific garage layouts, leading to rising demand for overhead and wall organization systems. The integration of smart and sustainable materials is also influencing product preferences in the region.

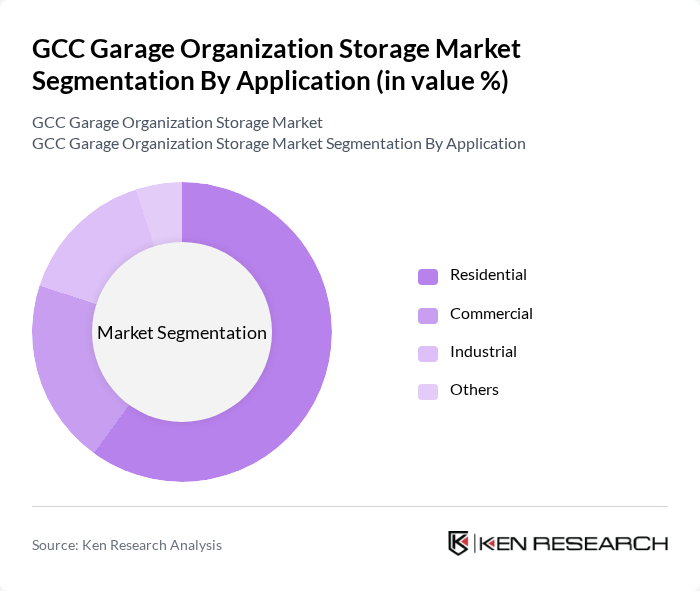

By Application:The market is segmented based on application into Residential, Commercial, Industrial, and Others. The Residential segment is the largest, driven by homeowners seeking to enhance garage space for better organization and utility. The popularity of DIY home improvement projects and the expansion of e-commerce platforms offering garage storage products have contributed to the growth of this segment. Commercial and industrial applications are also expanding, supported by the need for efficient storage in service centers and workshops.

The GCC Garage Organization Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, The Home Depot, Rubbermaid, ClosetMaid, Sterilite, Gladiator GarageWorks, Craftsman, Husky, Seville Classics, NewAge Products, Proslat, SystemBuild, SafeRacks, Fleximounts, Stanley Black & Decker, Lowe's, Al-Futtaim ACE, Danube Home, Almuftah Group, Al-Sorayai Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC garage organization storage market appears promising, driven by increasing urbanization and rising disposable incomes. As consumers become more conscious of home organization, the demand for innovative and customizable storage solutions is expected to rise. Additionally, the integration of smart technology into storage products will likely enhance user experience, making these solutions more appealing. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Garage Cabinets Shelving Units Wall Organization Systems Tool Storage Solutions Overhead Storage Systems Modular Storage Systems Others |

| By Application | Residential Commercial Industrial Others |

| By Material | Metal Plastic Wood Composite Materials Others |

| By Storage Capacity | Small Capacity Medium Capacity Large Capacity Custom Capacity Solutions |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Homeowners with Garage Spaces | 120 | Homeowners, DIY Enthusiasts |

| Retailers of Garage Organization Products | 60 | Store Managers, Product Buyers |

| Contractors and Home Improvement Professionals | 50 | General Contractors, Interior Designers |

| Manufacturers of Storage Solutions | 40 | Product Development Managers, Sales Executives |

| Urban Planners and Architects | 40 | Urban Planners, Architects |

The GCC Garage Organization Storage Market is valued at approximately USD 1.1 billion, driven by urbanization, rising disposable incomes, and a growing trend towards home improvement and organization solutions.